And don’t forget to check if you qualify for the Earned

Income Tax Credit

Paula M. McFarland

Rhode Island Association of Community Action Agencies

(RICAA), Providence VITA Coalition, Citizens Bank, and the United Way of Rhode

Island are collaborating on the launch of a campaign to build public awareness

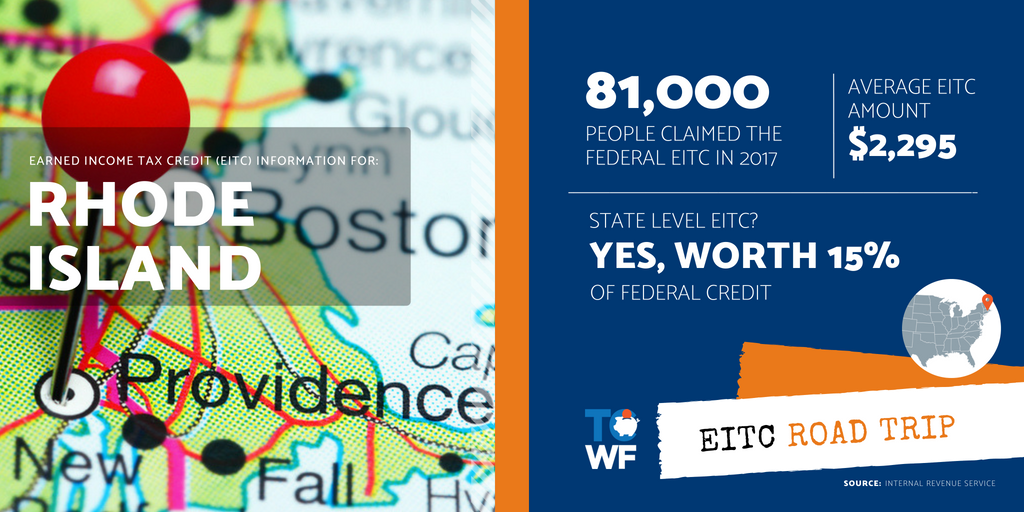

of the Earned Income Tax Credits (EITC) available to Rhode Island residents who

made $55,000 or less in 2018.

Rhode Island Association of Community Action Agencies

(RICAA), Providence VITA Coalition, Citizens Bank, and the United Way of Rhode

Island are collaborating on the launch of a campaign to build public awareness

of the Earned Income Tax Credits (EITC) available to Rhode Island residents who

made $55,000 or less in 2018. Twenty-four (24) sites serving all cities and towns throughout Rhode Island will be open starting January 28, 2019 to provide free tax preparation services with the help of Volunteer Income Tax Assistants (VITA).

The campaign will educate hard working Rhode Islanders on

the IRS’ EITC program and its benefits to individuals and married couples

receiving available tax credits for wages earned both at the federal and Rhode

Island levels.

Joanne McGunagle, President/CEO of Comprehensive Community Action and Board Chair of RICAA, whose member network serves more than 250,000 Rhode Islanders each year shared that “The maximum tax credit savings a filer can be eligible for is $6,431.”

McGunagle added, “we see working Rhode Islanders struggling

every day to meet the needs of their families. The Earned Income Tax Credit is

a resource working families can use to offset expenses and to save for the

future.”

In 2018, more than 12,000 residents took advantage of the

free tax preparation services through the VITA program administered by the

RICAA and Providence VITA coalition. Through available credits like EITC and

others, over $19.1 million was brought back to the Rhode Island economy.

“We’ve made progress over the last few years, helping

hard-working Rhode Islanders keep more of what they earn by increases created

by Rhode Island General Assembly through expanding EITC in Rhode Island,” share

McGunagle. “It is vitally important that families know about this credit so

they can take advantage of it and put money back in their pockets.”

The VITA Program, now in its fourteenth year, offers

certified tax preparers through volunteers at VITA sites throughout Rhode

Island including the Providence VITA Coalition and seven (7) member agencies of

RICAA.

The United Way of Rhode Island has also been supporting the program and VITA sites since 2004, with the operation of twenty-four (24) locations in Rhode Island. Information on site locations and free tax preparation is available to all tax filers at http://freetaxhelp.ricaa.org/ or by calling United Way’s toll-free referral line, 2-1-1.

The United Way of Rhode Island has also been supporting the program and VITA sites since 2004, with the operation of twenty-four (24) locations in Rhode Island. Information on site locations and free tax preparation is available to all tax filers at http://freetaxhelp.ricaa.org/ or by calling United Way’s toll-free referral line, 2-1-1.

In addition, both coalitions received grants from the

Internal Revenue Service (IRS) to assist with providing free tax preparation in

Rhode Island.

“Increasing awareness around the Earned Income Tax Credit

program is critical to getting more than $4.9 million into the hands of hard

working Rhode Islanders who are eligible for them, but don’t know they are,”

said Barbara Cottam, Rhode Island Market Executive for Citizens Bank.

“Citizens is proud to be a part of this important statewide coalition and public awareness campaign in an effort to spread the word and bring these dollars into the state to help our neighbors and positively impact the economy.”

“Citizens is proud to be a part of this important statewide coalition and public awareness campaign in an effort to spread the word and bring these dollars into the state to help our neighbors and positively impact the economy.”