How can you claim to support working people while protecting

payday loan predators?

By Phil Mattera for the Dirt Diggers Digest

Among the various roles played by

Donald Trump during his State of the Union address was that of class warrior.

Among the various roles played by

Donald Trump during his State of the Union address was that of class warrior.

He described a divide between

“wealthy politicians and donors” living in gated communities while supposedly

pushing for open borders and “working class Americans” who are “left to pay the

price for illegal immigration—reduced jobs, lower wages, overburdened schools,

hospitals that are so crowded you can’t get in, increased crime, and a depleted

social safety net.”

Trump’s efforts to stir up worker

resentment focus almost exclusively on situations in which foreigners can be

depicted as the real culprits.

He has no difficulty demonizing

undocumented immigrants or the Chinese government, yet he rarely has any

critical words for the traditional targets of populist anger: the super-wealthy

and powerful corporations.

On the contrary, those interests

have enjoyed a privileged place during the Trump era, receiving lavish benefits

in the form of tax breaks and regulatory rollbacks.

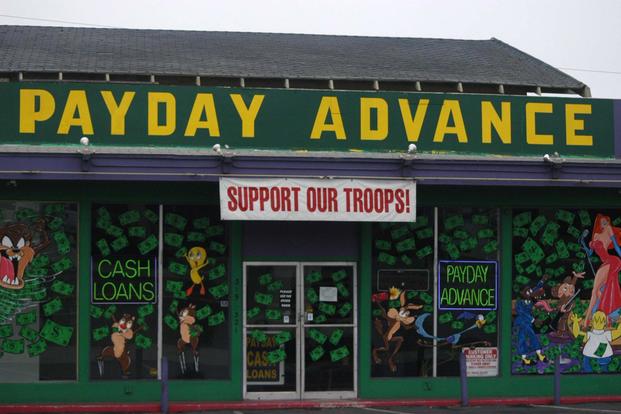

The latest example of the latter

came less than 24 hours after Trump concluded his remarks in the House chamber.

His Consumer Financial Protection Bureau announced plans to gut restrictions on

payday lenders that were developed during the Obama Administration and were

scheduled to take effect later this year.

The new rules were designed to put the responsibility on lenders to make sure their customers could afford the loans they were being offered.

This was seen as a necessary

safeguard in an industry notorious for charging astronomical interest rates to

vulnerable customers who frequently ended up with massive debts after rolling

over a series of short-term loans.

Prior to being neutered by the Trump

Administration, the CFPB conducted a series of enforcement actions against

payday lenders for egregious practices.

For example, in 2014 the

bureau brought a $10 million action against

ACE Cash Express, alleging that the company “used illegal debt collection

tactics – including harassment and false threats of lawsuits or criminal

prosecution – to pressure overdue borrowers into taking out additional loans

they could not afford.”

Payday lending has effectively been

outlawed in about 20 states, but the Obama-era rules would have made a big

difference in the rest of the country where the disreputable business is still

allowed to function with annual interest rates of 300 percent or more. It will

come as no surprise that many of the latter states are ones in which Trump

enjoys high levels of popularity.

I can’t help but wonder what working

class Trump supporters will think of this policy.

Coal miners cannot be completely

faulted for believing that Trump’s moves to dismantle power-plant emission

controls may help them get work, but will struggling low-income families be

cheered to learn that the administration is making it easier for payday lenders

to exploit them rather than following the lead of the states that put a lid on

usury?

Or, to put it more broadly, how long

will Trump be able to pretend to be a working-class populist while pursuing the

worst kind of plutocratic policies?