Be cautious about recession predictions

After consulting their models of the American economy, many political naysayers and Wall Street economists are shouting “A recession is coming! A recession is coming!”

Should we trust these projections, which dominate major news

reports on the economy? Count me a skeptic, given what the economic performance

data show and the conflicted interests of commercial economists.

In a piece typical of news articles last week, CNN reported:

“Former Federal Reserve Chairman Alan Greenspan believes a US recession is the

‘most likely outcome’ of the Fed’s aggressive rate hike regime meant to curb

inflation. He joins a growing chorus of economists predicting imminent economic

downturn.”

Then, without attribution, CNN added, “His views are

particularly important” because he was Fed chair from 1987 to 2007 under

Presidents Reagan, Clinton, and both Bushes.

Unmentioned by CNN and others: Greenspan couldn’t foresee the

mortgage market collapse that led to the Great Recession in late 2007, the

worst economic downturn since the Great Depression.

That’s amazing because Greenspan, now 96, cultivated an image as

a clear-eyed and profound student of economic statistics. So how did he miss

years of economic red lights flashing that housing prices were headed for a

collapse? It was so evident that I told my The New York Times editors

about the problem in 2003 and then twice found a way to write about it even though it was far beyond my

beat covering taxes.

In weighing Greenspan’s prognostications, remember that Ayn “Love

Is Immoral” Rand trusted him to be the executor of her estate.

Greenspan adored the views of Rand, who taught that altruism is a vice,

selfishness a virtue, and who wrote a novel glorifying a criminal who blows up

a building because it offended his aesthetics.

Greenspan’s views are, technically and philosophically, on the

fringe, yet he gets treated like a centrist.

Indicators

That said, how is our economy doing? Let’s examine some key

indicators.

The economy added a healthy 233,000 jobs in December.

Employers created more than four and a half million jobs in

2022. That’s an average of 375,000

new jobs per month, almost twice the rate of jobs growth during the

Trump Administration’s pre-pandemic years.

Indeed, 2022 was the second-best year ever for job growth. The best year was 2021, but much of that was due to our coming out of the worst of the pandemic, which Donald “inject bleach” Trump badly mismanaged, pushing the jobless rate to almost 15%. Most of those discharged performed manual work. People who do intellectual work mostly continued working.

For context, consider job growth under Barack Obama and Trump.

President George W. Bush’s laissez-faire banking policies produced

the Great Recession, so we’ll ignore the economic results he bequeathed to

Obama. Then, starting in October 2010, when the economy turned around, Obama

averaged 201,600 new jobs per month for six years.

Trump, before the pandemic, averaged just 191,100 jobs added.

That’s 5% less per month than Obama and barely half of Biden’s 2022 monthly

average.

Voluntarily Quitting

How about job quits? The level at which people voluntarily leave

their job says a lot about expectations that they will or already have found

new work, often at better pay or under better conditions. People who see a

recession looming usually stay put, even in a job they hate.

Each month starting in July, more than 4 million workers quit

their jobs voluntarily. The November quit rate was a

robust 2.7% or 1 in 37 jobs, although that’s down from the 3% rate a year

earlier.

Very Low Jobless Rate

How about unemployment? The jobless rate last month was 3.5%

under the most widely used measure.

That’s the lowest recorded level of joblessness since World War

II save the slightly lower 3.4% rate in May 1969 when Vietnam War and NASA

spending were boosting the economy, and early Boomers were entering the job

market en masse without driving up the jobless rate.

Trump’s average pre-pandemic jobless rate was 3.9% though he hit

3.5% for three months shortly before the Pandemic began in early 2020.

There is an alternative and broader measure of

unemployment, known as U-6 or Bureau of Labor Statistics Table

A-15.

U-6 counts people working part-time because they can’t find

full-time employment, or are only marginally part of the workforce, or have

temporarily given up trying to find work. These marginal workers, whose

economic lives are filled with stress and misery, are not central to whether

the economy grows or shrinks, but their numbers tell a deeper story about job

quality.

The U-6 rate was 6.5% in December, down from 7.3% a year

earlier. However, that doesn’t seem to suggest that a recession is at hand.

Inflation Abating

How about rising prices? While inflation is about 7.1% above a

year ago, that isn’t the story of the last half year.

Month-over-month inflation peaked at 1.3% in June.

Then it dropped to zero in July and 0.1% in August. Inflation rose to

0.4% in September and October. It fell back to 0.1% in November. The

December numbers should come out around Jan. 13.

Inflation may be whipped, although it could roar back. But for

now, its withering

The decent inflationary trend appears to have grown from the

pandemic when demand for goods and services fell sharply, and global supply

chain problems bedeviled businesses from toy sellers to carmakers. Remember all

those acres of parking lots with shiny new cars and trucks that could not be

sold until computer chips arrived from Asia? And those shipping containers

piled high in ports awaiting trucks to haul them away?

Those bottlenecks have been eliminated or considerably eased through

White House efforts to improve coordination and cooperation between merchant

sailors, stevedores, teamsters, local port, truck, and railroad managers, and

the companies that employ them all.

Still, high energy and food prices continue to bedevil most

Americans. Fossil fuels are a major component in food prices. It takes lots of

fuel to make fertilizers to grow crops, machines to plant and harvest them, and

trucks to berry foodstuffs to grocery stores nationwide.

Overall Economic Growth

How about economic growth measured by Gross Domestic Product or

GDP?

There was a lot of ill-informed talk of a recession last summer

because GDP was slightly negative for the year’s first half.

But the National Bureau of Economic Research’s Business Economic Cycle Dating Committee, which calls

economic contractions and expansions, didn’t call it a recession, partly

because the number of jobs kept growing, as did incomes. More jobs and more pay

are the opposite of what the word recession implies: “a

significant, widespread, and prolonged downturn in economic activity.”

We don’t have the full 2022 data yet, but the federal Bureau of

Economic Analysis shows overall economic growth, not contraction in the first nine months

of 2022.

By the way, Trump’s economy was slowly sinking before the pandemic, as DCReport advised readers in October 2020.

Pump Price Plummets

And what of inflation, much in the news this year?

The best news is that the national average price of gasoline has plummeted from a high of $5.11 in

early June to $3.77 recently. That’s $1.34 less per gallon, a stunning 26%

decline, not that it made much of a splash on front pages and broadcast news

programs.

The sharp drop in the price of gasoline came despite Vladimir

Putin’s February invasion of Ukraine which disrupted worldwide oil and grain

markets and may yet lead to mass starvation in Syria and parts of North Africa

that rely on Ukrainian wheat. The Biden Administration imposed severe price

caps on Russian oil via shipping insurance. At the same time, the

president released 180 million barrels of oil from the

American Strategic Petroleum Reserve to help knock down prices at the pump.

That 180 million barrels is roughly how much oil America burns

every ten days, but as is often the case in economics small changes in supply

or demand can prompt big changes in price, as our coverage of electrify

market manipulations has shown.

Because the Democratic Biden Administration sold oil at about $89

a barrel and will buy replacement oil at about $70 a barrel, the government is

expected to turn a profit of more than $3 billion on actions that sharply

lowered gasoline prices. Talk about win-win government economic policies.

An inflationary threat that may emerge is tied to rising sales

of what two decades ago were called Osama Wagons—gas-guzzling

trucks and SUVs that help sustain Middle East dictatorships.

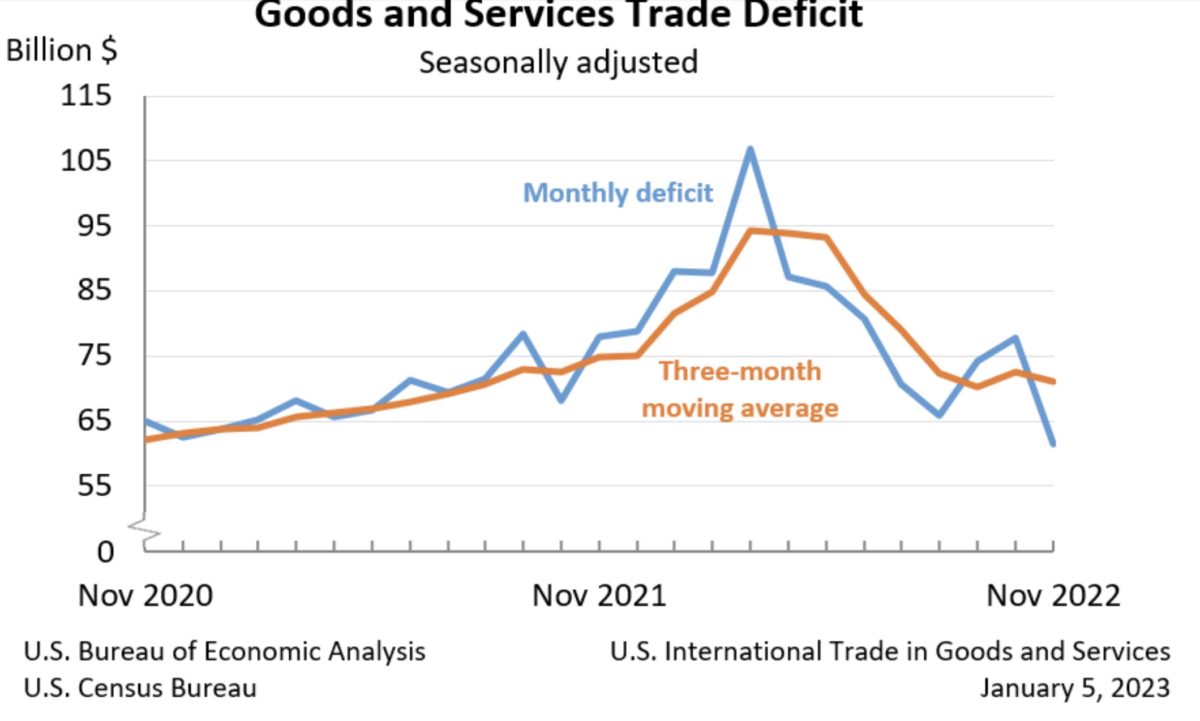

Trade Deficit Shrinks

Trade numbers are also improving under Biden Administration

policies, although there was a brief and severe rise in the trade deficit

months ago.

During Trump’s first 23 months in office his disastrous and

mismanaged trade war with China played a key role in the monthly trade

deficit ballooning by 26%, federal Bureau of Economic Analysis

data show.

The trade deficit, or surplus, comes in two parts. The first and

larger measures the value of goods we buy from overseas versus what we sell to

foreigners. The second measure is business services we buy from foreigners or

sell them.

|

| America’s Chronic Trade Deficit Shrinks |

Our perennial surplus of exported services slightly offsets a perennial and much larger deficit in goods. President Biden has made cutting reliance on overseas manufacturers—especially for computer chips and other high-value, high-tech products—a top priority.

As of November, the deficit is down 3.6% compared to when Biden

took office two years ago.

Mortgages and Paychecks

Another good sign, and a longer-term trend, is the falling share

of personal income going to interest and principal payments on mortgages.

At the end of 2007, as the Great Recession began, Federal

Reserve data showed 7.2% of personal income went to mortgage

principal and interest. Now it’s less than 4%, with a slight uptick last year

as the Federal Reserve under Chairman Jerome Powell, a Trump appointee, raised

the interest rates it controls.

Americans owe about $12 Trillion in mortgage

debt, down almost a fifth since the start of the Great Recession

once inflation is considered.

So why do so many people feel so much economic pain?

The median weekly wage—half earn more, half less—is the same now as at the end of 2019 after taking

inflation into account.

So why is the median not moving much?

Because a rapidly growing share of wages and salaries goes to

executives and others paid more than $1 million per year while rank-and-file

workers mostly lack unions and thus lack bargaining power.

Million Dollar Paychecks

In 2020 an eye-popping 82% of all pay raises went to the very thin and

well-compensated slice of workers making $1 million or more.

That fell to 29% in 2021. However, the million-and-up club

enjoyed average raises of $840,000 each while

full-time workers making up to $250,000 got only $1,600. That’s a ratio of $500

to $1.

Also in 2021, the poorest-paid 60 million workers collectively

made less than the best-paid 237,000, more than 500 of whom averaged about $151

million, my annual analysis of Social Security Administration payroll data shows.

The million-dollar and up pay club now collects almost 7% of all

wages and salaries, up from 2% in inflation-adjusted data from 1991. The number

of these high-paid workers has exploded from 191 in 1991 to 237,000 three

decades later in 2021. Last year the number of million-dollar-plus jobs grew 95

times faster than jobs overall.

Recession Risks

So, are we likely to fall into a recession, as Greenspan and

many Wall Street economists warn?

The honest answer is we don’t know. As Yankees catcher Yogi

Berra said, “it’s tough to make predictions, especially about the future.”

If the Fed raises interest rates too high or too fast, it could

so discourage executives and entrepreneurs that they go on a capital strike, halting

the new investment that is crucial to job creation. Then again higher interest

rates may also draw more capital into the United States, further strengthening

the dollar against other currencies.

When the dollar is high relative to other currencies, it makes

what we import cheap, while other countries are burdened with high prices to

purchase our goods and services.

The greenback has been riding very high for the past two

years. My wife and I vacationed in New Zealand (beautiful, fascinating,

and friendly) this fall. Our greenbacks were worth $1.78 against the Kiwi

dollar. In Australia, the exchange rate was above $1.60. The story is similar

worldwide.

My view on the chance of a recession: bringing back jobs from

Taiwan and China, especially microchips and related high-tech manufacturing,

will be a long-term boon to the American economy with some immediate effects.

If Biden succeeds in his goal of making America the go-to

country for high-quality, high-tech manufacturing the American economic future

will be bright. It will also enrich investors more than workers unless the

union movement or a proxy for it becomes a major player in economic

decision-making.

And as for the policies of the Fed?

It’s independent so you can’t do anything about how its regional

governors vote on interest rates and whether money is hard or easy. But the

notion that a recession is certain or even likely seems out there, at least for

now.

David Cay Johnston co-founded DCReport. He is a

best-selling author and investigative journalist who for 13 years reported for

The New York Times. Johnston is a specialist in economics and tax issues. He

won a 2001 Pulitzer Prize. He teaches at Syracuse University College of Law.