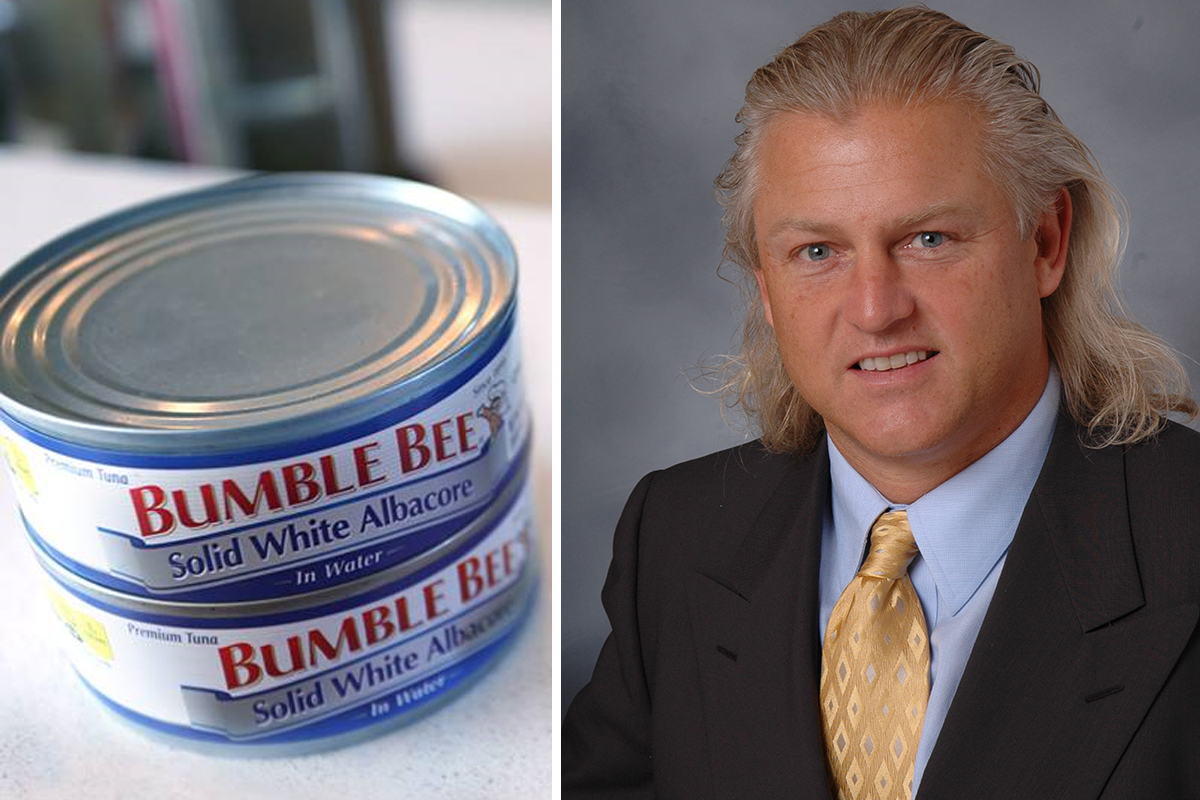

Bumble Bee CEO Gets Stung

Corporate critics, myself included,

have long complained about the unwillingness of federal authorities to hold top

executives personally responsible for illicit practices at the businesses they

run.

Corporate critics, myself included,

have long complained about the unwillingness of federal authorities to hold top

executives personally responsible for illicit practices at the businesses they

run.

It was thus surprising but

encouraging to learn that the Justice Department Antitrust Division has gotten

a grand jury to return an indictment against the chief

executive of Bumble Bee Foods for participating in a conspiracy to fix prices

of packaged seafood sold in the United States.

The case against Christopher

Lischewski comes in the wake of the prosecution of the company itself, which

last year agreed to pay a criminal fine of $25

million, which under certain circumstances could rise to more than $80 million.

The investigation has also ensnared

several other individuals, including two at Bumble Bee, which is owned by the

British private equity firm Lion Capital, and one at rival Star Kist.

We can hope that these cases are a sign that the Trump Administration’s Antitrust Division is taking its job seriously. Since Trump took office, the division has announced several large penalties against foreign banks such as France’s BNP Paribas for manipulation of currency markets, but this was the continuation of an investigation that began under Obama.

Some other Trump era cases have been

pretty minor, such as the $409,342 fine imposed on an e-commerce

company for fixing the price of promotional wristbands.

Price manipulation relating to

consumer and industrial products is a perennial form of corporate misconduct.

It is one of the main business offenses that regularly involves criminal

charges and results in guilty pleas.

In Violation Tracker we document 241 Antitrust Division cases

against corporations that resulted in more than $10 billion in penalties.

Looking at the list, one is struck by the fact that so many of the defendants

are foreign firms, including 11 of the dozen biggest fines.

This is not to say that U.S.

companies don’t fix prices. Probably the most famous price-fixing case ever was

the conspiracy to manipulate the electrical equipment market by the likes of

General Electric and Westinghouse in the 1950s. U.S. agribusiness giant Archer

Daniels Midland was at the center of a lysine price fixing scandal in the

1990s.

It may be that in recent years

federal antitrust prosecutors have felt pressure not to go after domestic

companies, or else that foreign corporations are emboldened by the pro-business

climate in the U.S. to engage in more brazen behavior.

In any event, at a time of

unprecedented concentration of ownership in many U.S. industries, there is

bound to be plenty of price collusion going on that needs to be investigated.