Wouldn’t be needed if we had sing-payer system

KENNY STANCIL

for Common Dreams

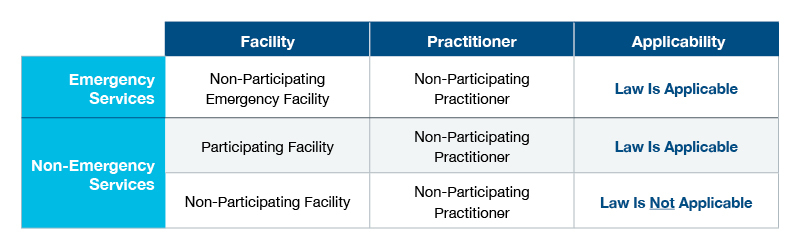

While welcoming a federal ban on most surprise medical bills that went into effect on Saturday, Medicare for All advocates made clear that the new law, which crucially excludes ground ambulances, is only necessary because the United States lacks the superior alternative taken for granted in every other wealthy nation: a single-payer healthcare system.

Thanks

to the No Surprises Act, a bipartisan piece of legislation passed during

the Trump administration and "fine-tuned"

by the Biden administration, millions of

people in the U.S. will be protected from unexpected and costly bills

that private-equity-owned providers

foist upon patients who

inadvertently receive out-of-network care during medical emergencies, the New

York Times reported.

"Even

with insurance, emergency medical care can still be expensive, and patients

with high deductible plans could still face large medical bills,"

the Times noted. "But the law will eliminate the risk

that an out-of-network doctor or hospital will send an extra bill. Currently,

those bills add up to billions in costs for consumers each year."

Journalist

James Conner, founder and editor of the Flathead Memo, tweeted earlier

this week that "this law would not be needed if we ha[d] an everyone

covered for everything, zero copay, federal single-payer healthcare system paid

for by fair taxes."

The Times reported that "behind the scenes, medical providers are still fighting with regulators over how they will be paid when they provide out-of-network care. But those disputes will not interfere with the law's key consumer protections."

The

newspaper explained:

If

you are having a medical emergency and go to an urgent care center or emergency

room, you can't be charged more than the cost-sharing you are accustomed to for

in-network services. This is where the law's protections are the simplest and

the most clear for people with health insurance.

You

will still be responsible for things like a deductible or a co-payment. But

once patients make that normal payment, they should expect no more bills.

For scheduled services, like knee operations, C-sections, or colonoscopies, it's important you choose a facility and a main doctor that is in your insurance plan's network. If you do that, the law bars anyone else who treats you from sending you a surprise bill. This also addresses a large problem.

Surprise bills

from anesthesiologists, radiologists, pathologists, assistant

surgeons, and laboratories were common before.

If, for some reason, you are having such a service and you really want an out-of-network doctor to be part of your care, that doctor typically needs to notify you at least three days before your procedure, and offer a "good faith estimate" of how much you will be charged.

If you sign a form

agreeing to pay extra, you could get additional bills. But the hospital or

clinic can't force you to sign such a form as a condition of your care, and the

form should include other choices of doctors who will accept your insurance.

Joe

Sparks, host of "Medicare for All

Explained", a podcast made in collaboration with Physicians for

a National Health Program, said on

Twitter that "while this is good news for consumers, this is necessary

because of our complex multi-payer for-profit healthcare system."

"Medicare

for All would eliminate the need for surprise medical bills and... other

out-of-pocket medical expenses," he added.

Notably,

the No Surprises Act only addresses narrowly defined "surprise

bills," by which health policy experts mean "extra charges from a

medical provider whom patients didn't choose," the Times reported.

"But there are still many parts of the U.S. healthcare system that remain

perplexing."

Setting

aside the fact that 28 million people in the U.S. were uninsured in

2020, the newspaper noted that "it is still not always obvious what

medical care will cost in advance, and what insurance plans will cover."

That's

why those with high deductible insurance plans or so-called

"coinsurance" cost-sharing plans are still likely to be surprised by

large medical bills that fall outside of the law's purview.

Moreover, even

though the No Surprises Act is designed to protect patients who are unable to

avoid out-of-network care during medical emergencies, it contains a key

exception when it comes to transportation services.

Although

it eliminates surprise bills from air ambulances, the Times reported,

the legislation "does not

prevent ambulance companies from billing you directly for their

services if they travel on roads."

Such

rides constitute a significant

expense, with out-of-network ground ambulance bills totaling nearly

$130 million per year.

According

to the newspaper, "Ground ambulances were left out of the recent

legislation because legislators determined they would need a different

regulatory approach. Congress established a commission to study the issue and

may consider reforms."

Pointing

to the omission of ground ambulances from the ban on surprise medical bills,

Sparks said,

"Don't rejoice too much" about the new law.

"Again,"

he added, "this wouldn't be an issue with Medicare for All."