by Jesse Eisinger for ProPublica

President-elect Donald Trump's transition-team adviser on financial policies and appointments, Paul Atkins, has been depicted as an ideological advocate of small government.

President-elect Donald Trump's transition-team adviser on financial policies and appointments, Paul Atkins, has been depicted as an ideological advocate of small government.But the ways that the Trump administration and Congressional Republicans are likely to approach financial deregulation could serve Atkins' wallet as well as his political agenda.

Like Trump himself, Atkins himself faces potential conflicts between his business dealings and his public role.

In 2009, a year after he finished his term as a Republican member of the Securities and Exchange Commission, Atkins formed Patomak Global Partners, a consulting firm headquartered on 17th Street, nestled blocks from the Hay-Adams Hotel and the south lawn of the White House.

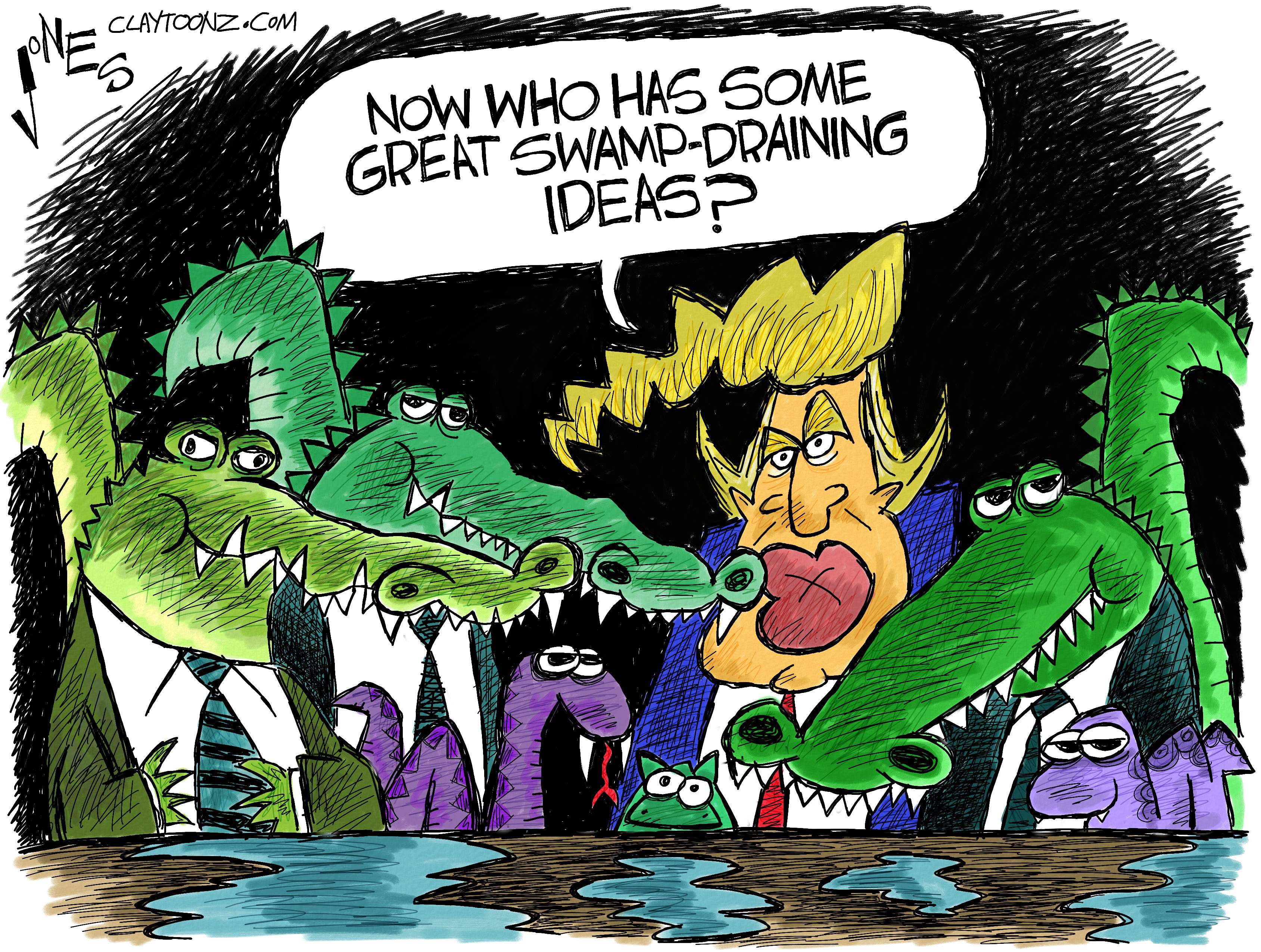

While Trump promised to "drain the swamp" of Washington, Atkins' environs could not get any swampier. Patomak's president is Daniel Gallagher, also a right-leaning former SEC commissioner who might be a candidate for SEC chairman under Trump. Former high-level government officials populate Patomak's ranks.

Patomak has thrived as financial firms tried to navigate the new world of post-crisis regulations. Patomak and its counterparts, like Promontory Financial Group, are not technically lobbyists, but they exploit their connections to regulators to help their clients — banks and other financial institutions — navigate the rules. (Such consulting firms say they help clients comply with, not circumvent, the rules. A Patomak spokeswoman did not respond to a request for comment.)

The firms stand as emblems of the Washington revolving door. Banks pay a premium to former high-level regulators, valuing them for their contacts at the regulatory agencies. Stacked with Republicans, Patomak is well positioned to benefit from the new power structure in Washington.

"They have better lines of communications with those in power. They are better able to see and understand what is coming down the pike," says one former high-ranking regulator who now works for a hedge fund.

Under a court order last month, Atkins and his firm are now monitoring Deutsche Bank's agreement with the Commodities Futures Trading Commission to properly oversee and disclose its derivatives trading. Separately, Deutsche Bank is negotiating with the Department of Justice over the size of its fine to settle mortgage related misdeeds.

Donald Trump has outstanding loans from Deutsche Bank. These inter-connections raise a host of conflict of interest issues. Will Patomak monitor Deutsche Bank vigilantly? Will financial regulators, perhaps appointed by Trump on Atkins' recommendation, be inclined to soften their regulatory stance on Deutsche Bank in exchange for business favors to the Trump empire?

Wall Street is thrilled about the incoming Trump administration. Bank stocks are soaring. Atkins, who is overseeing the appointees to the independent financial regulators like the SEC and the Federal Deposit Insurance Corporation, will be able to help shape the Trump Administration approach to financial regulation. But just what does that vision entail? Or, among the disparate groups vying for influence, whose ideas will win out?

There seem to be three tribes in the Trump financial regulatory coalition: ideologues, Wall Streeters and populists.

Atkins belongs to the first tribe. "I think of him as more libertarian than conservative," says Simon Lorne, the former general counsel for the SEC, who worked with Atkins in the Clinton Administration.

In testimony last year to the House Financial Services Committee, Atkins opened by approvingly quoting Friedrich Hayek, the Austrian economist and philosopher beloved by libertarians. Hayek, Atkins explained, identified the "fatal conceit": the idea that "man is able to shape the world around him according to his wishes."

Governments, in Atkins' view, share this hubristic notion. When they try to corral capital markets to prevent exploitative or risky behavior, they end up hurting the economy. Since the financial crisis, Atkins has been a part of the steady assault on Dodd Frank.

"The real tragedy — or inconvenient truth — behind Dodd-Frank and the hundreds of other rules flowing from Washington every year is that consumers, investors, and small business are harmed the most," he told Congress in May.

But as the existence of Patomak demonstrates, even ideologues find the regulatory state lucrative.

Meanwhile, the Wall Street crowd appears to have a seat at the table. Steve Mnuchin, the former Goldman Sachs partner who was the Trump campaign's national finance chairman, is a possible Treasury secretary.

The third tribe, in theory, is the populists. Trump campaigned with a populist message but they have no representatives on regulatory transition team or among the rumored appointees.

Steve Bannon, Trump's chief political strategist and a former Goldman Sachs partner, has criticized the 2008 bank bail-out, and the Republican platform called for breaking up the big banks. But few expect anything resembling that.

Experts say the GOP isn't likely to repeal Dodd Frank wholesale. Instead, they will likely chip away at it, opening up loopholes. Some changes will come from Congress, others from inside the regulatory bodies themselves. Many "elements can be dismantled in back rooms," says Marcus Stanley, policy director of the consumer group Americans for Financial Reform.

Instead of shuttering the Consumer Financial Protection Bureau, the GOP-controlled Congress may change its leadership structure, shift its source of funding, and shave its budget. Instead of repealing the Volcker Rule, which prohibits banks from trading for their own account, regulators may widen the number of trades that fall outside the definition.

Legislators have floated proposals to loosen derivatives trading rules. They aspire to weaken the Financial Stability Oversight Council. Congress will likely continue to trim the budgets for the SEC and the CFTC and reverse rules extending fiduciary standards to new classes of financial advisors.

Such moves diminish Republican vulnerability to Democratic attacks that a repeal of Dodd Frank is a gift to Wall Street. Maintaining a sprawling kudzu of arcane rules and regulations preserves the necessity of specialists in the art of navigating the bramble of the swamp. Including firms like Patomak.

ProPublica is a Pulitzer Prize-winning investigative newsroom. Sign up for their newsletter.