To make the right choice, consider all the angles

During this Medicare Open Enrollment period, ask yourself these seven questions. And, please know that you can always call the Medicare Rights Center at 1-800-333-4114 or your SHIP—State Health Insurance Assistance Program—for free, unbiased advice on any of your Medicare questions.

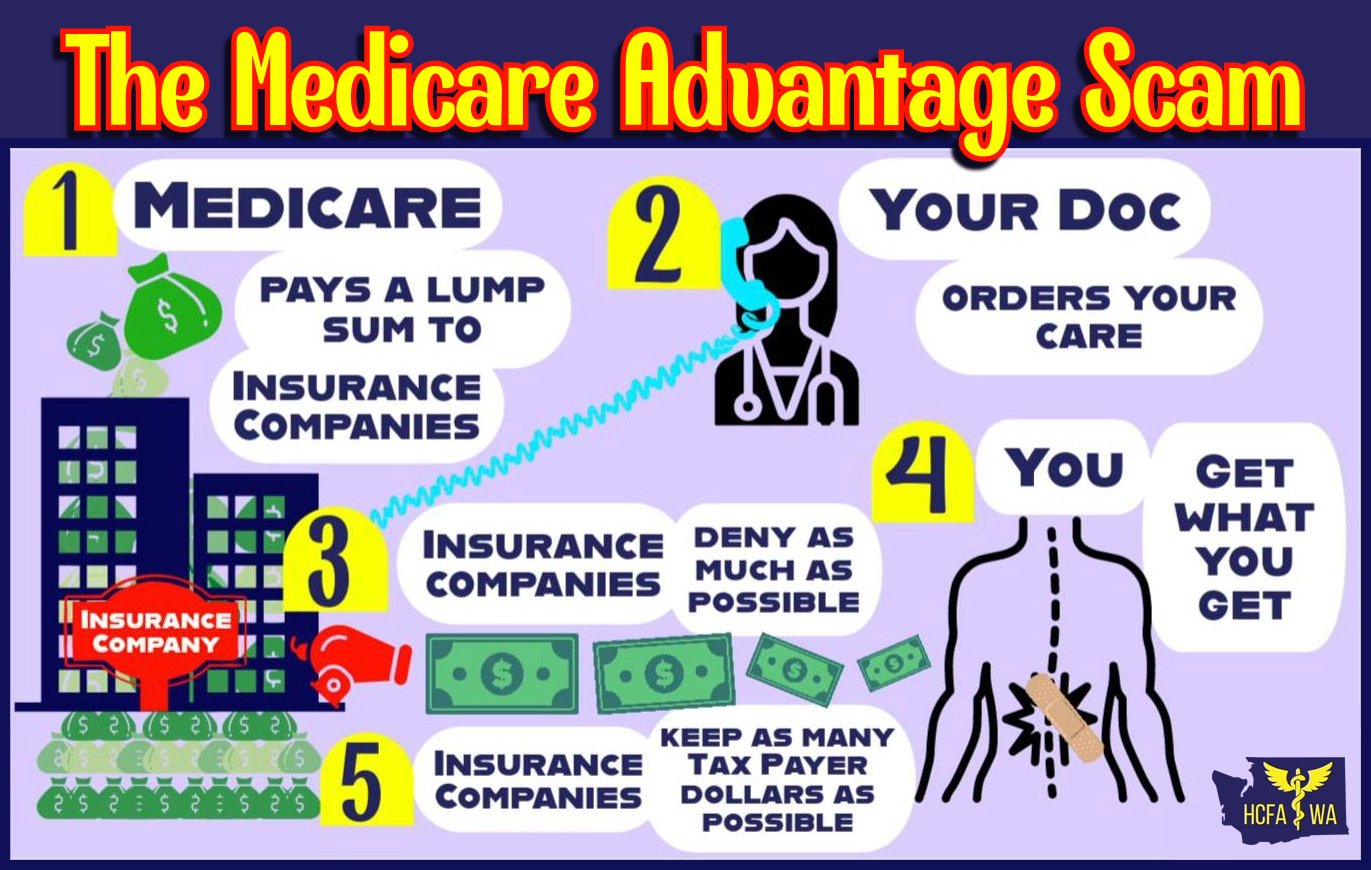

Q. What’s the biggest difference between traditional Medicare and a Medicare Advantage plan? To ensure you have good coverage for both current and unforeseeable health needs, you should enroll in traditional Medicare. In traditional Medicare, you and your doctor decide the care you need, with no prior approval. And, you have easy access to care from almost all doctors and hospitals in the United States with no incentive to stint on your care.

In a Medicare Advantage plan, a corporate insurance company decides when you get care, often requiring you to get its approval first. Medicare Advantage plans also restrict access to physicians and too often second-guess your treating physicians, denying you needed care inappropriately.

The less care the Medicare

Advantage plan provides, the more the insurance company profits. You will pay

more upfront in traditional Medicare if you don’t have Medicaid and need to buy

supplemental coverage, but you are likely to spend a lot less out of pocket

when you need costly care. Regardless of whether you stay in traditional

Medicare or enroll in Medicare Advantage, you still need to pay your Part B

premium.

Q. Should I trust an insurance agent’s advice about my Medicare options? No. Unfortunately, insurance agents are paid more to steer you away from traditional Medicare and into a Medicare Advantage plan, even if it does not meet your needs. While some insurance agents might be good, you can’t know whom to trust.

Keep in mind that while Medicare Advantage

plans tell you that they offer you extra benefits, you still need to pay your

Part B premium, and extra benefits are often very limited and come with high

out-of-pocket costs; be aware that many Medicare Advantage plans won’t cover as

much necessary medical and hospital care as traditional Medicare. For free

independent advice about your options, call the Medicare Rights Center at

1-800-333-4114 or a SHIP.

Q. Why can’t I rely on my friends or the government’s star-rating system to pick a good Medicare Advantage plan? Unlike traditional Medicare, which gives you easy access to the physicians and hospitals you use from everywhere in the U.S. and allows for continuity of care, you can’t count on a Medicare Advantage plan to cover your care from the healthcare providers listed in their network or to cover the medically necessary care that traditional Medicare covers. Even if your friends say they are happy with their Medicare Advantage plan right now, they are gambling with their healthcare.

The government’s five-star rating system does not consider

that some Medicare Advantage plans engage in widespread inappropriate delays

and denials of care, and other Medicare Advantage plans engage in

different bad acts that can endanger your health. So, while you should never

sign up for a Medicare Advantage plan with a one, two, or three-star rating,

Medicare Advantage plans with four and five-star ratings can have very high

denial and delay rates.

Q. If I’m enrolled in a Medicare Advantage plan, can I count on seeing the physicians listed in the network and lower costs? Unfortunately, provider networks in Medicare Advantage plans can change at any time and your out-of-pocket costs can be as high as $8,300 this year for in-network care alone. You can study the MA plan literature, and you can know your total out-of-pocket costs for in-network care.

But, you cannot know whether the MA

plan will refuse to cover the care you need or delay needed care for an

extended period. This year alone, dozens of health systems have canceled their Medicare

Advantage contracts, further restricting access to care for their

patients in MA, because MA plans make it hard for them to give people needed

care.

Q. Doesn’t the

government make sure that Medicare Advantage plans deliver the same benefits as

traditional Medicare? No.

The government cannot protect you from Medicare Advantage bad actors. The

insurers offering Medicare Advantage plans can decide you don’t need care when

you clearly do, and there’s no one stopping them; they are largely

unaccountable for their bad acts. In the last few years there have been

multiple government and

independent reports on insurance company bad acts in Medicare Advantage plans.

Q. If I join a

Medicare Advantage plan, can I disenroll and switch to traditional Medicare? You can switch to traditional Medicare each

annual open enrollment period. However, depending upon your situation, where

you live, your income, your age, and more, you might not be able to get

supplemental coverage to pick up your out-of-pocket costs and protect you from

high costs. What’s worse, you could incur thousands of dollars in out-of-pocket

costs in Medicare Advantage.

Q. If I have

traditional Medicare and Medicaid, what should I do? If you have both Medicare and Medicaid,

traditional Medicare covers virtually all your out-of-pocket costs. You will

get much easier access to physicians and inpatient services in traditional

Medicare than in a Medicare Advantage plan if you need costly healthcare

services or have a complex condition.

Again, for free

independent advice about your options, call the Medicare Rights Center at

1-800-333-4114 or a SHIP.

DIANE ARCHER is president of Just Care USA, an independent

digital hub covering health and financial issues facing boomers and their

families and promoting policy solutions. She is the past board chair of

Consumer Reports and serves on the Brown University School of Public Health

Advisory Board. Ms. Archer began her career in health advocacy in 1989 as

founder and president of the Medicare Rights Center, a national organization

dedicated to ensuring that older and disabled Americans get the health care

they need. She served as director, Health Care for All Project, Institute for

America's Future, between 2005 and 2010.