Make the rich pay the same tax as the rest of us

Is your salary less than $160,200?

If so, you’re among the 94 percent of American workers who pay into

Social Security all year long. Thanks to a loophole that exclusively benefits

the affluent, income above that amount simply isn’t taxed for Social Security.

That means someone like Tucker Carlson, who makes a reported $8 million a year, stopped

contributing to Social Security on January 8. Joe Rogan, who reportedly makes $4 million a month, stopped contributing on January 2.

That’s how quickly these high rollers cleared that

$160,200 benchmark. But this isn’t even the worst of it.

Many billionaires receive all of their money in the form

of bonuses and stock options. Elon Musk is the highest paid CEO in the world, but because

none of it is “wage income,” he doesn’t pay a single penny into

Social Security.

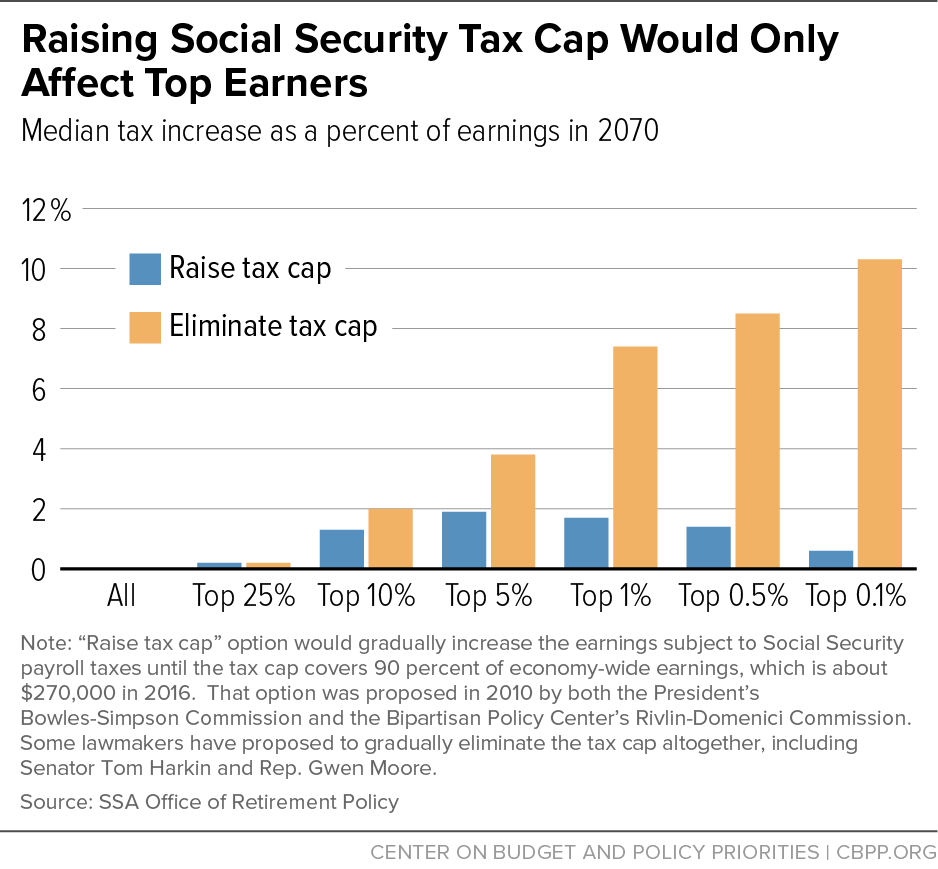

Right-wing politicians and cable news pundits frequently say that we “can’t afford” Social Security. Their solution? Cut benefits for working people who’ve paid into the program for our entire lives.

They never suggest that we simply require the wealthiest

people in America to pay into Social Security all year long, just like the rest

of us. If we taxed them like we tax everyone else, we could afford not just to

protect our benefits, but expand them.

The Social Security Expansion Act would do just

that. This bill would require the wealthy to contribute into Social Security on

all their income over $250,000 — including investment income. And it would use

the additional revenue to increase Social Security benefits and keep the

program strong.

Another piece of legislation, Social Security 2100: A Sacred Trust, would also

lift the cap on Social Security contributions and use the revenue to expand

benefits. It had the support of about 90 percent of House Democrats in the last

Congress.

The movement to finally require the wealthy to pay into

Social Security all year long isn’t limited to Congress. President Joe Biden campaigned on

lifting the cap and using the revenue for targeted benefit expansions.

Polling shows that the idea has widespread support

among the public, including 76 percent of all voters and 65 percent of

Republican voters. Unfortunately, Republican politicians are not listening to

their voters.

The Republican Study Committee, a group that counts 156

House Republicans as members, released a budget last year that would make massive cuts to Social Security

benefits, including raising the full retirement age to 70. It doesn’t raise one

dime of additional revenue from the wealthy.

These politicians are focused on protecting their wealthy

donors, who pay less into Social Security than ever. The Economic Policy

Institute (EPI) recently found that as inequality increases, a record

share of all earnings are above the $160,200 cap on Social Security

contributions.

In 1983, the last time Congress made major reforms to

Social Security, they set the cap at a level that covered 90 percent of all

wage income, leaving only 10 percent above the cap. By 2021, the percentage of

income above that cap had nearly doubled. And that doesn’t even include

investment income which, as in Musk’s case, accounts for the bulk of the income

of the wealthiest.

EPI estimates that rising inequality has cost the Social

Security Trust Fund $1.4 trillion. That’s a massive windfall for the wealthy —

and a massive loss for our Social Security system and the millions of Americans

who rely on it.

Congress has the power to end this injustice. All it would take is Republican politicians listening to their voters and joining with Democrats to require the wealthy to pay into Social Security on all of their income, just like the rest of us do.

Linda

Benesch is the Communications Director at Social Security Works.

This op-ed was adapted from Inequality.org and distributed for syndication by

OtherWords.org.