Brian Mittendorf, The Ohio State University

The National Rifle Association’s 2019 annual convention in Indianapolis drew around 80,000 gun enthusiasts, an arsenal of firearm-accessory vendors and appearances by President Donald Trump and Vice President Mike Pence.

The National Rifle Association’s 2019 annual convention in Indianapolis drew around 80,000 gun enthusiasts, an arsenal of firearm-accessory vendors and appearances by President Donald Trump and Vice President Mike Pence.It also produced an unusual display of disunity at the top.

The NRA’s now-former President Col. Oliver North lost his job after accusing Wayne LaPierre, the gun group’s long-serving CEO, of financial improprieties. LaPierre countered by accusing North of extortion. The New York attorney general’s office is now investigating the NRA’s finances.

The increasingly complicated and public drama may seem to have come out of nowhere. But it’s actually a culmination of years of financial problems.

As an accounting scholar who researches nonprofit finances, I have seen the crisis at the NRA slowly unfold in its tax filings. From my perspective, some key financial red flags underlie the NRA’s current struggles.

A pattern of deficit spending

At the end of 2017, the assets that the NRA had available to use at its discretion were actually negative, to the tune of US$31.8 million, according to the paperwork they filed with the IRS.This deep hole came about from years of spending more than they brought in.

Like most accounting experts, I would say that the logical and most responsible reaction to stagnant revenues is to curb spending. But the NRA – whose reputation relies in part on its display of size and strength – found such thrift difficult. While the gun group’s revenue grew only about 0.7% a year over the past decade, NRA expenses grew by an average of 6.4% a year.

And although the organization has historically seen ebbs and flows in its finances, deficit spending has become routine.

Borrowing from unlikely sources

The NRA has been borrowing money to make ends meet amid this deficit spending. Having nearly maxed out its conventional lines of borrowing through banks, it’s also been borrowing from those closer to it.For example, it has aggressively pushed members to pay upfront for multi-year memberships, effectively borrowing from its member ranks. This strategy comes at a cost, however, by closing off those member dues as sources of future cash. At the end of 2017, the NRA’s obligations to members exceeded $30 million.

It also owes its current and future retirees money – after leaving its pension plan underfunded by $49.7 million in 2017. Reports that it has cut back on those promises by freezing its pension plan point to further resource strain.

Perhaps most striking is the NRA’s stopgap borrowing from its own affiliated charity, the NRA Foundation. Charity spending rules do not allow affiliated charities to simply give the NRA money to cover any expenses, but they can lend it funds. This is precisely what the gun group did in 2017, by borrowing $5 million from its affiliated foundation as a short-term loan that was then extended.

An additional $18.8 million of grants from the charity – representing over 40% of the foundation’s budget – demonstrate the group’s heavy reliance on its affiliate. Since charity rules strictly govern how such funds can be used, the New York attorney general’s office probe will surely scrutinize these cash transfers.

Too big to succeed

Boards of directors supervise the nation’s roughly 1.5 million nonprofits, providing financial oversight, strategic guidance and help with fundraising. They also hire, manage and – when needed – fire the group’s top executives.And when nonprofits exhibit signs of distress, their boards are supposed to step in. The NRA’s board, however, has largely backed decisions made by NRA leaders until now. One reason for this may be its size.

The average nonprofit board consists of 15 members. The NRA’s has 76, making it an outlier and perhaps ill-suited to meet its current challenges. Being that big dilutes the responsibility each member has to oversee operations and creates the risk that individual members feel disconnected and more apt to defer to top staffers.

Some of the board members get paid for their work although most do it on a volunteer basis, the NRA’s most recent tax paperwork available indicates.

Media reports paint a picture of the NRA’s board being kept in the dark about key financial problems and struggling to unify around a plan to force the group’s leaders to rein in spending.

Given that LaPierre has led the group since 1991, his sway over the board is clear. The board unanimously re-elected LaPierre, whom the NRA has paid up to $5 million a year, at a meeting following North’s ouster.

Lavish contracts

Perhaps the most salacious accusations at the NRA surround its largest contractor, the Ackerman McQueen ad agency. NRA records indicate that the group spent at least $42.7 million, well over 10% of its entire budget, on the ad firm in 2017.The blurring lines between the NRA and its ad firm allegedly led to cases where some of the NRA’s most visible personalities – like Oliver North and spokeswoman Dana Loesch – were actually paid by Ackerman McQueen for their work, including appearances on NRA TV, the group’s official video channel.

As the NRA’s finances have soured, however, so too have relations with Ackerman McQueen. A lawsuit the group recently filed against the agency over improper billing procedures brought tensions to a boiling point.

Ackerman McQueen isn’t the NRA’s only highly-paid contractor. The NRA paid Akron-based Infocision, a telemarketing giant that specializes in political and nonprofit fundraising, $24.3 million in 2017.

The same company is no stranger to regulatory scrutiny, having agreed to pay a $250,000 settlement after a federal agency accused it of lying to donors. Infocision asserts that it did nothing wrong.

The purpose of Infocision’s NRA contract is, at least ostensibly, to raise funds for the organization. But it actually keeps 100% of the credit card payments it collects from new and lapsed members and only hands over a portion of invoiced member dues. In total, Infocision kept half of all the money it collected in the course of NRA fundraising in 2017.

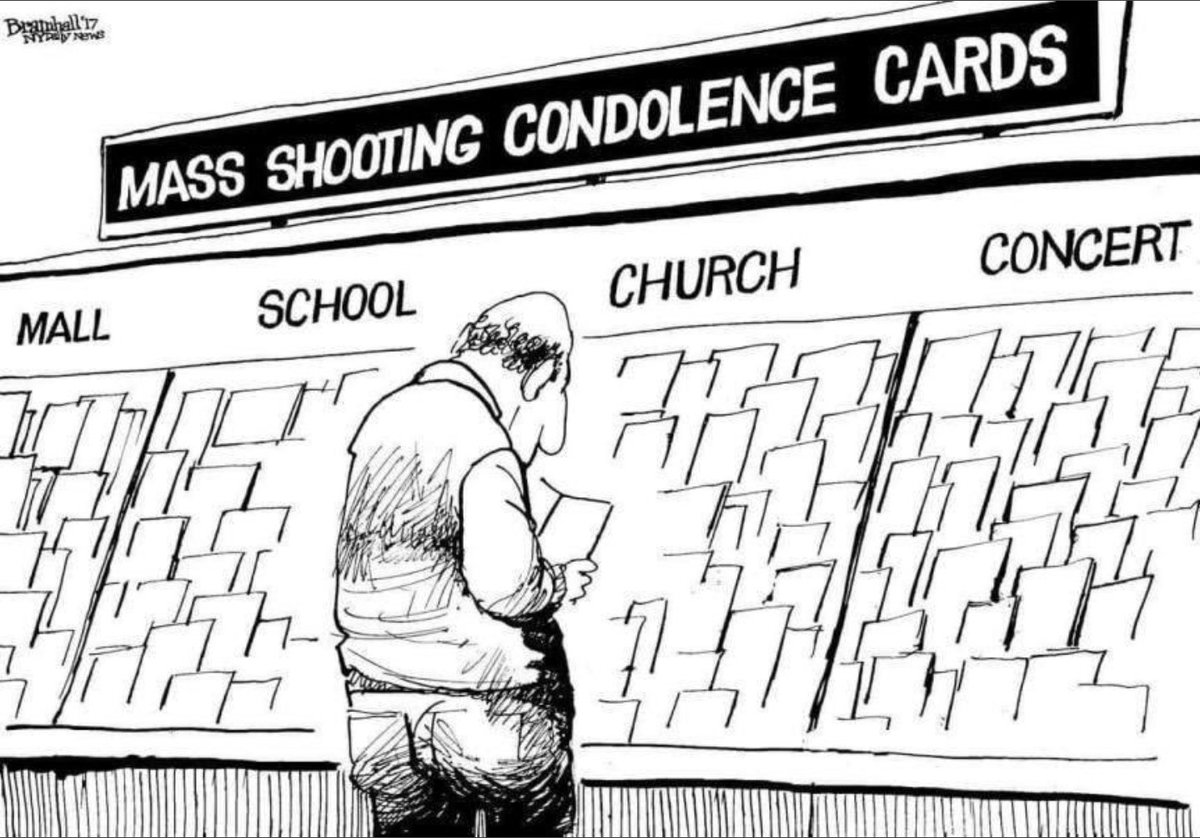

These arrangements, coupled with a failure to curtail spending amid shrinking cash balances, brought the NRA’s turmoil to its peak at a time when it’s also facing growing pushback from a burgeoning gun-control movement outraged by increasingly frequent and deadly mass shootings.

What the threat of insolvency, spate of lawsuits, personnel upheaval and heightened government oversight ultimately do to the NRA remains to be seen. But one thing is already clear: They have the potential to permanently fracture the NRA’s political clout.

Portions of this article appeared in a prior article published on Dec. 14, 2018.

Brian Mittendorf, Fisher Designated Professor of Accounting and Chair, Department of Accounting & Management Information Systems (MIS), The Ohio State University

This article is republished from The Conversation under a Creative Commons license. Read the original article.