Taxing them is good for it

By Omar Ocampo

A new, disturbing milestone has been confirmed in the latest Forbes World Billionaires List. The U.S. billionaire class is now larger and richer than ever, with 813 ten-figure oligarchs together holding $5.7 trillion.

This is a $1.2 trillion increase from the year before —

and a gargantuan $2.7 trillion increase since March 2020.

The staggering upsurge shows how our economy primarily

benefits the wealthy, rather than the ordinary working people who produce their

wealth. Even worse, those extremely wealthy individuals often use these assets

to undermine our democracy.

Billionaires have enormous power to influence the

political process. They spent $1.2 billion in the 2020 general election

and more than $880 million in the 2022 midterms.

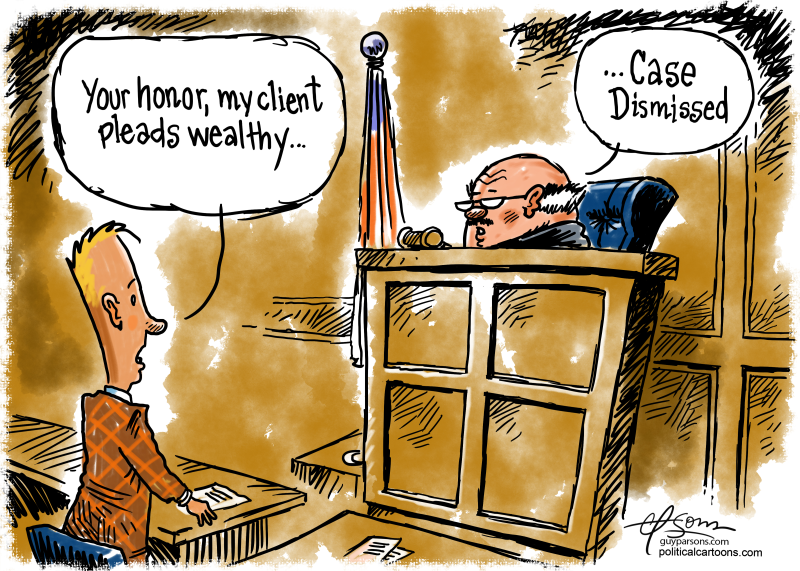

Even when their preferred candidates aren’t in office, our institutions are

still more likely to respond to their policy preferences than the average

voter’s, especially when it comes to taxes.

The vast majority of Americans, including 63 percent

of Republicans, support higher taxes on the wealthy. Yet our representatives

consistently fail to deliver. A quintessential example was Donald Trump’s 2017

tax cuts for corporations and the rich — the

most unpopular legislation signed into law in the past 25

years.

Though backers promised the tax cuts would benefit all Americans, a recent report by the Center on Budget and Policy Priorities revealed that the primary beneficiaries were the top 1 percent.

The good news? Those cuts are set to expire after next

year. So we’ll have an opportunity for a new tax reform — one that raises more

money for the services we rely on while protecting our democracy from extreme

wealth concentration.

President Joe Biden’s Billionaire Minimum Income Tax (BMIT) is one

promising proposal. By raising the top tax rate and taxing unrealized capital

gains, the BMIT seeks to repair a system where billionaires pay a lower average

tax rate than working people. It would raise $50 billion a year over the next

decade, making our tax system a bit more equitable.

Senator Ron Wyden’s (D-OR) similarly named Billionaire Income Tax (BIT) is more

straightforward. It would target asset gains that can easily be tracked by the

public, like a billionaire’s stock holdings in a publicly traded company.

Another idea? A well-designed progressive tax on

billionaire wealth.

A modest 5 percent tax on all wealth above $1 billion

would raise more than $244 billion this year alone. And that’s likely an

underestimate, since some billionaires keep their wealth concealed from Forbes. Wealth-X, a private research firm, identified

955 billionaires in their Census last year, 142 more than what Forbes just registered.

A wealth tax wouldn’t hurt investment and innovation —

most innovation in the U.S. is driven by people worth less than $50

million. But for billionaires, it would function “as a constraint on their rate of wealth accumulation,”

according to Patriotic Millionaires, a group of wealthy people who support

higher taxes on the rich.

Of course, a wealth tax alone isn’t enough to ensure the

safety of our democracy. We also need campaign finance reform to limit

political spending. And stronger labor unions could prevent extreme

concentrations of wealth from occurring in the first place. Unions not only

increase the collective power of workers, they also close wage gaps between workers and CEOs.

Finally, we need better tax enforcement. The Inflation

Reduction Act gave the IRS more resources to track down wealthy tax dodgers,

and now the agency is projecting an unexpected windfall in tax revenue over the

next decade.

That’s a great first step towards strengthening our democracy and democratizing our economy. Now let’s take the next step and fix the tax code itself.

Omar Ocampo is a researcher for the

Program on Inequality and the Common Good at the Institute for Policy Studies.

This op-ed was adapted from a longer version at Inequality.org and distributed

for syndication by OtherWords.org.