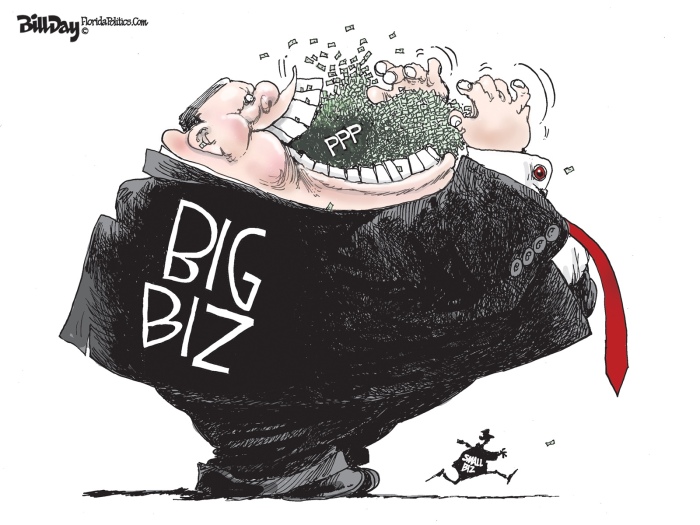

Does EVERY company deserve COVID-19 relief?

By Phil Mattera for the Dirt Diggers

Digest

|

| By Bill Day, Florida Politics |

Apart from the issue of size, there is the question of

behavior—that is, should a company with a track record of bad conduct be

eligible for large amounts of taxpayer-funded aid?

This issue is behind the decision my colleagues and I made to

create Covid

Stimulus Watch, a website that combines available company recipient

data with information on the accountability records of the corporations getting

the aid.

Much of the latter consists of penalty data we have previously collected for our Violation Tracker database. We also added data on issues such and tax avoidance and CEO pay.

Much of the latter consists of penalty data we have previously collected for our Violation Tracker database. We also added data on issues such and tax avoidance and CEO pay.

So far, we know the recipients of only about 400 grant and

loans, mostly PPP awards that publicly traded firms have disclosed in SEC

filings. Yet there are already signs that corporate bad actors are getting

assistance.

I took a close look at the executive compensation data we collected. In their documents known as proxy statements, firms are required to disclose how much their chief executive is paid and calculate the ratio of that compensation to the median pay of the company’s workforce, which is also disclosed.

Smaller companies can opt out of the requirement to reveal median worker pay and the ratio.

Among the publicly traded firms that have disclosed PPP awards,

five reported paying their typical worker an amount below the federal poverty

level for a family of four ($26,200).

These included three with active loans: Drive Shack ($13,902), Applied Opto-Electronics ($15,620) and Trans World Entertainment Corporation ($17,346). The two others are among the larger firms that are returning their loans in response to public pressure: Fiesta Restaurant Group ($14,241) and Shake Shack ($17,032).

These included three with active loans: Drive Shack ($13,902), Applied Opto-Electronics ($15,620) and Trans World Entertainment Corporation ($17,346). The two others are among the larger firms that are returning their loans in response to public pressure: Fiesta Restaurant Group ($14,241) and Shake Shack ($17,032).

The restaurant employers tend to complain in their proxies that

they have to include part-timers in their calculations, while Applied

Opto-Electronics tries to downplay its low figure by noting that it includes

employees in China and Taiwan.

The company provides a separate figure for U.S. workers only — $43,427 — which is still below the national median income level.

The company provides a separate figure for U.S. workers only — $43,427 — which is still below the national median income level.

Many of the low-wage employers are much more generous when it

comes to CEO pay. Drive Shack, for instance, paid its CEO more than $7 million,

which is more than 500 times what the median employee received.

Problematic corporate recipients can be found in other covid

stimulus program. Take the Higher Education Emergency Relief Fund. There was a

great deal of criticism among Republicans, including Trump, over the fact that

Harvard University, with its immense endowment, was participating in the

program.

Yet, it turns out that for-profit colleges are also among those institutions getting aid.

Looking through the list published by the Department of Education, I found 11 awards going to the likes of the University of Phoenix, owned by the Apollo Education Group, and Chamberlain University, owned by Adtalem Global Education.

The largest amount I found (looking only at the maximum portion schools are allowed to use for institutional costs) was $11.2 million going to Grand Canyon Education Inc.

This industry has been embroiled in numerous scandals based on

allegations of unfair and deceptive practices, especially that of luring

students with deceptive claims about the value of the degrees they offered.

For example, Perdoceo Education Corporation, the parent of two schools receiving the stimulus aid, used to be known as Career Education Corp., which in 2019 had to pay $493 million to resolve fraud allegations by state attorneys general.

For example, Perdoceo Education Corporation, the parent of two schools receiving the stimulus aid, used to be known as Career Education Corp., which in 2019 had to pay $493 million to resolve fraud allegations by state attorneys general.

Or consider the Provider Relief Fund set up by the Department of

Health and Human Services. Those providers include for-profit hospital chains

such as Tenet Healthcare, which has reported receiving $370 million so far from the fund.

Tenet has had to pay out hundreds of millions of dollars to resolve regulatory violations and False Claims Act cases brought by the Justice Department, including a 2016 settlement in which the company paid $513 million and two of its subsidiaries pleaded guilty to criminal charges relating to bribes and kickbacks.

Tenet has had to pay out hundreds of millions of dollars to resolve regulatory violations and False Claims Act cases brought by the Justice Department, including a 2016 settlement in which the company paid $513 million and two of its subsidiaries pleaded guilty to criminal charges relating to bribes and kickbacks.

We are thus left with the question of whether companies that pay

poverty-level wages, have excessive CEO compensation levels, routinely cheat

their customers or plead guilty to criminal bribery charges should qualify for

aid amid a pandemic. There is no easy answer.

The executives of those firms may not deserve help, but

lower-level employees should not suffer because of the sins of their bosses.

The solution might be to attach some strings to the aid they receive, requiring them, for example, to pay a living wage and to deal honestly with their customers and the government. Failure to adhere to those provisions should trigger an obligation to refund all the aid and other serious consequences.

The solution might be to attach some strings to the aid they receive, requiring them, for example, to pay a living wage and to deal honestly with their customers and the government. Failure to adhere to those provisions should trigger an obligation to refund all the aid and other serious consequences.

Getting such a system enacted would be a longshot, and even if

it happened, an administration like the current one could undermine it with

weak enforcement.

Yet it is worth imaging how well-structured covid stimulus programs might not only provide relief from the effects of the pandemic but also promote better corporate behavior now and in the future.

Yet it is worth imaging how well-structured covid stimulus programs might not only provide relief from the effects of the pandemic but also promote better corporate behavior now and in the future.