Thanks to tax-dodging Donald Trump, we now know we really need to fix our upside down tax code.

By Josh Hoxie

Soon, this

election will be over, and the task of governing will fall on the winning

candidate and the reshuffled Congress. At the top of the list of issues to

address in the early months of 2017 should be reforming our broken tax code.

Soon, this

election will be over, and the task of governing will fall on the winning

candidate and the reshuffled Congress. At the top of the list of issues to

address in the early months of 2017 should be reforming our broken tax code.

Why should tax reform take

center stage among the many issues plaguing the country?

Because Americans desperately

want to see rising inequality addressed. Concern over the issue drove the

insurgent Bernie Sanders presidential campaign and is top among issues of

importance to Democratic voters.

Lest one think Sanders’ primary

loss gave the green light for inaction on inequality, note that the socialist

senator from Vermont is currently the most popular politician in the country.

The growing divides between the rich and the rest of us rank consistently among the most pressing issues facing all voters, not just Bernie supporters. In short, the public’s appetite for action is high, and the next president as well as Congress would do well to listen to them.

There are a number of drivers of

inequality, but none are so obvious and so fixable as the deeply unfair tax

code.

A review of tax returns by the New York Times last year showed the top one thousandth of

1 percent — the richest of the rich — pay just 17.6 percent of their income in

taxes. For context, the top tax rate in the country, intended to tax these very

people, is more than double that figure, at 39.6 percent.

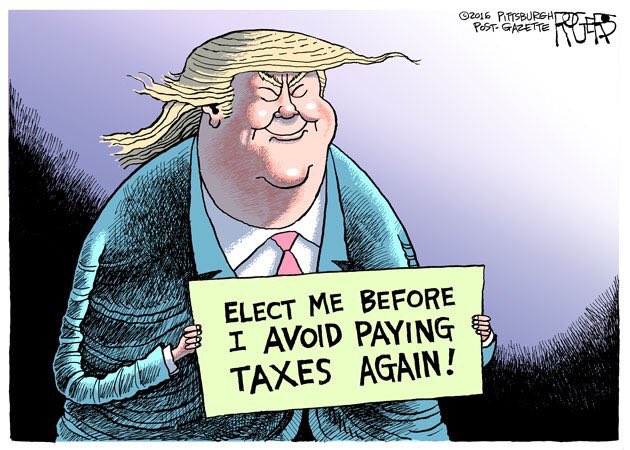

Perhaps the most egregious

poster child for the broken tax code is Donald J. Trump. The billionaire

appears to pay zero federal income taxes.

In other words, the major party

presidential candidate has contributed nothing to the development of our roads

and bridges, our schools and public parks, or any of the other essential public

services that taxpayers make possible.

But Trump’s far from the only

offender.

Wealthy households and their

armies of lawyers and accountants are able to dodge paying their fair share

through loopholes they helped put in place.

The same goes for the most

profitable corporations, many of which have also dropped their federal income

tax rate to zero. Plenty of these corporations are exploiting offshore tax

shelters to avoid paying over $700 billion in taxes.

It’s now commonplace for these

elites to spend millions to save billions on tax reform. Meanwhile, working and

middle class families, who don’t have millions to spend on lobbyists or

“creative” accountants, are left to fill the hole.

The solutions to fix the tax

code and thus make a dent in reversing inequality are straightforward.

Close the expensive loopholes

and offshore tax havens that only exist to encourage tax evasion.

Update the

tax code to ensure those who make their money via investments or inheritance

pay taxes on their income the same way people who punch a time clock do.

Of course, the simplicity of a

solution doesn’t imply it’ll be easy. Powerful forces aligned to create the

unfair tax code we have now, and they’ll go to great lengths defending it.

An

equally powerful movement will be required to overcome this, on par with the social

movements required for all the major steps forward our country has taken in its

history.

The conservative anti-tax

activist Grover Norquist famously said, “You win the tax issue, you win all the

issues.” On this point, he was right.

Josh Hoxie directs the Project on Taxation and

Opportunity at the Institute for Policy Studies. Distributed by

OtherWords.org.