Morgan tries the oldest trick in the book on Rhode Island seniors

By Will Collette

Charlestown state Senator Elaine Morgan issued a news release to mark her introduction of new legislation to eliminate the state's income tax on ALL Social Security income. In her statement, she notes the economic plight of seniors and claims her bill will "be akin to giving Rhode Island retirees a raise."Except that's a lie.

In fact, Rhode Island has already enacted legislation to make Social Security income exempt from state income tax for single seniors with net incomes of $95,800 and couples with net incomes of $119,750 or less.

Any Rhode Islander relying solely on Social Security is already fully exempt from state income tax. Most of the rest of Rhode Islanders drawing Social Security payments are under the income limit to receive the tax break. That includes all Rhode Islanders whose incomes from all sources are in the defined "middle class" income brackets.

So Morgan's proposal only covers the Republican Party's favorites: upper-income earners.

When the current Social Security tax legislation was introduced and then enacted almost 10 years ago, Morgan's colleague, the fact-challenged ex-state Rep for Charlestown Blake "Flip" Filippi took credit for it. But in fact, it was Rep. Bob Craven's bill that ended up getting signed into law.

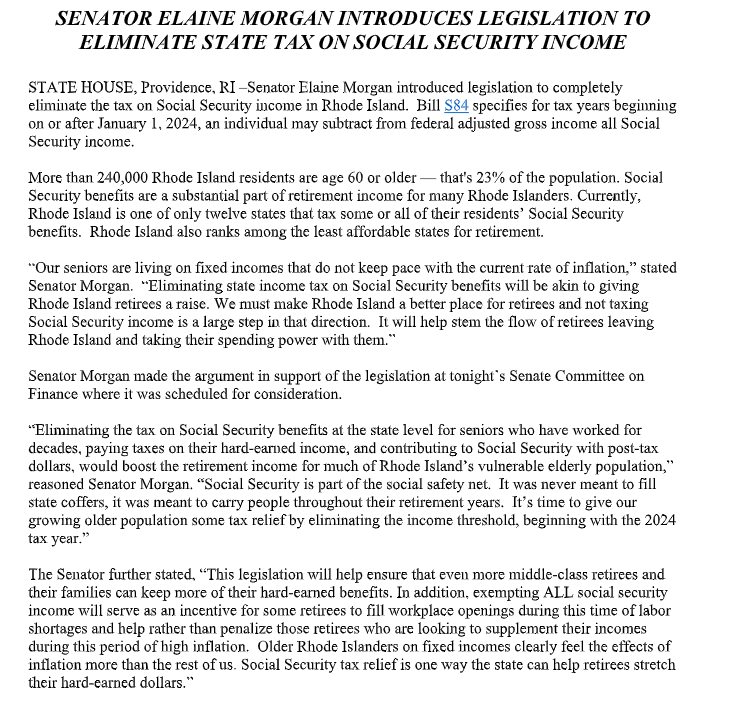

Here's Morgan's news release and Senator Sam Bell's rebuttal.