Cooking the Books in the Trump Universe

Once upon a time, there was a little-known energy company called

Enron. In its 16-year life, it went from being dubbed America’s most innovative company by Fortune Magazine to being the poster

child of American corporate deceit. Using a classic recipe for book-cooking,

Enron ended up in bankruptcy with jail time for those involved. Its

shareholders lost $74 billion in the four years leading up

to its bankruptcy in 2001.

A decade ago, the flameout

of my former employer, Lehman Brothers, the global financial firm, proved far

more devastating, contributing as it did to a series of events that ignited a

global financial meltdown. Americans lost an estimated $12.8 trillion in the havoc.

Despite the differing

scales of those disasters, there was a common thread: both companies used

financial tricks to make themselves appear so much healthier than they actually

were. They both faked the numbers, thanks to off-the-books or offshore

mechanisms and eluded investigations... until they collapsed.

Now, here’s a question for

you as we head for the November midterm elections, sure to be seen as a

referendum on the president: Could Donald Trump be a one-man version of either

Enron or Lehman Brothers, someone who cooked “the books” until, well, he

imploded?

Since we’ve never seen his

tax returns, right now we really don’t know.

What we do know is that he’s been dodging bullets ever since the Justice Department accused him of violating the Fair Housing Act in his operation of 39 buildings in New York City in 1973.

Unlike famed 1920s mob boss Al Capone, he may never get done in by something as simple as tax evasion, but time will tell.

What we do know is that he’s been dodging bullets ever since the Justice Department accused him of violating the Fair Housing Act in his operation of 39 buildings in New York City in 1973.

Unlike famed 1920s mob boss Al Capone, he may never get done in by something as simple as tax evasion, but time will tell.

Rest assured of one thing

though: he won’t go down easily, even if he is already the subject of multiple

investigations and a plethora of legal slings and arrows. Of course, his methods

should be familiar. As President Calvin Coolidge so famously put it, “the business of America is business.”

And the business of business is to circumvent or avoid the heat... until, of

course, it can’t.

The Safe

So far, Treasury Secretary

and former Trump national campaign finance chairman Steven Mnuchin

has remained out of the legal fray that’s sweeping away some of his fellow

campaign associates.

So far, Treasury Secretary

and former Trump national campaign finance chairman Steven Mnuchin

has remained out of the legal fray that’s sweeping away some of his fellow

campaign associates. Certainly, he and his wife (photo at left) have grandiose tastes. And, yes, his claim that his hedge fund, Dune Capital Management, used offshore tax havens only for his clients, not to help him evade taxes himself, represents a stretch of the imagination. Other than that, however, there seems little else to investigate -- for now.

Still, as Treasury secretary he does oversee a federal agency that means the world to Donald Trump, the Internal Revenue Service, which just happens to be located across a courtyard from the Trump International Hotel on Washington’s Pennsylvania Avenue.

As it happens, the IRS in

the Trump era still doesn’t have a commissioner, only an acting head. What it

may have, National

Enquirer-style, is genuine presidential secrets in the form of

Donald Trump’s elusive tax returns. Last fall, outgoing IRS Commissioner John

Koskinen said that there were plans to relocate them to a shiny new safe

where they would evidently remain.

In 2016, Trump became the

first candidate since President Richard Nixon not to disclose his tax returns.

During the campaign, he insisted that those returns were undergoing an IRS audit and that he would not release them until it was completed. (No one at the IRS has ever confirmed that being audited in any way prohibits the release of tax information.)

The president’s pledge to do so remains unfulfilled and last year counselor to the president Kellyanne Conway noted that the White House was “not going to release his tax returns,” adding -- undoubtedly thinking about his base -- “people didn’t care.”

During the campaign, he insisted that those returns were undergoing an IRS audit and that he would not release them until it was completed. (No one at the IRS has ever confirmed that being audited in any way prohibits the release of tax information.)

The president’s pledge to do so remains unfulfilled and last year counselor to the president Kellyanne Conway noted that the White House was “not going to release his tax returns,” adding -- undoubtedly thinking about his base -- “people didn’t care.”

On April 17, 2018, the

White House announced that the president would defer

even filing his 2017 tax returns until this October. As every president since

Nixon has undergone a mandatory audit while in office, count on American taxpayers

hearing the same excuse for the rest of his term, even if Congress were to

decide to invoke a 1924 IRS provision to view them.

Still, Conway may have a

point when it comes to the public. After all, tax dodging is as American as

fireworks on the Fourth of July. According to one study, every year the U.S. loses $400

billion in unpaid taxes, much of it hidden in offshore tax havens.

Yet the financial

disclosures that The Donald did make during election campaign 2016 indicate that there are more than 500

companies in over two dozen countries, mostly with few to no employees or real

offices, that feature him as their “president.”

Let’s face it, someone like Trump would only create a business universe of such Wall Street-esque complexity if he wanted to hide something. He was likely trying to evade taxes, shield himself and his family from financial accountability, or hide the dubious health of parts of his business empire.

As a colleague of mine at Bear Stearns once put it, when tax-haven companies pile up like dirty laundry, there’s a high likelihood that their uses aren’t completely clean.

Let’s face it, someone like Trump would only create a business universe of such Wall Street-esque complexity if he wanted to hide something. He was likely trying to evade taxes, shield himself and his family from financial accountability, or hide the dubious health of parts of his business empire.

As a colleague of mine at Bear Stearns once put it, when tax-haven companies pile up like dirty laundry, there’s a high likelihood that their uses aren’t completely clean.

Now, let’s consider what

we know of Donald Trump’s financial adventures, taxes and all. It’s quite a

story and, even though it already feels like forever, it’s only beginning to be

told.

The Trump Organization

Atop the non-White House

branch of the Trump dynasty is the Trump Organization. To comply with federal

conflict-of-interest requirements, The Donald officially turned over that company’s reins to his

sons, Eric and Donald Jr. For all the obvious reasons, he was supposed to

distance himself from his global business while running the country.

Only that didn’t happen

and not just because every diplomat and lobbyist in town started to

frequent his money-making new hotel on Pennsylvania

Avenue.

/https%3A%2F%2Fblueprint-api-production.s3.amazonaws.com%2Fuploads%2Fcard%2Fimage%2F231449%2Ff546228cd085451d8b52137a7f968c4e.jpg) Now, according to the New York Times,

the Manhattan district attorney’s office is considering pressing criminal

charges against the Trump Organization and two of its senior officials because

the president’s lawyer, Michael Cohen, paid off an adult film actress and a

former Playboy model to keep

their carnal knowledge to themselves before the election.

Now, according to the New York Times,

the Manhattan district attorney’s office is considering pressing criminal

charges against the Trump Organization and two of its senior officials because

the president’s lawyer, Michael Cohen, paid off an adult film actress and a

former Playboy model to keep

their carnal knowledge to themselves before the election.

/https%3A%2F%2Fblueprint-api-production.s3.amazonaws.com%2Fuploads%2Fcard%2Fimage%2F231449%2Ff546228cd085451d8b52137a7f968c4e.jpg) Now, according to the New York Times,

the Manhattan district attorney’s office is considering pressing criminal

charges against the Trump Organization and two of its senior officials because

the president’s lawyer, Michael Cohen, paid off an adult film actress and a

former Playboy model to keep

their carnal knowledge to themselves before the election.

Now, according to the New York Times,

the Manhattan district attorney’s office is considering pressing criminal

charges against the Trump Organization and two of its senior officials because

the president’s lawyer, Michael Cohen, paid off an adult film actress and a

former Playboy model to keep

their carnal knowledge to themselves before the election.

Though Cohen effectively

gave Stormy Daniels $130,000 and Karen McDougal $150,000 to keep them

quiet, the Trump Organization then paid Cohen even more, $420,000, funds it

didn’t categorize as a reimbursement for expenses, but as a “retainer.” In its internal paperwork, it then

termed that sum as “legal expenses.”

The D.A.’s office is

evidently focusing its investigation on how the

Trump Organization classified that payment of $420,000, in part for the funds

Cohen raised from the equityin his home to calm the Stormy (so to

speak). Most people take out home equity loans to build a garage or pay down

some debt. Not Cohen.

It’s a situation that could become far thornier for Trump. As Cohen already knew, Trump couldn’t possibly wield his pardon power to absolve his former lawyer, since it only applies to those convicted of federal charges, not state ones.

It’s a situation that could become far thornier for Trump. As Cohen already knew, Trump couldn’t possibly wield his pardon power to absolve his former lawyer, since it only applies to those convicted of federal charges, not state ones.

And that’s bad news for

the president. As Lanny Davis, Cohen’s lawyer, put it, “If those payments were a crime for

Michael Cohen, then why wouldn’t they be a crime for Donald Trump?”

The bigger question is:

What else is there?

Those two payoffs may, after all, just represent the beginning of the woes facing both the Trump Organization and the Trump Foundation, which has been the umbrella outfit for businesses that have incurred charges of lobbying violations (not disclosing payment to a local newspaper to promote favorable casino legislation) and gaming law violations.

His organization has also been accused of misleading investors, engaging in currency-transaction-reporting crimes, and improperly accounting for money used to buy betting chips, among a myriad of other transgressions. To speculate on overarching corporate fraud would not exactly be a stretch.

Those two payoffs may, after all, just represent the beginning of the woes facing both the Trump Organization and the Trump Foundation, which has been the umbrella outfit for businesses that have incurred charges of lobbying violations (not disclosing payment to a local newspaper to promote favorable casino legislation) and gaming law violations.

His organization has also been accused of misleading investors, engaging in currency-transaction-reporting crimes, and improperly accounting for money used to buy betting chips, among a myriad of other transgressions. To speculate on overarching corporate fraud would not exactly be a stretch.

Unlike his casinos, the Trump Organization has not (yet)

gone bankrupt, nor -- were it to do so -- is it in a class with Enron or Lehman

Brothers.

Yet it does have something in common with both of them: piles of money secreted in places designed to hide its origins, uses, and possibly end-users. The question some authority may pursue someday is: If Donald Trump was willing to be a part of a scheme to hide money paid to former lovers, wouldn't he do the same for his businesses?

Yet it does have something in common with both of them: piles of money secreted in places designed to hide its origins, uses, and possibly end-users. The question some authority may pursue someday is: If Donald Trump was willing to be a part of a scheme to hide money paid to former lovers, wouldn't he do the same for his businesses?

The Trump Foundation

Questions about Trump’s

charity, the Donald J. Trump Foundation, have abounded since campaign 2016.

They prompted New York Attorney General Barbara Underwood to file a lawsuit on

June 14th against the foundation, also naming its board of directors, including

his sons and his daughter Ivanka.

Questions about Trump’s

charity, the Donald J. Trump Foundation, have abounded since campaign 2016.

They prompted New York Attorney General Barbara Underwood to file a lawsuit on

June 14th against the foundation, also naming its board of directors, including

his sons and his daughter Ivanka. It cites “a pattern of persistent illegal conduct... occurring over more than a decade, that includes extensive unlawful political coordination with the Trump presidential campaign, repeated and willful self-dealing transactions to benefit Mr. Trump’s personal and business interests, and violations of basic legal obligations for non-profit foundations.”

As the New York Times reported, “The lawsuit

accused the charity and members of Mr. Trump’s family of sweeping violations of

campaign finance laws, self-dealing, and illegal coordination with Mr. Trump’s

presidential campaign.”

It also alleged that for four years -- 2007, 2012, 2013, and 2014 -- Trump himself placed his John Hancock below incorrect statements on the foundation’s tax returns.

It also alleged that for four years -- 2007, 2012, 2013, and 2014 -- Trump himself placed his John Hancock below incorrect statements on the foundation’s tax returns.

The main issue in

question: Did the Trump Foundation use any of its funds to benefit The Donald

or any of his businesses directly? Underwood thinks so.

Asshe pointed out, it “was little more than a checkbook for payments from Mr. Trump or his businesses to nonprofits, regardless of their purpose or legality.” Otherwise it seems to have employed no one and, according to the lawsuit, its board of directors has not met since 1999.

Asshe pointed out, it “was little more than a checkbook for payments from Mr. Trump or his businesses to nonprofits, regardless of their purpose or legality.” Otherwise it seems to have employed no one and, according to the lawsuit, its board of directors has not met since 1999.

Because Trump ran all of

his enterprises, he was also personally responsible for signing their tax

returns. His charitable foundation was no exception. Were he found to have

knowingly provided false information on its tax returns, he could someday face perjury charges.

On August 31st, the

foundation’s lawyers fought back, filing papers of their own,

calling the lawsuit, as the New York

Times put it, “a political attack motivated by the former attorney

general’s ‘record of antipathy’ against Mr. Trump.”

They were referring to Eric Schneiderman, who had actually resigned the previous May -- consider this an irony under the circumstances -- after being accused of sexual assault by former girlfriends.

They were referring to Eric Schneiderman, who had actually resigned the previous May -- consider this an irony under the circumstances -- after being accused of sexual assault by former girlfriends.

The New York state court

system has, in fact, emerged as a vital force in the pushback against the

president and his financial shenanigans.

As Zephyr Teachout, recent Democratic candidate for New York attorney general, pointed out, it is “one of the most important legal offices in the entire country to both resist and present an alternative to what is happening at the federal level." And indeed it had begun fulfilling that responsibility with The Donald long before the Mueller investigation was even launched.

As Zephyr Teachout, recent Democratic candidate for New York attorney general, pointed out, it is “one of the most important legal offices in the entire country to both resist and present an alternative to what is happening at the federal level." And indeed it had begun fulfilling that responsibility with The Donald long before the Mueller investigation was even launched.

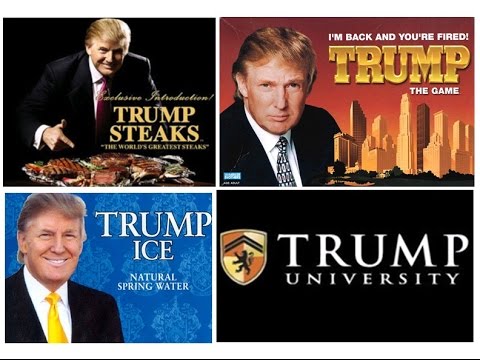

In 2013, Schneiderman

filed a civil suit against Trump University,

calling it a sham institution that engaged in repeated fraudulent behavior. In

2016, Trump finally settled that case in court, agreeing to a $25 million payment to its former students

-- something that (though we don’t, of course, have the tax returns to confirm

this) probably also proved to be a tax write-off for him.

These days, the New York

attorney general’s office could essentially create a branch only for matters

Trumpian. So far, it has brought more than 100 legal or administrative

actions against the president and congressional Republicans since he took

office.

Still, don’t sell the

foundation short. It did, in the end, find a way to work for the greater good

-- of Donald Trump. He and his wife, Melania, for instance, used the “charity”

to purchase a now infamous six-foot portrait of himself for $20,000 -- and true

to form, according to the Washington Post, even that purchase could

turn out to be a tax violation.

Such “self-dealing” is considered illegal. Of course, we’re talking about someone who “used $258,000 from the foundation to pay off legal settlements that involved his for-profit businesses.” That seems like the definition of self-dealing.

Such “self-dealing” is considered illegal. Of course, we’re talking about someone who “used $258,000 from the foundation to pay off legal settlements that involved his for-profit businesses.” That seems like the definition of self-dealing.

The Trump Team

The president swears that he has an uncanny ability to

size someone up in a few seconds, based on attitude, confidence, and a handshake -- that,

in other words, just as there’s the art of the deal, so, too, there’s the art

of choosing those who will represent him, stand by him, and take bullets for him, his White House, and

his business enterprises.

And for a while, he did indeed seem to be a champion when it came to surrounding himself with people who had a special knack for hiding money, tax documents, and secret payoffs from public view.

And for a while, he did indeed seem to be a champion when it came to surrounding himself with people who had a special knack for hiding money, tax documents, and secret payoffs from public view.

These days -- think of

them as the era of attrition for Donald Trump -- that landscape looks a lot

emptier and less inviting.

On August 21st, his former

campaign manager, Paul Manafort, was convicted in Virginia of “five counts of

tax fraud, two counts of bank fraud, and one count of failure to disclose a foreign

bank account.” (On September 14th, he would make a deal with Robert Mueller and plead guilty to two counts of

conspiracy.)

On that same August day, Trump's personal lawyer, Michael Cohen, also pled guilty to eight different federal crimes in the Manhattan U.S. attorney’s office, including -- yep -- tax evasion.

On that same August day, Trump's personal lawyer, Michael Cohen, also pled guilty to eight different federal crimes in the Manhattan U.S. attorney’s office, including -- yep -- tax evasion.

Three days later,

prosecutors in the Cohen investigation granted immunity to the Trump

Organization’s chief financial officer, Allen Weisselberg. A loyal employee of

the Trump family for more than four decades, he had also served as treasurer

for the Donald J. Trump Foundation.

If anyone other than the president and his children knows the financial and tax secrets of the Trump empire, it’s him. And now, he may be ready to talk. Lurking in his future testimony could be yet another catalyst in a coming Trump tax debacle.

If anyone other than the president and his children knows the financial and tax secrets of the Trump empire, it’s him. And now, he may be ready to talk. Lurking in his future testimony could be yet another catalyst in a coming Trump tax debacle.

And don’t forget David

Pecker, CEO of American Media, the company that publishes the National Enquirer. Pecker bought and buried stories for The Donald

for what seems like forever.

And don’t forget David

Pecker, CEO of American Media, the company that publishes the National Enquirer. Pecker bought and buried stories for The Donald

for what seems like forever. He, too, now has an immunity deal in the federal investigation of Cohen (and so Trump), evidently in return for providing information on the president’s hush-money deals to bury various exploits that he came to find unpalatable.

The question is this: Did

Trump know of Cohen’s hush-money payments?

Cohen has certainly indicated that he did and Pecker seems to have told federal prosecutors a similar story. As Cohen said in court of Pecker, "I and the CEO of a media company, at the request of the candidate, worked together" to keep the public in the dark about such payments and Trump’s involvement in them.

Cohen has certainly indicated that he did and Pecker seems to have told federal prosecutors a similar story. As Cohen said in court of Pecker, "I and the CEO of a media company, at the request of the candidate, worked together" to keep the public in the dark about such payments and Trump’s involvement in them.

The president’s former

lawyer faces up to 65 years in prison. That’s enough time to make him consider

what other tales he might be able to tell in return for a lighter sentence,

including possibly exposing various tax avoidance techniques he and his former

client cooked up.

And don’t think that

Cohen, Pecker, and Weisselberg are going to be the last figures to come forward

with such stories as the Trump team begins to come unglued.

In the cases of Enron and

Lehman Brothers, both companies unraveled after multiple shell games imploded.

Enron’s losses were being hidden in multiple offshore entities.

In the case of Lehman Brothers, staggeringly over-valued assets were being pledged to borrow yet more money to buy similar assets. In both cases, rigged games were being played in the shadows, while vital information went undisclosed to the public -- until it was way too late.

In the case of Lehman Brothers, staggeringly over-valued assets were being pledged to borrow yet more money to buy similar assets. In both cases, rigged games were being played in the shadows, while vital information went undisclosed to the public -- until it was way too late.

Donald Trump’s equivalent

shell games still largely remain to be revealed. They may simply involve hiding

money trails to evade taxes or to secretly buy political power and business

influence. There is, as yet, no way of knowing. One thing is clear, however:

the only way to begin to get answers is to see the president’s tax returns,

audited or not. Isn’t it time to open that safe?

Nomi Prins

is a TomDispatch regular. Her new book, Collusion: How Central Bankers Rigged the World (Nation

Books), has just been published. Her previous books include:All the Presidents' Bankers: The

Hidden Alliances That Drive American Power (Nation

Books) and Other People's Money: The Corporate Mugging of America. She is a former Wall Street executive.

Follow her on Twitter: @nomiprins