Tax the Wealthy Like We Used To

ROBERT REICH in Robertreich.Substack.Com

The dire warnings of fiscal hawks are once again darkening the skies of official Washington, demanding that the $31 trillion federal debt be reduced and government spending curtailed (thereby giving cover to Republican efforts to hold America hostage by refusing to raise the debt ceiling).

It’s

always the same when Republicans take over a chamber of Congress or the

presidency. Horrors! The debt is out of control! Federal spending must be cut!

Not

only is the story false, but it leaves out the bigger and more important story

behind today’s federal debt: the switch by America’s wealthy over the last half

century from paying taxes to the government to lending

the government money.

This back story needs to be told if Americans are to understand what’s really happened and what needs to be done about it. Republicans won’t tell it, so Democrats (starting with Joe Biden) must.

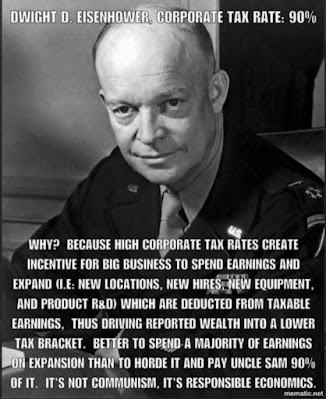

A

half century ago, American’s wealthy financed the federal government mainly

through their tax payments. Tax rates on the wealthy were high: Under

Republican President Dwight Eisenhower, they were over 90 percent. Even

after all tax deductions, the wealthy typically paid half of their incomes in

taxes.

Since

then — courtesy of Ronald Reagan, George W. Bush, and Donald Trump — the

effective tax rate on wealthy Americans has plummeted. Even as they’ve

accumulated unprecedented wealth, today’s rich are now paying a lower tax rate

than middle-class Americans. (The 400 richest American families paid a tax rate

of just 3.4 percent between

2014 and 2018, while the rest of us paid an average tax rate of 13.3 percent.)

One

of the biggest reasons the federal debt has exploded is that tax cuts on

wealthier Americans have reduced government revenue.

Meanwhile,

America’s wealthy are financing America’s exploding debt by lending the federal

government money, for which the government pays them interest.

As

the federal debt continues to mount, those interest payments are ballooning —

hitting a record $475 billion in

the last fiscal next year (which ran through September). The Congressional

Budget Office predicts that interest payments on the federal debt will

reach 3.3 percent of the

GDP by 2032 and 7.2 percent by

2052.

The

biggest recipients of these interest payments are not foreigners but wealthy

Americans who park their savings in treasury bonds held by mutual funds, hedge

funds, pension funds, banks, insurance companies, personal trusts, and estates.

Hence

the half-century switch: The wealthy used to pay higher taxes

to the government. Now the government pays the wealthy

interest on their loans to finance a swelling debt that’s been caused largely

by lower taxes on the wealthy.

This

means that a growing portion of your taxes are going to the

wealthy in the form of interest payments, rather than paying for government

services everyone needs.

So,

the real problem isn’t America’s growing federal budget deficit. It’s the

decline in tax revenue from America’s wealthy combined with

growing interest payments to them.

Both

are worsening America’s already horrific inequalities of income and wealth.

What

should be done? Reduce the debt by raising taxes on the wealthy.

This

back story needs to be told. Please spread the word.

©

2021 robertreich.substack.com

ROBERT REICH

is the Chancellor's Professor of Public Policy at the University of California,

Berkeley, and a senior fellow at the Blum Center for Developing Economies. He

served as secretary of labor in the Clinton administration, for which Time

magazine named him one of the 10 most effective cabinet secretaries of the

twentieth century. His book include: "Aftershock" (2011), "The

Work of Nations" (1992), "Beyond Outrage" (2012) and,

"Saving Capitalism" (2016). He is also a founding editor of The

American Prospect magazine, former chairman of Common Cause, a member of the

American Academy of Arts and Sciences, and co-creator of the award-winning

documentary, "Inequality For All." Reich's newest book is "The

Common Good" (2019). He's co-creator of the Netflix original documentary

"Saving Capitalism," which is streaming now.