What better time than during an election year?

By Will Collette

|

| This is an official Charlestown map from the town's Comprehensive Plan showing the amount of "conservation and open space areas" |

The Charlestown Citizens Alliance (CCA) has made it a point of pride to brag that Charlestown has a very low tax RATE, which is true, while ignoring several important facts such as how little we actually get in municipal services for our money.

Most routine municipal functions such as

trash collection, water and sewage are extras that Charlestown taxpayers must

pay for separately.

There’s also how we got to this year’s tax rate. It was a fanciful

exercise in budget manipulation: the CCA-controlled Budget Commission and Town

Council ignored the $3 million

“oopsie” and through the use of federal American Rescue Plan money and an

unassigned surplus, propped up the budget without an increase in the tax rate.

While our tax rate is artificially low, the other part of the tax equation, property assessments, are very high.

|

| $9.5 million! From Lila Delman |

The buying-binge by rich out-of-staters is a mixed blessing. While

it generates more tax revenue for the town, it also drives up property values

generally, which is great if you are selling, but a living hell if you are

buying but in either case, higher assessments mean higher taxes.

It makes Charlestown one of the least affordable towns in the

state, forcing the grown-up children of Charlestown families to look elsewhere

for housing. Plus, the next time the town reassesses property values, you’ll

find yourself with a higher assessment and higher tax bill.

In fact, I received a July 1 letter from Tax Assessor Ken Swain saying that Charlestown will do a full, town-wide reassessment with inspectors coming to your door asking to take a look inside. NOTE that you are not required to allow the data collector in. If you refuse entry, they will look around outside and take measurements.

Your actual tax bill comes about is through a

byzantine system of tax breaks. Only a minority of Charlestown property

owners pay the full amount of tax on their land because most land in town is tax-exempt, tax-favored or the owners qualify for a broad range of tax breaks.

Many hundreds of other properties pay less than the full amount

because the owners qualify for tax breaks for veterans, the handicapped,

the blind, and low-income elderly. Plus many other property owners get tax

breaks through conservation

easements or by qualifying for the Farm,

Forest and Open Space program.

Some property owners benefit from property that is mis-zoned, a problem that was first detailed by ex-Town Planner Ashley Hahn in 2012.

For example, when Charlestown zones some commercial property as "OS/R" (open space- recreational), the amount of tax can drop by as much as 75%. Ashley offered three ways to resolve this problem:

|

| Former Town Planner Ashley Hahn's 2012 memo |

Planning Commissar Ruth Platner promised she would fix this problem. That was 10 years ago. The problem has NOT been fixed.

While I do have major issues with fake fire

districts that are little more than a tax rip-off and with our expensive

habit of buying open space for the town even when

the land is already protected, I do not begrudge the other tax breaks.

I do believe Charlestown should publicize its program of

tax breaks so that those who qualify don’t have to find out by accident. It’s

already too late to qualify for this year, but if you fall within any of the

categories I listed, especially veterans and the disabled, you should contact

Tax Assessor Ken Swain to apply.

Tax policy is a reflection of social values. We use tax breaks to

reward the worthy (e.g. veterans, disabled, elderly) and encourage good

behavior (conserving farms, woods and open space).

But in my opinion, we simply don’t go far enough.

|

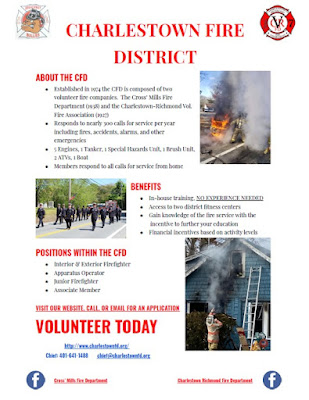

| CFD needs volunteers |

To help with recruitment, as well as to reward firefighters for

their service, we should award each active firefighter a substantial tax credit

(maybe $500-$1000 a year or more) to reduce their property or car tax.

The climate crisis will hit Charlestown first and will hit it hard

through severe storms and sea level rise. We can’t hold back the tide; seawalls

are really not a very good option. However, we can all do our bit by installing

green energy devices such as solar panels and residential wind power

generators.

We’ll need to change Charlestown’s

draconian anti-wind ordinance. With the emergence of vertical

axis wind devices that resolve just about all of the anti-wind

NIMBY objections to wind, it’s time to roll back the ordinance. Charlestown should craft a tax credit

program that rewards residents who own, maintain or install green energy

devices.

I also think Charlestown needs to give the Homestead Tax Credit another look – and a serious one this time.

This issued was raised by

Charlestown Democrats in 2011 and was thoroughly trashed by the CCA and a

mob of angry absentee landowners. I called it “The Riot

of the Rich.”

They claimed that giving permanent residents a $1000 tax credit

was somehow unfair, even though such programs are prevalent

in many of the states where our absentee property owners live

(especially Florida). Further, homestead tax breaks partially make up for the

cost to year-round residents of maintaining an infrastructure built to

accommodate the tripling of the town’s population in the summer.

The rich rioters threatened that if full-time Charlestown residents

got this credit, the out-of-state rich would stop giving to local charities and

would no longer hire local workers for building, maintenance and housekeeping.

Such bullshit, as if (a) they gave much, if anything, to local

charities and (b) they would mow their own grass, trim their own shrubbery, clean

their own toilets, do their own plumbing and build their own additions to their

beach “cottages.”

I think it’s very unlikely that seeing their tax bills rise by a

few hundred dollars would make our rich summer people do any more than shrug.

Just recently, candidate for Congress, Second District Sarah

Morgenthau had to explain yet another embarrassing fact that disclaims her

alleged Rhode Island ties. WPRI

investigators discovered that über-wealthy Morgenthau is still

collecting a homestead property tax credit

on her $3.2 million Washington DC home.

She will be applying to get North Kingstown’s

recently enacted 5% pre-tax homestead exemption on

assessed value for her new Saunderstown home.

Earlier in the campaign, on the defensive over her carpetbagger

status, according to WPRI, Morgenthau brought up a family vacation house her

family has owned in Saunderstown: “’I have been paying property taxes in the 2nd District for

40 years,’” Morgenthau said in April

during an

interview on 12 News at 4.”

The embarrassment to Morgenthau aside, homestead tax breaks are

pretty commonplace and generally enjoy public approval – except in Charlestown.

I have noted in several

articles that Narragansett enacted a 10%

pre-tax homestead exemption in 2017 that is quite popular and has not

affected the town’s ability to pay its bills.

The CCA only wants to talk about the illusion of the low tax rate,

as if that is the only thing that matters when it comes to your tax bill. But

it’s just not that simple. It’s time to start looking beyond the CCA rhetoric

and dig deep into the question of whether our taxes are fair and whether we are

using our taxation policies for Charlestown’s betterment.