Not surprisingly, tax breaks for the rich are 2024 GOP mainstay

BRETT WILKINS for Common Dreams

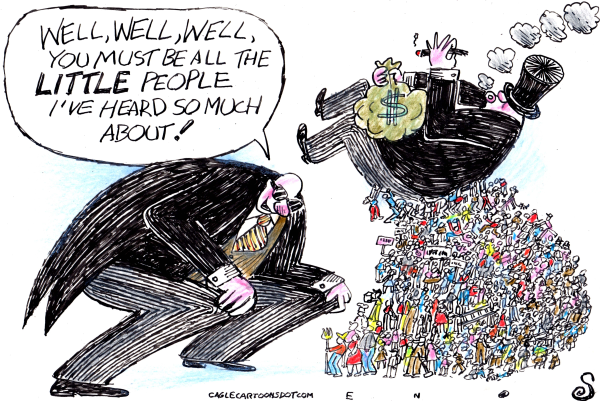

As House Republicans prepare for Donald Trump's possible White House return by plotting to expand the billionaire and corporate tax cuts that were the cornerstone of the former president's first administration, congressional Democrats and advocates for working Americans warned Thursday that a second Trump term would bring more of the same inequality-exacerbating policies.

The GOP-controlled House Ways and Means Committee held a hearing on "expanding the success" of the 2017 Tax Cuts and Jobs Act (TCJA)—widely derided by opponents as the "GOP Tax Scam."

Republican committee members couched a policy that the Center for Popular

Democracy said "delivered big benefits to the rich and corporations but

nearly none for working families" as "relief to help hardworking

American families."

Rep. Richard Neal (D-Mass.), the committee's ranking member, pushed back during Thursday's hearing, noting that "in the last three decades, Republicans have skyrocketed the deficit with trillions in tax cuts for billionaires and big corporations, always with the same result: the top 1% benefits while nothing trickles down for workers."

Neal continued:

In 2017, Ways and Means Democrats saw the GOP corporate tax giveaway for what it was: a scam. We knew that their Tax Scam would disproportionately benefit the wealthy and well-connected. We knew that it wouldn't pay for itself. We knew that big corporations, not their workers, would feel the most benefit. Six years since the GOP Tax Scam was signed into law, we've been proven right on every count. It didn't pay for itself, it didn't increase revenue, and it didn't increase wages.

A recent study whose authors included [Joint Committee on Taxation] economists—let that sink in—found that ALL of the corporate gains from TCJA went to shareholders and high-paid executives, with absolutely nothing flowing to workers. Fifty-six percent of the tax cuts enriched shareholders, and the remaining 44% lined the pockets of execs. Zero percent went to workers. ZERO!

"There are 20 years of data showing

trickle-down economics doesn't work, yet today will still be a whole lot of

revisionist history and wishful thinking on the singular largest failure of

fiscal policy in recent memory," Neal added. "If workers and the

middle class are actually your priorities, putting them ahead of big

corporations and billionaires is the only way."

Rep. Don Beyer (D-Va.)—who also sits on the

committee—agreed, asserting on social

media that "the Trump tax cuts were a huge 'success' if you were a

billionaire or an executive at a large corporation. They made out like bandits,

with a huge amount of the benefits from the GOP tax law going to the

wealthiest. Now Republicans want to give the superrich even more tax

cuts."

Trump is open about this. At an exclusive

fundraiser at his Mar-a-Lago resort in Florida last week, he shouted out his

"rich as hell" supporters, telling them, "We're gonna give you tax

cuts, we're gonna pay off our debt."

That's the same debt that soared by around $8 trillion during

Trump's term—largely as a result of his tax cuts. Meanwhile, U.S. billionaires

have collectively gotten $2.2 trillion richer since

the GOP tax cuts took effect.

With many provisions of the TCJA set to

expire at the end of 2025, progressives are underscoring what's at stake in

this November's elections.

"Today the American people got a preview of what's in store for them next year if the Trump Tax Scam expires under conservative leadership," Groundwork Collaborative executive director Lindsay Owens said following the House hearing.

"The conservative

playbook for the 2025 tax fight is coming into focus, and we can be sure it

includes more giveaways for the wealthy and corporations."