There May Be Federal Funds That Can Help

By Colleen Cronin / ecoRI News staff

New Year’s resolutions can take many forms.

This year I want to save money!

In 2023, I want to be greener!

Starting Jan. 1, I’ll never eat another chocolate croissant

again!

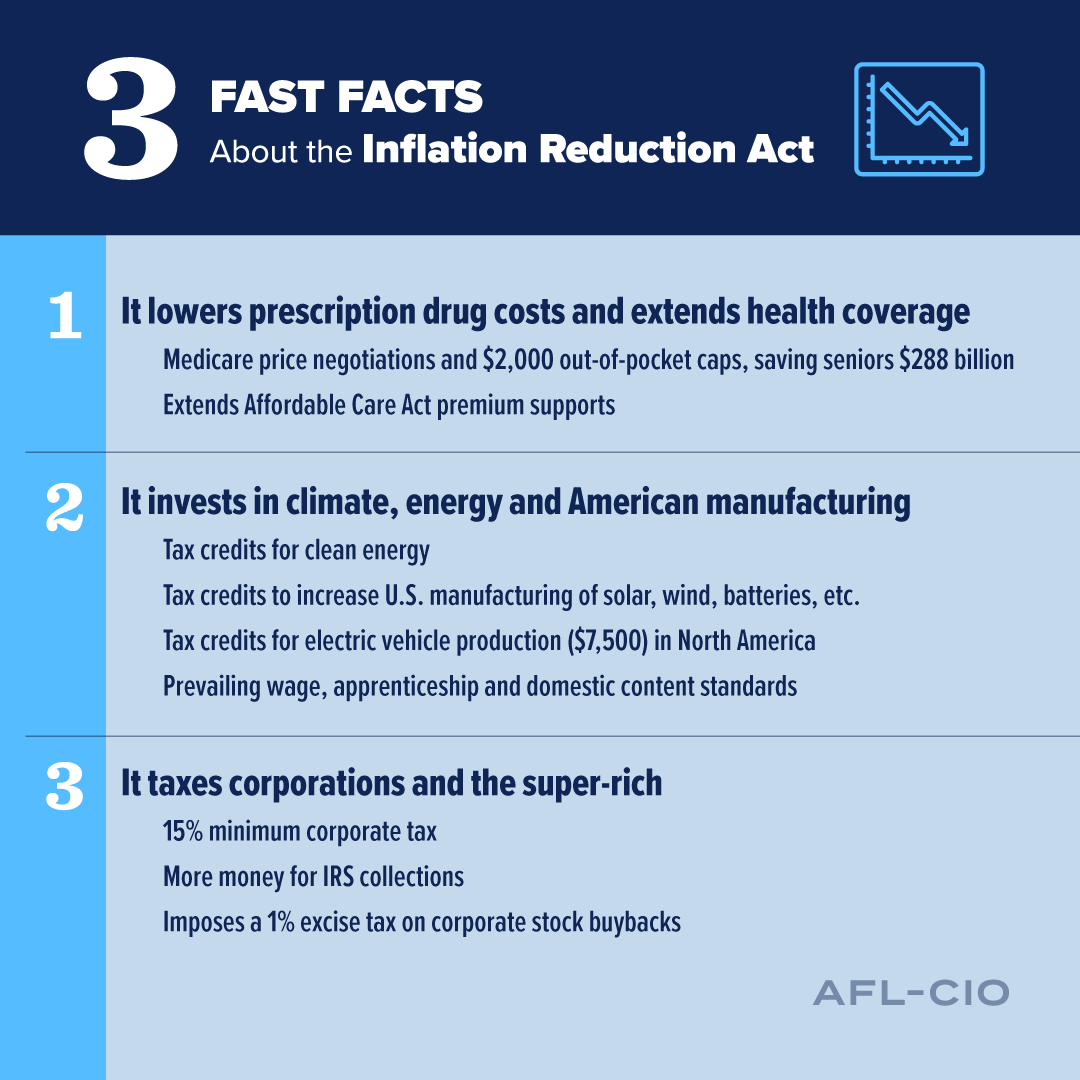

This year, the federal government wants to help you accomplish

those goals — well, at least the first two — through billions of Inflation Reduction Act (IRA)

dollars.

“It’s one thing to have these programs available. It’s one thing to have federal tax advantages, et cetera. But if no one knows about it, it doesn’t make any sense,” Sen. Jack Reed, D-R.I., said in late December, standing next to a Rhode Island-made heat pump, the first manufactured in the Ocean State.

Heat pumps are more efficient heating and cooling systems that

can help households save money and reduce emissions. They are also among the

appliances and systems eligible for tax credits this year through the IRA.

The senator was speaking at an event hosted at Taco

Comfort Solution in Cranston, where Rhode Island heat pumps are

made, to promote some of the new incentives and rebates state residents can

take advantage of.

Reed began rattling off rebates: up to $7,000 for a new electric

car and $4,000 for a used electric car; rebates for energy-efficient appliances

and retrofits total $9 billion; the IRA gives Rhode Island $4.5 million to

discount renewable energy upgrades.

Using Rewiring America’s IRA Saving Calculator, Reed said Rhode Islanders

can see how much they could save by switching to cleaner energy and how much

they could save annually if their utilities were greener.

A family of four living in East Providence and making $100,000

annually could receive an estimated $25,700 in energy incentives and save about

$1,000 on their energy bill each year, for example.

Ari Matusiak, CEO and co-founder of Rewiring America, recounted his own experience trying to

afford heating a home in Rhode Island after graduating from college and paying

$650 in rent and $650 on an oil bill all in the same month.

“The idea of spending as much money on my heating as I was on my

rent … was a pretty sort of sobering realization,” he said.

Although many of the incentives and savings will go to

homeowners, Matusiak said rebates for electric stoves, heat pump window-unit

air cooling and heating systems, heat-pump clothes dryers, and other energy-efficient

appliances could be utilized by renters and brought to new residences.

Matusiak noted landlords may be incentivized to make their

property greener because the volatility in fossil fuel options is making

inefficient homes more expensive and less attractive to potential tenants.

“People will, at a certain point, say, ‘You know what, that’s

actually like a surcharge on my rent. I’m going to go look for someplace that

is more efficient, energy efficient, so that it’s more affordable,’” he said.

Rewiring America will soon have material available for renters

to present to their landlords about some of these incentives, according to

Matusiak.

Many of these programs started last year, while others

became available Jan. 1.

Here are some of the opportunities that residents can take

advantage of:

Residents that place solar panels on their

roofs can be eligible for a tax credit for 30% of the cost.

To add insulation or energy-efficient windows and doors,

households can receive a $1,200 tax credit.

There is up to a $150 in credit for an energy audit. (Rhode

Island also offers energy assessments for free.)

Households could get up to $4,000 in rebates to make their

homes more efficient with electric appliances and

retrofitting. Low-income households could be eligible for up to $8,000.

Households that install heat pumps can receive a tax credit for 30%

of the cost.

Up to $2,000 is available for households that need

electrical upgrades to install a heat pump.

Low- and moderate-income households could receive up to

$8,000 for heat pumps and $4,000 for electrical upgrades needed to install one.

One hundred percent of the cost of some appliances such as

heat pump water heaters and clothes dryers are covered for low-income

households.

If buying a new, American-assembled electric car, which has

a battery that meets certain sourcing standards, income-qualifying households

can get up to a $7,500 tax credit.

Buying used electric cars that are at least two years old

and cost $25,000 or less can get households up to a $4,000 tax credit.

The IRA sunsets in 2032, so many of the incentives will be

available for several years.