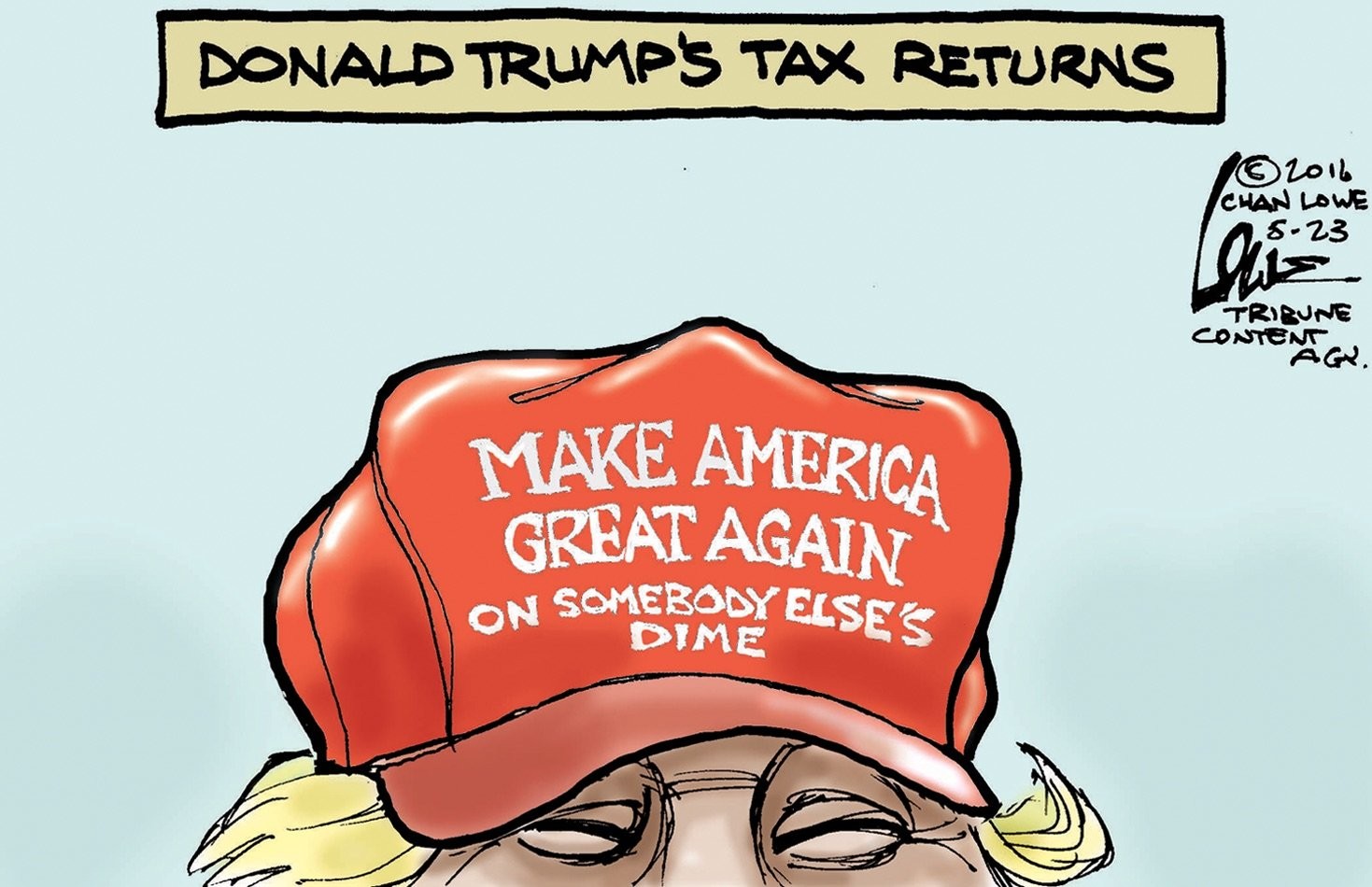

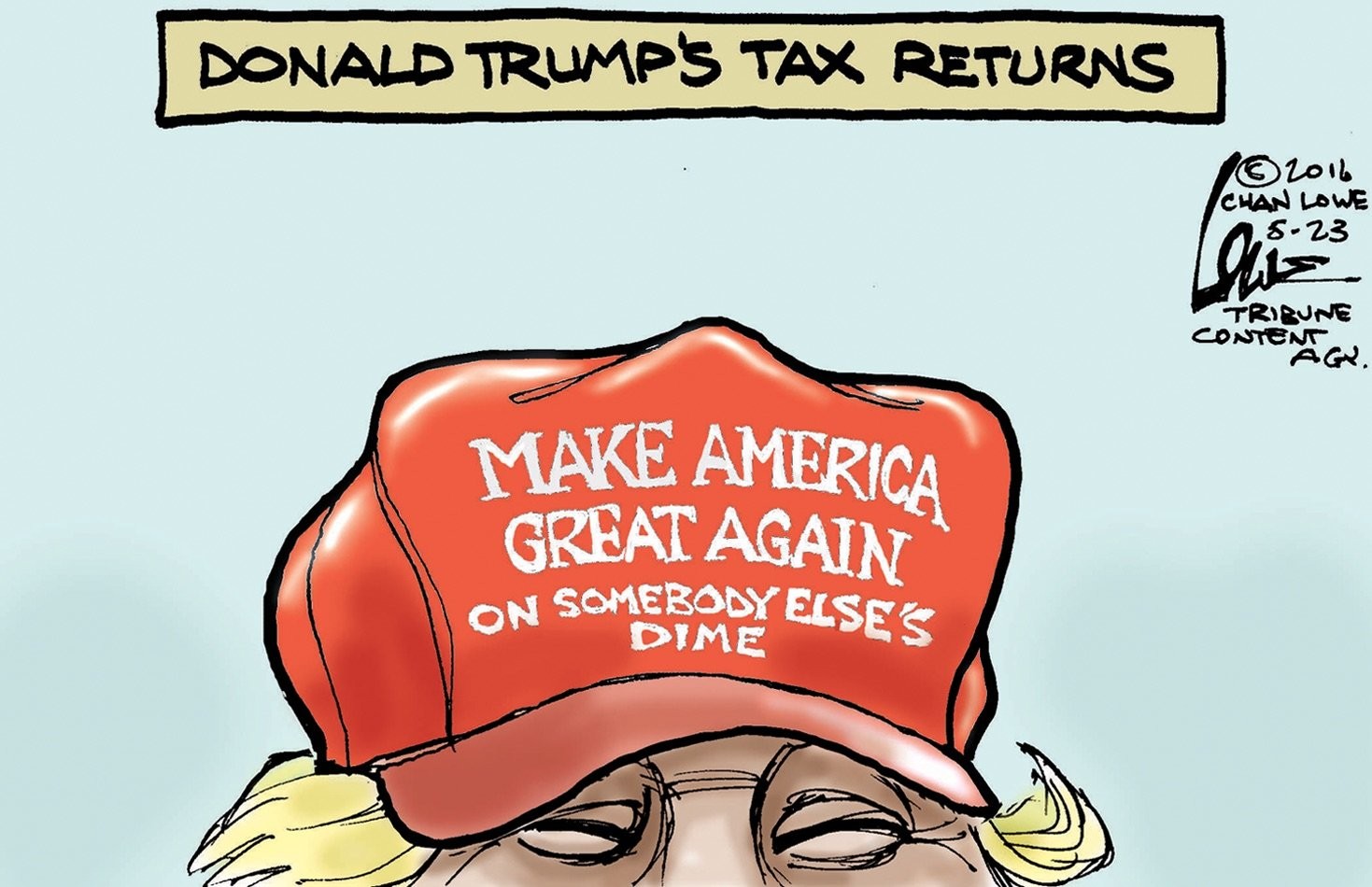

What is he hiding?

By Kristen Doerer for ProPublica

The Supreme Court is expected to rule on two cases regarding access to President Donald Trump’s tax filings soon. At the heart of the cases: Can House committees and a New York grand jury subpoena financial institutions for Trump’s personal and business tax filings?

The Supreme Court is expected to rule on two cases regarding access to President Donald Trump’s tax filings soon. At the heart of the cases: Can House committees and a New York grand jury subpoena financial institutions for Trump’s personal and business tax filings?

If the Supreme Court rules against Trump, it opens the possibility that the public could eventually see his personal tax return and business records, though experts say it would be unlikely to happen quickly. Here’s why people want to see Trump’s tax returns and what they may reveal about the president.

Why Do Presidents Share Their Tax Returns in the First Place?

Since Richard Nixon, presidents have shared their tax returns in some way or another with the public. Nixon perhaps explained why best: “I welcome this kind of examination because people have got to know whether or not their president’s a crook. Well, I’m not a crook.”

But Nixon had not shared his tax returns entirely willingly. During the Watergate scandal, an IRS employee leaked information from Nixon’s tax returns that suggested that the president had underpaid his taxes for two years.

As reporters put pressure on Nixon to disclose his returns, he finally shared them, confirming that he had wrongly claimed a deduction and woefully underpaid his taxes.

Nixon, who was under audit at the time, was sent a tax bill of about $470,000 plus interest to pay in back taxes from the IRS.

Nixon’s release of his federal returns set a precedent. While no law requires presidential candidates (or the president for that matter) to share his or her tax returns, it was understood among future candidates:

The office of the presidency requires a certain amount of transparency, and voters have a right to know if their president pays his or her fair share of taxes and, yes, “whether or not their president’s a crook.”

Why Do People Want to See Trump’s Tax Returns?

While Trump promised to share his tax returns during his 2016 campaign, he refused to do so when he assumed office, breaking this four-decade tradition among presidents and presidential candidates.

Trump has claimed that voters don’t care about his taxes. Polls suggest otherwise.

According to a 2019 Pew Research poll, 64% of Americans say that Trump has a responsibility to share his tax returns. His refusal to share them has some Americans wondering what he’s hiding.

So, Why Isn’t He Sharing Them Voluntarily?

Trump has offered many reasons for not sharing his tax returns. He has said that he couldn’t share them while he was under audit — but an audit wouldn’t prevent him from sharing them — and he has simply said that his tax rate is “none of your business.”

Pundits have made guesses as to why, suggesting that perhaps he’s not as rich as he says he is, that he has financial ties to Russia, that he’s paid no income tax or that he hasn’t donated as much to charity as he said he has.

OK. But Why Is the Supreme Court Involved?

Multiple House committees have subpoenaed the accounting firm and banks used by Trump for 10 years of his personal financial records, those of his three oldest children and those of parts of his businesses.

The Manhattan district attorney’s office also issued subpoenas for those financial records in addition to eight years of Trump’s business and personal tax returns. The Supreme Court is expected to rule on the legal battles, which have been consolidated into two cases — Trump v. Mazars USA, LLP and Trump v. Vance — in early July.

Separately, the House Ways and Means Committee sued the Treasury Department for Trump’s tax returns, after Treasury Secretary Steven Mnuchin defied the committee’s subpoena for them.

In late 2019, an investigation by Heather Vogell of ProPublica and WNYC’s joint podcast, “Trump, Inc.,” found major inconsistencies between how three of the Trump Organization’s properties — 40 Wall Street, Trump International Hotel and Tower, and Trump Tower — reported financial information to New York City tax authorities and lenders.

The Trump Organization did not respond on the record to detailed questions provided by ProPublica when the investigation was originally published. A lawyer from the firm Marcus & Pollack, which handles Trump’s property tax appeal filings with the city, said he was not authorized to discuss the documents.

A spokeswoman for Mazars USA, which signed off on the two properties’ expense and income statements, said the firm does not comment on its work for clients. Executives with Trump’s lender, Ladder Capital, declined to be quoted for the story.

By appearing less profitable to tax officials and more profitable to lenders, Trump’s business could potentially reduce its tax bill and get loans with lower rates from lenders.

After ProPublica’s findings, New York City Mayor Bill de Blasio asked the DA’s office to investigate. ProPublica and WNYC’s investigation continues. Given this pattern in his company’s tax records, it makes sense that people would want to see the president’s personal tax returns, too.

The tax deadline has been extended to July 15, 2020, for Americans to pay their taxes OR file for an extension. Learn how to file your state and local taxes completely for free, whether or not you qualify for the earned income tax credit (EITC) or how to track your return once you’ve filed.

Listen to “Trump, Inc.” from WNYC and ProPublica on Apple, Spotify or wherever you get your podcasts.

You can also sign up to get notified when new episodes publish.

If you’re having trouble with your rent, mortgage or debts — tax related or otherwise — we’d love to hear from you.

By Kristen Doerer for ProPublica

The Supreme Court is expected to rule on two cases regarding access to President Donald Trump’s tax filings soon. At the heart of the cases: Can House committees and a New York grand jury subpoena financial institutions for Trump’s personal and business tax filings?

The Supreme Court is expected to rule on two cases regarding access to President Donald Trump’s tax filings soon. At the heart of the cases: Can House committees and a New York grand jury subpoena financial institutions for Trump’s personal and business tax filings?If the Supreme Court rules against Trump, it opens the possibility that the public could eventually see his personal tax return and business records, though experts say it would be unlikely to happen quickly. Here’s why people want to see Trump’s tax returns and what they may reveal about the president.

Why Do Presidents Share Their Tax Returns in the First Place?

Since Richard Nixon, presidents have shared their tax returns in some way or another with the public. Nixon perhaps explained why best: “I welcome this kind of examination because people have got to know whether or not their president’s a crook. Well, I’m not a crook.”

But Nixon had not shared his tax returns entirely willingly. During the Watergate scandal, an IRS employee leaked information from Nixon’s tax returns that suggested that the president had underpaid his taxes for two years.

As reporters put pressure on Nixon to disclose his returns, he finally shared them, confirming that he had wrongly claimed a deduction and woefully underpaid his taxes.

Nixon, who was under audit at the time, was sent a tax bill of about $470,000 plus interest to pay in back taxes from the IRS.

Nixon’s release of his federal returns set a precedent. While no law requires presidential candidates (or the president for that matter) to share his or her tax returns, it was understood among future candidates:

The office of the presidency requires a certain amount of transparency, and voters have a right to know if their president pays his or her fair share of taxes and, yes, “whether or not their president’s a crook.”

Why Do People Want to See Trump’s Tax Returns?

While Trump promised to share his tax returns during his 2016 campaign, he refused to do so when he assumed office, breaking this four-decade tradition among presidents and presidential candidates.

Trump has claimed that voters don’t care about his taxes. Polls suggest otherwise.

According to a 2019 Pew Research poll, 64% of Americans say that Trump has a responsibility to share his tax returns. His refusal to share them has some Americans wondering what he’s hiding.

So, Why Isn’t He Sharing Them Voluntarily?

Trump has offered many reasons for not sharing his tax returns. He has said that he couldn’t share them while he was under audit — but an audit wouldn’t prevent him from sharing them — and he has simply said that his tax rate is “none of your business.”

Pundits have made guesses as to why, suggesting that perhaps he’s not as rich as he says he is, that he has financial ties to Russia, that he’s paid no income tax or that he hasn’t donated as much to charity as he said he has.

OK. But Why Is the Supreme Court Involved?

Multiple House committees have subpoenaed the accounting firm and banks used by Trump for 10 years of his personal financial records, those of his three oldest children and those of parts of his businesses.

The Manhattan district attorney’s office also issued subpoenas for those financial records in addition to eight years of Trump’s business and personal tax returns. The Supreme Court is expected to rule on the legal battles, which have been consolidated into two cases — Trump v. Mazars USA, LLP and Trump v. Vance — in early July.

Separately, the House Ways and Means Committee sued the Treasury Department for Trump’s tax returns, after Treasury Secretary Steven Mnuchin defied the committee’s subpoena for them.

In late 2019, an investigation by Heather Vogell of ProPublica and WNYC’s joint podcast, “Trump, Inc.,” found major inconsistencies between how three of the Trump Organization’s properties — 40 Wall Street, Trump International Hotel and Tower, and Trump Tower — reported financial information to New York City tax authorities and lenders.

The Trump Organization did not respond on the record to detailed questions provided by ProPublica when the investigation was originally published. A lawyer from the firm Marcus & Pollack, which handles Trump’s property tax appeal filings with the city, said he was not authorized to discuss the documents.

A spokeswoman for Mazars USA, which signed off on the two properties’ expense and income statements, said the firm does not comment on its work for clients. Executives with Trump’s lender, Ladder Capital, declined to be quoted for the story.

By appearing less profitable to tax officials and more profitable to lenders, Trump’s business could potentially reduce its tax bill and get loans with lower rates from lenders.

After ProPublica’s findings, New York City Mayor Bill de Blasio asked the DA’s office to investigate. ProPublica and WNYC’s investigation continues. Given this pattern in his company’s tax records, it makes sense that people would want to see the president’s personal tax returns, too.

The tax deadline has been extended to July 15, 2020, for Americans to pay their taxes OR file for an extension. Learn how to file your state and local taxes completely for free, whether or not you qualify for the earned income tax credit (EITC) or how to track your return once you’ve filed.

Listen to “Trump, Inc.” from WNYC and ProPublica on Apple, Spotify or wherever you get your podcasts.

You can also sign up to get notified when new episodes publish.

If you’re having trouble with your rent, mortgage or debts — tax related or otherwise — we’d love to hear from you.

ProPublica is a Pulitzer Prize-winning investigative newsroom. Sign up for The Big Story newsletter to receive stories like this one in your inbox.