They'll sure as hell try

By Philip Mattera, director of the Corporate Research Project

for the Dirt Diggers Digest

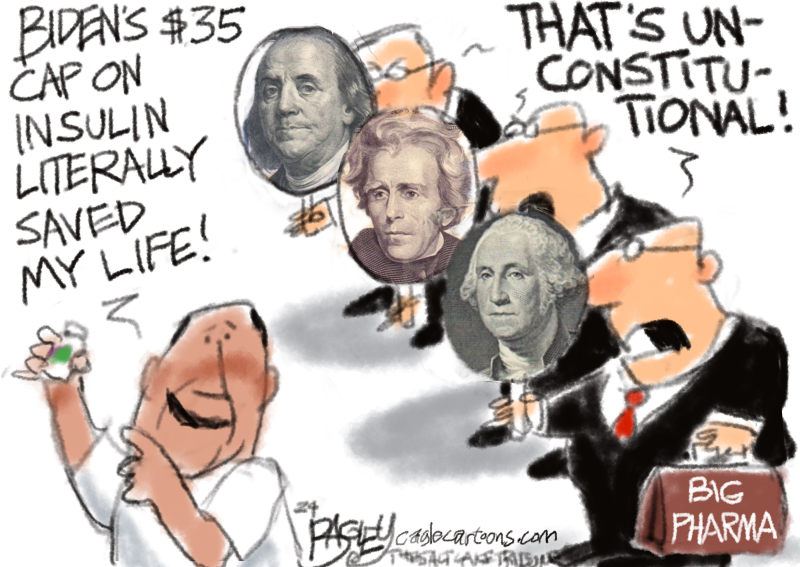

Tensions are mounting between the Biden Administration, which wants to implement legislation passed in 2022 allowing Medicare to negotiate drug prices, and the pharmaceutical industry, which would like to nullify the law and maintain the highly profitable status quo.

Big Pharma has little support from the American public, which

pays much more for its meds than residents of other countries. The industry is

ultimately counting on being rescued by the business-friendly majority on the

Supreme Court.

Being able to dictate prices to Medicare is not the only way

drugmakers fleece government agencies and the public. In Violation Tracker we

document more than 150 major cases of drug price cheating by large producers.

Some of these cases are old-fashioned price-fixing, in which supposedly competing producers conspire to set prices.

Last year, for example, criminal charges were brought against Teva Pharmaceuticals and Glenmark Pharmaceuticals for scheming to fix prices of several generic drugs. Teva paid a $225 million criminal penalty and Glenmark paid $30 million. The companies were also ordered to divest their operations relating to the cholesterol drug pravastatin.

Generic producers are supposed to help reduce drug prices, but they often do the opposite. Along with price-fixing, they often engage in schemes called pay for delay.

These are illegal deals in which they receive

payments from producers of brand-name drugs whose patent protection is ending

to look the other way as those producers use tricks to extend their

exclusivity. Pay for delay arrangements are frequently challenged via class

action lawsuits, and both brand-name and generic drugmakers have paid billions

in settlements.

Earlier this year, for instance, Gilead Sciences agreed to pay

over $246 million to

settle litigation alleging it entered into an improper deal to delay the

introduction of a generic version of its HIV medications. Pay for delay is

apparently so profitable that nine-figure settlements have not put a dent in

it.

Another form of cheating involves manipulation of the wholesale

price levels drug companies are required to report to state Medicaid agencies

and which are used in determining how much they receive for their products.

This reporting is supposed to ensure that the prices being paid by Medicaid are

not out of line with those charged to other parties.

Drugmakers have repeatedly been accused of reporting inflated

prices to Medicaid, and have paid out large amounts in settlements. In 2016

Pfizer and its subsidiary Wyeth paid $784 million to

resolve allegations that Wyeth knowingly reported to the government false and

fraudulent prices on two of its proton pump inhibitor drugs.

Then there is the issue of rebates. Pharmaceutical companies often offer them to private-sector customers to promote their products, but they frequently fail to provide the same benefit to government health programs.

Violation Tracker contains numerous cases in which drugmakers were accused

shortchanging government agencies on rebates. In 2021 Bristol-Myers Squibb

paid $75 million to

settle one such case.

The Pharma giants have also driven up costs indirectly through

practices such as paying kickbacks to healthcare providers to prescribe

expensive medications and engaging in improper marketing to encourage off-label

use of those over-priced meds.

There seems to be no end to the ways pharmaceutical companies

pick the pockets of taxpayers and consumers. The Inflation Reduction Act could

begin to tip the scales in the other direction—unless the courts decide to keep

us at the mercy of the industry.