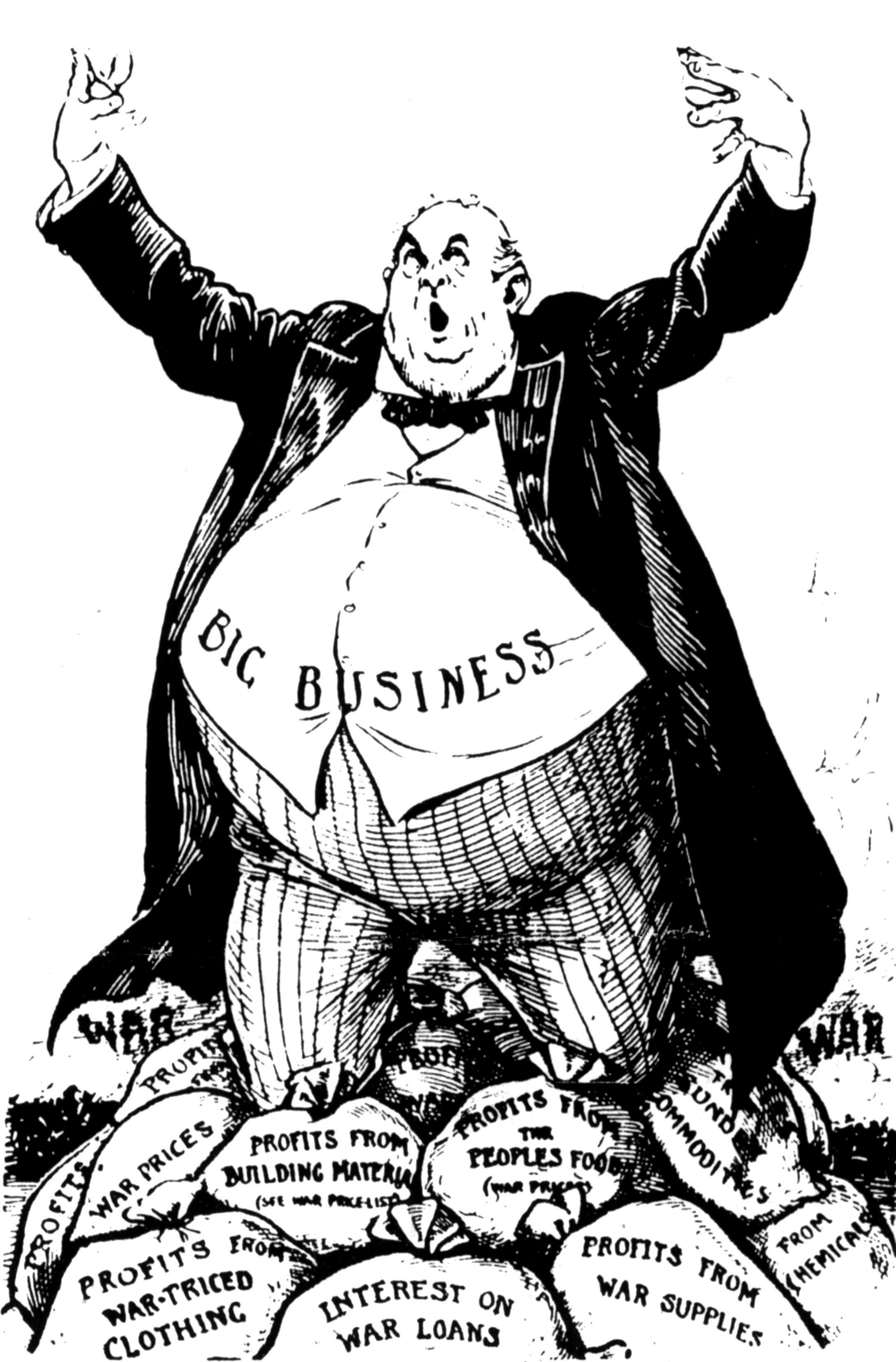

Too

Big to Be Honest

By

Phil Mattera, editor of the Dirt

Diggers Digest

For a long time the big financial institutions of the United States had an unrelenting urge to grow bigger. Acting on the principle that only the big would survive, banks and related entities spent the 1990s and the early 2000s gobbling up one another at a furious pace.

The result was a small group of

mega-institutions such as Citigroup and Bank of America that nearly brought

down the whole financial system in 2008.

Federal

regulators declined to break up the giants, which in recent years have grown

only larger. But now some of the rules put in place in the wake of the meltdown

are having the desired effect.

Some major financial players are deciding to

split themselves up in the hope of evading the more stringent capital

requirements imposed on companies designated as systemically important (SiFi)

institutions.

The

latest firm to bow to this pressure is insurance behemoth MetLife, which just announced it is exploring a spinoff of

its retail life and annuity business in the U.S. into a new presumably non-SiFi

company.

The move comes in the wake of moves by General Electric to dismantle

large parts of its huge GE Capital business. Among the businesses that

contributed to GE Capital’s heft was the banking operation it purchased from MetLife in 2011 as part of

a previous move by the insurer to reduce its regulatory oversight.

Now other large insurers such as Prudential Financial and American International Group, the latter the recipient of a $180 billion federal bailout, may take similar steps. Apart from the regulatory pressures, AIG has been dealing with breakup calls from investors such as John Paulson and Carl Icahn, who dubbed it “too big to succeed.”

It

remains to be seen whether the big banks will succumb to the breakup. For the

moment they are resisting, but that’s the stance MetLife had long maintained.

Their sagging stock prices make them susceptible to a move by someone like

Icahn.

It’s

gratifying to see regulation working as designed to make the country less

vulnerable to large reckless institutions and a bit less enthralled with

financialization. GE’s announcement that it is moving its headquarters to

Boston is part of its retreat from finance.

Yet

more still needs to be done to get the banks to clean up their act. Stricter

capital rules are fine, but the likes of B of A and JPMorgan Chase need to feel

more pressure to obey the law. They’ve had to cough up larger and larger

financial settlements and in a few

cases have even had to plead guilty to criminal charges. Yet they

haven’t gotten the message.

Perhaps

what’s needed are “honesty requirements” to go along with the more stringent

capital requirements. In other words, banks that break the law would have to

sell off the businesses involved in the misconduct. This would accelerate the

move away from overly large financial institutions and hopefully put more

operations in the hands of firms that are willing to play by the rules.

———-

Note: the Dirt Diggers Digest Enforcement

page, which provides links to the compliance data posted by more

than 50 federal regulatory agencies, has just been updated and expanded.