If Wage Growth Is Driving Inflation, Why Is Workers’ Share of Income Falling?

By DEAN

BAKER

A popular line on our recent surge of inflation is that an over-tight labor market has led to rapid wage growth, which in turn forces companies to raise prices. Higher prices in turn lead workers to demand higher wages, which will give us a wage-price spiral and soon lead to double-digit inflation.

While

this was a story that plausibly fit the data in the 1970s, it is very hard to

make the wage-price spiral fit the current situation for a simple reason: the

wage share of income has fallen sharply since the pandemic. By wage share I

mean total compensation to workers, including fringe benefits, not just cash

wages and salaries.

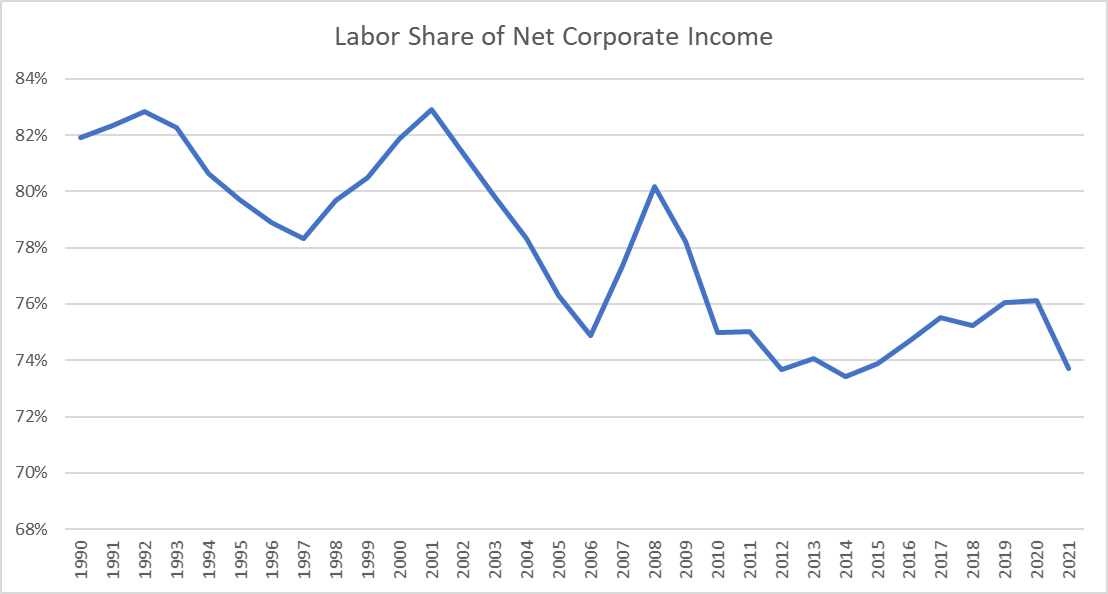

Here’s

the picture:

|

| Worker Share of Net Corporate Income Declines. Source: Federal Bureau of Economic Analysis |

As can be seen, the wage share of corporate income had been recovering gradually from the troughs it hit in 2014 following the Great Recession. However, we see a sharp reversal in 2021, with the wage share falling from 76.1% to 73.7%, a decline of 2.4 percentage points.

Perhaps

some economists can tell a story where rapid wage growth is driving inflation

even as the wage share of income is falling, but I’m not that good an

economist. [Editor’s Note: “Good” as in dishonest.]

This

still looks to me like a case where supply-side disruptions, associated with

the economy reopening from the pandemic together with the war in Ukraine, are

driving inflation.

This

view is consistent with the fact that year-over-year inflation in the European

Union was 7.5% as of March. The EU countries did not have as big a stimulus as

the United States and by most measures the EU labor market is not as tight as

in the United States.

Dean

Baker co-founded the Center for Economic and Policy Research in

1999. His areas of research include housing and macroeconomics, intellectual

property, Social Security, Medicare and European labor markets. He is the

author of several books, including "Rigged: How Globalization and the

Rules of the Modern Economy Were Structured to Make the Rich Richer."