Bank to pay $9 million in redlining settlement

By Christopher Shea, Rhode Island Current

The nation’s oldest community bank will pay over $9 million to settle a federal lawsuit alleging it discriminated against Black and Hispanic borrowers in Rhode Island, the U.S. Justice Department (DOJ) announced Wednesday.

Washington Trust was accused of redlining, the name for the practice of avoiding providing credit services to people because of their race, color or national origin. The federal government outlawed redlining with the 1968 Fair Housing Act.

Wednesday’s settlement marks the ninth such agreement under the DOJ’s Combating Redlining Initiative, launched in 2021.

“Everyone who pursues the American Dream has the right to expect to be treated equally and with dignity, regardless of their race, their background, or ZIP code,” U.S. Attorney Zachary A. Cunha said in a statement. “When communities are denied access to fair lending, families are denied the opportunity to build stability and financial success.”

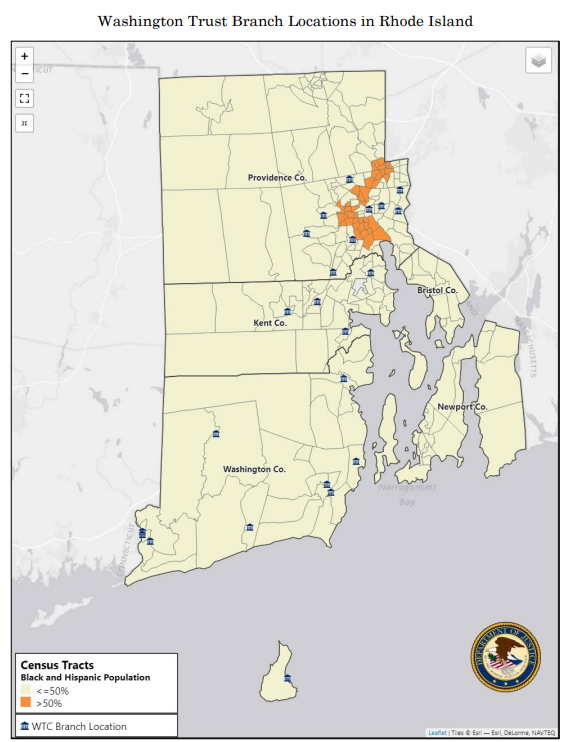

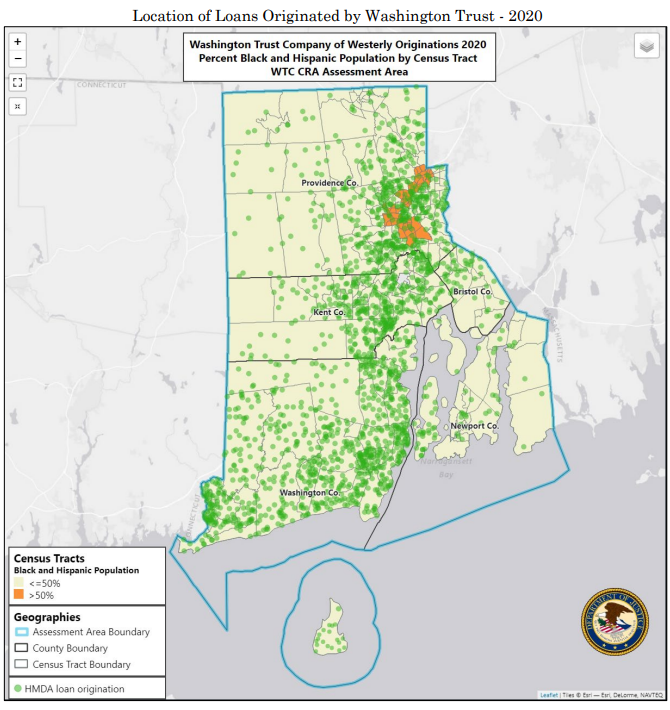

From 2016 to 2021, investigators claim Washington Trust bank “failed to provide mortgage lending services to majority-Black and Hispanic neighborhoods.” Officials at the DOJ said despite expanding across the state, it never opened a branch in a community of color.Even in cases where Washington Trust generated loan applications from majority-Black and Hispanic areas, the DOJ said “applicants themselves were disproportionately white.”

The Westerly-based bank has 25 branches across 18 municipalities in Rhode Island including Block Island Cumberland, Cranston, and Warwick. There are two locations in Providence: one downtown and one on the East Side along Waterman Street.

washington_trust_branch_locationsWashington Trust CEO Edward O. Handy III said in a statement Wednesday “we vehemently deny the allegations and have entered into this agreement solely to avoid the expense and distraction of potential litigation.”

“We believe we have been fully compliant with the letter and spirit of fair lending laws, and the agreement will further strengthen our focus on an area that has always been important to us,” Handy added. “Rhode Island has been home to Washington Trust for 223 years and our neighbors count on us to provide affordable loan opportunities no matter where they live.”

“Washington Trust has invested significantly in mortgage loan subsidies, community outreach, and marketing in Majority-Minority Census Tracts, and will continue these efforts to make [a] positive impact in these communities,” the statement continued.

Under the proposed consent agreement filed in federal court, the DOJ calls for Washington Trust to provide at least $7 million in loan credit opportunities for majority-Black and Hispanic neighborhoods in Rhode Island..

The bank will also spend $1 million on community partnerships to provide services that increase residential mortgage credit access for residents of Black and Brown neighborhoods and an additional million for advertising, outreach, consumer financial education and credit counseling.

Washington Trust also agreed to open two new branches in communities of color and to employ a director of community lending who will oversee the continued development of lending in those areas.

The consent agreement is subject to court approval, according to the DOJ.

GET THE MORNING HEADLINES DELIVERED TO YOUR INBOX

Rhode Island Current is part of States Newsroom, a network of news bureaus supported by grants and a coalition of donors as a 501c(3) public charity. Rhode Island Current maintains editorial independence. Contact Editor Janine L. Weisman for questions: info@rhodeislandcurrent.com. Follow Rhode Island Current on Facebook and Twitter.