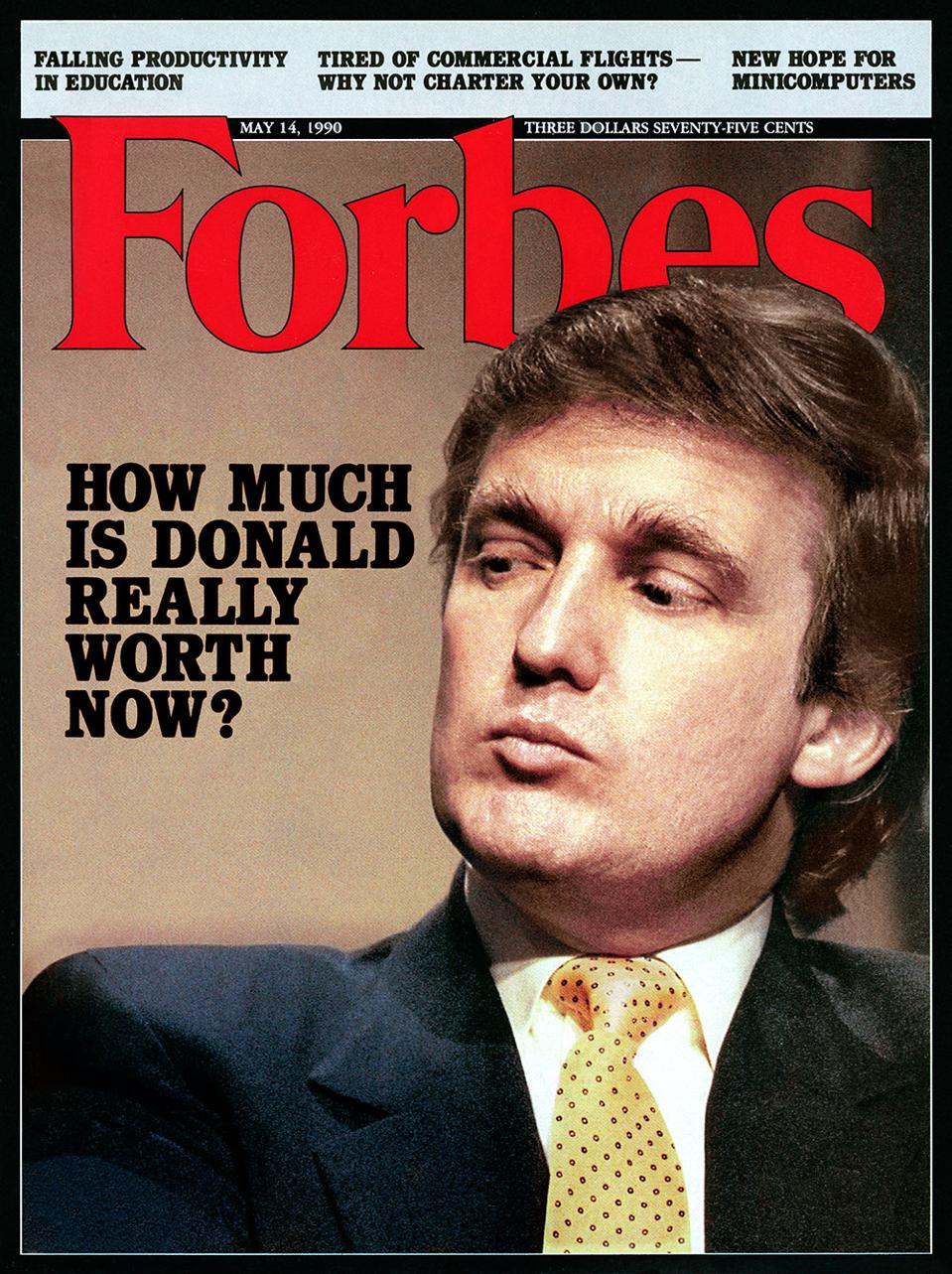

New Trump tax facts hint at massive cheating and vulnerability to Russian influence

By David Cay Johnston, Editor-in-Chief Now that Donald Trump has been exposed as perhaps the biggest

loser in American business history, here are two reasonable questions to ask:

Now that Donald Trump has been exposed as perhaps the biggest

loser in American business history, here are two reasonable questions to ask:

Does this shed any light on his fight to keep Congress from

seeing his recent tax returns?

Do Trump’s tax filings matter to us and our government?

And the answers are yes

and YES!

The losses Trump took far exceed the value of his buildings… That

means he also had large other losses, which was known generally, but not the

scale of those losses.

Any taxpayer can get their

own IRS tax transcript. People routinely authorize banks, employers and others

to obtain their personal and business transcripts.Despite the bluster, the data is a reliable record of what Trump told the IRS in his annual tax returns, as the newspaper carefully explained to readers.

A major implication of these tax documents, as well as the 2005 partial tax return obtained and other records, is that Trump’s tax returns would not stand up under audit.

Congress allows real estate developers to depreciate the value of their buildings even if they were bought with 100% borrowed money, as Trump did repeatedly. Owners of all other kinds of businesses must have their own money at risk to get tax breaks.

So, reporting negative

income, as Trump did every year, is no surprise. But the size of the losses is.

Trump took almost 2% of all the losses reported in 1994 in the whole

country, The Times reported.

The real estate losses Trump took far exceed the value of his buildings and the limits enacted by Congress governing how much of that value can be written off each year.

That means he also had large other losses, which was known generally, but not the scale of those losses.

Because there is no tax to collect when there are losses, reported as negative income. Imagine a tax return showing $10 million of negative income.

An auditor works the case and finds $3 million of phony losses. The taxpayer now has $7 million of negative income and no tax is due.

For years I urged IRS commissioners, key staff and Congressional tax staff to take a hard look at people who report negative income not once because of business failure, but year after year. Waste of limited audit resources, I was told.

Under a 1924 anti-corruption law the IRS must hand over the tax returns requested by Rep. Richard Neal, the Massachusetts Democrat who chairs the House Ways and Means Committee.

Trump’s Two Tax Fraud Trials

Remember that Trump lost two tax fraud trials. These were civil, not criminal trials, but the evidence was damning and more than sufficient to have justified criminal charges. Trump’s own tax lawyer and accountant, Jack Mitnick, testified against him at one trial.

And they will likely show he is nowhere near as wealthy as he claims, even after revising downward his claim of more than $10 billion of wealth to about a tenth of that in his Office of Government Ethics reports, which hardly anyone seems to know.

Tax crime was one of the articles of impeachment that Richard Nixon escaped by resigning. Nixon’s tax lawyer went to prison, while Nixon got a pardon from Jerry Ford, our only unelected president.

Beyond the expanded reasons that Congress needs to get, and audit, Trump’s tax returns is the impact on our government.

If millions of people believe the president can cheat the government and get away with it then tax cheating will rise.

Two decades ago I exposed 14 small business owners who didn’t withhold taxes from their workers’ paychecks or pay their own taxes, boasting that since the IRS had not moved against them, they must be behaving legally.

Those business owners were then all indicted separately, tried, convicted and sent to prison, where some of them died.

There’s another even more troubling aspect to Trump’s taxes and our government.

That’s because instead of building up profitable businesses, he strips them of cash, abandons them and moves on. That fits a classic profile of someone susceptible to being influenced by unsavory forces, be they mob loan sharks or foreign intelligence agencies.

We know from the family’s And we know that Trump has denounced America’s foreign intelligence agencies, including the FBI, while praising Vladimir Putin and saying he trusts what Putin says.

Imagine Obama Behaving Like Trump

In the Oval Office Trump disclosed sources and methods, the most sensitive intelligence information, to the Russian foreign minister and its ambassador to America.

We know this only because the Russians announced it, by the way.

What is the complete financial history between the oligarchs, as Putin’s gang of thieves is known, and Trump?

But we don’t know because Trump is stonewalling on the Mueller Report, which he tried to block by firing Mueller (his aides would not carry out the order) and holding back testimony and the redacted portions of the report.

Since Trump has said Mueller vindicated him, why would Trump do this? The answer is obvious.

It is the story of a known tax cheat who has taken an oath to uphold and defend our Constitution but ignores that oath, violate that oath.

The real estate losses Trump took far exceed the value of his buildings and the limits enacted by Congress governing how much of that value can be written off each year.

That means he also had large other losses, which was known generally, but not the scale of those losses.

Because there is no tax to collect when there are losses, reported as negative income. Imagine a tax return showing $10 million of negative income.

An auditor works the case and finds $3 million of phony losses. The taxpayer now has $7 million of negative income and no tax is due.

For years I urged IRS commissioners, key staff and Congressional tax staff to take a hard look at people who report negative income not once because of business failure, but year after year. Waste of limited audit resources, I was told.

Under a 1924 anti-corruption law the IRS must hand over the tax returns requested by Rep. Richard Neal, the Massachusetts Democrat who chairs the House Ways and Means Committee.

Trump’s Two Tax Fraud Trials

Remember that Trump lost two tax fraud trials. These were civil, not criminal trials, but the evidence was damning and more than sufficient to have justified criminal charges. Trump’s own tax lawyer and accountant, Jack Mitnick, testified against him at one trial.

And they will likely show he is nowhere near as wealthy as he claims, even after revising downward his claim of more than $10 billion of wealth to about a tenth of that in his Office of Government Ethics reports, which hardly anyone seems to know.

Tax crime was one of the articles of impeachment that Richard Nixon escaped by resigning. Nixon’s tax lawyer went to prison, while Nixon got a pardon from Jerry Ford, our only unelected president.

Beyond the expanded reasons that Congress needs to get, and audit, Trump’s tax returns is the impact on our government.

If millions of people believe the president can cheat the government and get away with it then tax cheating will rise.

Two decades ago I exposed 14 small business owners who didn’t withhold taxes from their workers’ paychecks or pay their own taxes, boasting that since the IRS had not moved against them, they must be behaving legally.

Those business owners were then all indicted separately, tried, convicted and sent to prison, where some of them died.

There’s another even more troubling aspect to Trump’s taxes and our government.

That’s because instead of building up profitable businesses, he strips them of cash, abandons them and moves on. That fits a classic profile of someone susceptible to being influenced by unsavory forces, be they mob loan sharks or foreign intelligence agencies.

We know from the family’s And we know that Trump has denounced America’s foreign intelligence agencies, including the FBI, while praising Vladimir Putin and saying he trusts what Putin says.

Imagine Obama Behaving Like Trump

In the Oval Office Trump disclosed sources and methods, the most sensitive intelligence information, to the Russian foreign minister and its ambassador to America.

We know this only because the Russians announced it, by the way.

What is the complete financial history between the oligarchs, as Putin’s gang of thieves is known, and Trump?

But we don’t know because Trump is stonewalling on the Mueller Report, which he tried to block by firing Mueller (his aides would not carry out the order) and holding back testimony and the redacted portions of the report.

Since Trump has said Mueller vindicated him, why would Trump do this? The answer is obvious.

It is the story of a known tax cheat who has taken an oath to uphold and defend our Constitution but ignores that oath, violate that oath.