RI's richest man and only billionaire is doing fine during the pandemic. Most of us don't

By the Working Families Party

|

| Harvard Business School alumnus |

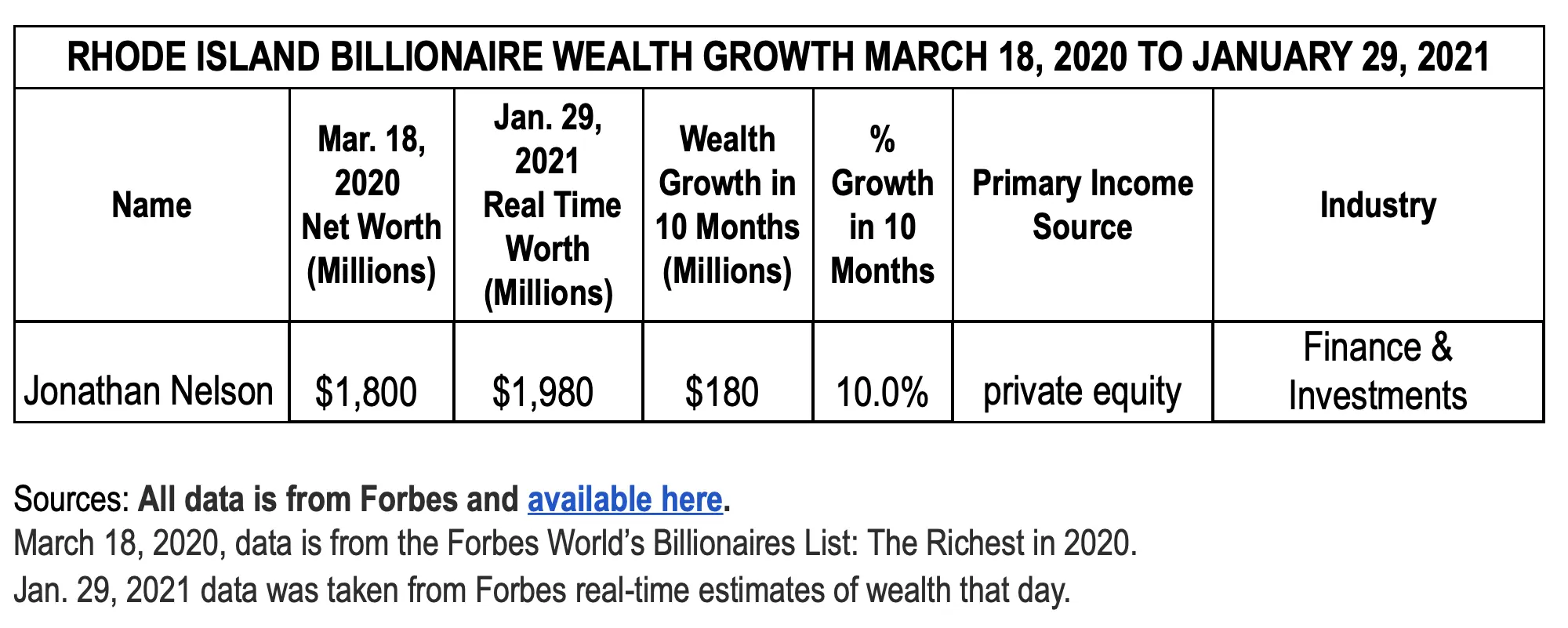

Between March 18 – the rough start

date of the pandemic shutdown, when most federal and state economic restrictions were put in place – and

January 29, Nelson’s fortune rose from $1.8 billion to $2 billion between March

18 and Jan 29, based on this analysis of Forbes data.

Nelson’s private gain is a sharp contrast to the severe health and economic crises hitting average Rhode Islanders.

Over the same 10 months, close to 113,754 state residents fell ill with the coronavirus, 2,144 died from it and 290,100 lost jobs in the accompanying recession.

23,716 Rhode Islanders residents were collecting unemployment the

week of Jan. 4, and late last year, 80,000 adult state residents, or 11%,

reported going hungry over the past week. The figure for

households with children was 14%.

While federal lawmakers debate more

cash payments to people and families in the next relief package, Nelson has

amassed enough new wealth during the pandemic, a $180 million surge, to

send every one of the state’s 1,059,361 residents a relief check of roughly

$170 each. A family of four would get $680.

Nationwide over the same 10-month period, the total wealth of the nation’s 661 billionaires leaped by $1.2 trillion, or 40%—more than the $900 billion federal pandemic relief package enacted in Congress in December. At $4.1 trillion, the total wealth of America’s 661 billionaires is two-thirds higher than the $2.4 trillion in total wealth held by the bottom half of the population.

Republicans have objected to federal aid to states and localities included in President Joe Biden’s new $1.9 trillion COVID relief plan meant to relieve local governments suffering like Rhode Island from big revenue drops that threaten public services.

Biden’s plan would

provide $350 billion in general aid to state and local

governments to preserve jobs and critical public services plus $170 billion to

help schools reopen and support public colleges.

As Rhode Island’s billionaire rides out the crisis on a

rising tide of wealth, the state’s working families struggle to keep their

heads above water:

- · 23,716 state residents were collecting unemployment the week ended Jan. 9 [U.S. Department of Labor]

- · Between March and September 2020, 377 state businesses closed, 222 of them permanently. [YELP]

- · Late last year, 80,000 adult state residents, or 11%, reported going hungry over the past week. The figure for households with children was 14%. [Center on Budget & Policy Priorities, CBPP, Table 1]

- · 16% of the state’s tenants—42,000—were behind in their rent at the end of 2020. [CBPP, Table 3]

Low-wage workers, people of color and women have suffered disproportionately in the combined

medical and economic crises because of long-standing racial and gender

disparities.

“If this pandemic has shown us anything, it is that the growing gap between social classes is leaving too many behind,” said Representative Karen Alzate (Democrat, District 60, Pawtucket), the lead sponsor of a 2020 House bill to raise the top income tax rate from 5.99% to 8.99% on earnings above $475,000.

“The richer

get richer and many of the rest of us struggle to buy food, pay rent or afford

doctor bills. There is plenty of money in Rhode Island and the country to make

sure that all of us recover from this pandemic and the recession it caused. We

just need to prioritize the health of our communities over the wealth of the

already wealthy.”

The campaign to raise taxes for the

wealthiest Rhode Islanders has gained support from lawmakers, business owners

and economists across the state. Led by a coalition of progressive groups, the

campaign is calling on state lawmakers to pass Alzate’s bill and it’s companion

bill introduced by Senator Melissa Murray (Democrat,

District 24, North Smithfield, Woonsocket).

“This pandemic will hurt working Rhode Islanders for years to come,” said Georgia Hollister Isman, state director of the RI Working Families Party. “The WFP will continue to call on our state’s leaders to invest in long-term recovery for all Rhode Islanders – Black, white, and brown, native and newcomer – by making the wealthy few pay their fair share.

"We call on the General Assembly to pass a new tax bracket in

2021 and make this a place we’re proud to call home, with the world-class

schools, affordable healthcare and community services our families need. We

also need our federal government to do their part and make big investments now

in our recovery.”

“Billionaires have been reaping bushels of pandemic profits the last 10 months while many working families are reeling, state and local services are suffering and jobs are disappearing,” said Frank Clemente, executive director of Americans for Tax Fairness.

“Congress needs to come to the immediate rescue to get the country

out of this mess. And then it should turn its attention to enacting sweeping

reforms that make the wealthy and corporations pay their fair share of taxes so

we can create an economy that works for all of us.”

Some billionaires have seen a particularly astonishing

increase in wealth:

- · Elon Musk’s wealth grew by over $156 billion, from $24.6 billion on March 18 to $181 billion on Jan. 29, a more than six-fold increase, boosted by his Tesla stock.

- · Jeff Bezos’s wealth grew from $113 billion on March 18 to $188.6 billion, an increase of 67%. Adding in his ex-wife MacKenzie Scott’s wealth of $57 billion on Jan. 29, the two had a combined wealth of almost a quarter of a trillion dollars thanks to their Amazon stock.

- · Mark Zuckerberg’s wealth grew from $54.7 billion on March 18 to $97 billion, an increase of over two-thirds (77%) fueled by his Facebook stock.

President Biden’s “build back

better” tax and investment plans could address immediate needs created by the

pandemic and put the nation on a trajectory toward economic growth that

restores the middle class, good jobs, healthcare and equitable opportunity for

everyone to prosper. Even Wall Street analysts praise the plan because of the jobs

and growth it would create.

A key component is tax reform that would begin to ensure the wealthy and corporations pay their fair share. Biden’s tax plan would transform huge billionaire gains into public revenue to help heal a hurting nation by both raising taxes on the wealthy and closing tax loopholes that allow the rich to delay, diminish and even avoid paying the taxes they owe on wealth increases.

President Biden and

the new Congress could make structural changes to level the playing field so

that the rich are taxed more like the rest of us.

A number of approaches will be debated in Congress, including an annual wealth tax on the biggest fortunes, proposed by Senators Elizabeth Warren and Bernie Sanders. Another option is the annual taxation of investment gains on stocks and other tradable assets, an idea advanced by the new Senate Finance Committee chair,

Ron Wyden. Even under the current discounted tax rates

for investment income, if Wyden’s plan had been in effect in 2020, billionaire

Nelson would be paying tens of millions of dollars in extra taxes this spring

thanks to his gargantuan pandemic profits last year, helping to address the

pandemic’s impact and keep the economy afloat.

Can you help Uprise RI?

Funding for UpriseRI reporting relies on

the generosity of readers like you. Our independence allows us to write stories

that hold RI state and local government officials accountable. All of our

stories are free and available to everyone. But your support is essential to

keeping Steve and Will on the beat, covering the costs of reporting many

stories in a single day. If you are able to, please support Uprise RI.

Every contribution, big or small is so valuable to us. You provide the

motivation and financial support to keep doing what we do. Thank you.