No more!

By Alexander Castro, Rhode Island Current

Deny, deny, deny: That’s what Rhode Island Attorney General Peter Neronha is asking the state’s health insurance commissioner to do with the premium hikes requested by a half dozen Rhode Island insurance companies for 2025.

Neronha’s office shared on Tuesday a letter to Cory King, who leads the state’s Office of the Health Insurance Commissioner (OHIC). In his letter, Neronha asks the commissioner to reject health insurers’ requested increases that “range from an arguably modest 2.5% to an astronomical 22.7%.”

Earlier this month, Neronha issued a memo opposing proposed 2025 rates by Blue Cross Blue Shield of Rhode Island, the only individual market insurer who submitted an increase more than 10% higher. Neronha’s latest critique is a blanket rejection of proposed increases for small- and large-group plans from six insurance companies.

Neronha being at odds with health insurers is nothing new — he recommended against requested rate hikes last year, too. King’s office approved most requested rates, albeit with a few percentage points shaved off, which still led to a savings of approximately $24 million. The commissioner is expected to release his office’s decision on this year’s proposed rates later this month.

The Office of Attorney General uses actuaries to analyze proposed rate increases and determine their feasibility. The health insurance commissioner also analyzes the rates, solicits public feedback and ultimately approves or denies the requested increases.

Neronha, whose job duties include consumer protection, wrote in his latest memo that actuarial recommendations might only scratch the surface of a deeper problem.

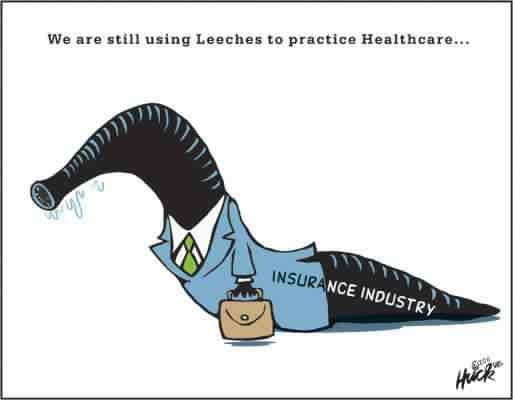

“It is not the role of the Attorney General to simply advise whether the actuarial projections provided by an insurer can support requested rate increases; rather, it is incumbent upon the Attorney General to also determine whether such increases are warranted given the health care and economic landscape against which they are sought,” Neronha wrote. “[T]o put it bluntly, we have a system that is broken.”

Neronha pointed out in his memo that “despite significant collective” investment in the health care system, U.S. residents don’t get much bang for their buck, with life expectancy six years lower than in similar countries and subpar health outcomes for people of color.

Another systemic problem, specific to Rhode Island: The health insurance commissioner only had jurisdiction over about 15% of Rhode Islanders, thanks to what Neronha calls “the fractured nature of our regulatory scheme.” King’s office reviews rates for only certain kinds of insurance. Self-insured employers who offer insurance via the Employee Retirement Income Security Act of 1974 (ERISA) are exempt because federal law dictates those arrangements.

Still, Neronha added in a footnote that some health insurers have started to use this office’s tips on methodology, such as changing the data sources used for calculating manual rates, tweaking risk adjustment calculations or calculating small group rates based on comparable data from Massachusetts rather than Pennsylvania.

“Yet, even when robust actuarial methods are followed, rate increases continue,” Neronha wrote.

In response to Neronha’s latest critique, Blue Cross reiterated its previous statement: Rising prescription drug costs and higher utilization of medical services in the post-pandemic age ultimately led Blue Cross to an operating loss of $26 million in 2023, wrote spokesperson Jeremy Duncan in an email Thursday.

Spokespeople for both Neighborhood Health Plan and UnitedHealthcare had no comment on Neronha’s memo. The latter had the priciest request overall, with a proposed 22.7% hike on small group market rates.

Neronha’s office did not respond to multiple requests for copies of its actuaries’ reports and recommendations.

Any proposed rate increase over 10% requires review by the attorney general’s office, which is why Neronha targeted Blue Cross in his earlier comments and left alone Neighborhood, with its 5.6% increase. But the most expensive proposals — and the largest number of people whose premiums would be affected — are found in the proposed increases for small- and large-group plans offered by employers.

Al Charbonneau, executive director of Rhode Island Business Group on Health (RIBGH), wrote in an emailed statement that the group “agrees with the Attorney General that our healthcare system, both in Rhode Island and across the country, is indeed broken…and we support the Attorney General’s call for more substantial changes.”

The rate increases should be rejected, Charbonneau wrote, as they contribute to an “unsustainable” and expensive situation for Rhode Island consumers. A recent brief from the group found that nearly 28% of median household income can now be attributed to Rhode Island’s commercial family premiums.

“Our analysis shows that the delivery system is the major cause of increasing premiums, although all involved in the provision of services and insurance need to contribute more to affordability,” Charbonneau wrote. “RIBGH supports the idea of paying more to primary care physicians and nursing personnel but also calls for a thorough understanding of where the money was spent if it was not used to support nurses, for example.”

GET THE MORNING HEADLINES DELIVERED TO YOUR INBOX

Rhode Island Current is part of States Newsroom, a nonprofit news network supported by grants and a coalition of donors as a 501c(3) public charity. Rhode Island Current maintains editorial independence. Contact Editor Janine L. Weisman for questions: info@rhodeislandcurrent.com. Follow Rhode Island Current on Facebook and X.