Trump plan would screw fifteen million workers

Julia Conley for Common Dreams

Project 2025, the right-wing policy blueprint spearheaded by the Heritage Foundation and co-authored by more than 100 former Trump administration staffers, has been denounced for several of its tax proposals, including slashing the corporate tax rate and the capital gains tax to benefit wealthy Americans—but a research group on Wednesday warned that one economic policy that hasn't gotten much attention could "greatly increase" financial hardships for millions of working families.

EPI

Action, a nonpartisan research and advocacy organization affiliated with

the Economic Policy Institute, published an

analysis of a proposal that appears on page 7 of Project 2025's section on the Treasury

Department—whose authors include at least two people who served on

Republican presidential nominee Donald Trump's campaign and transition team for

his term in office.

The

proposal calls to tax employers on workplace benefits that exceed $12,000 per

worker annually—which would undoubtedly "lead to employers cutting back on

these benefits," wrote Josh Bivens, chief economist for EPI Action.

Based

on health insurance benefits that are provided to more than 150 million

Americans through their employers, Bivens found, more than 15 million workers

would see their benefits taxed under the Project 2025 plan.

Those workers would collectively pay over $12 billion more in taxes if their employers shifted away from providing benefits as a cost-cutting measure.

Under

the proposal, "at best, employers would switch compensation away from

tax-preferred benefits to taxable wages and salaries, increasing the taxes

workers must pay," wrote Bivens. "At worst, employers would simply

cut back on benefits without offering an offsetting increase in wages and

salaries."

The analysis explains that currently, all wages and other employee benefits can be deducted by employers when they calculate the taxes they owe, counting the wages and benefits as costs to the company. But under the policy, costs in excess of $12,000 would no longer be deductible—so "they will stop offering this compensation."

The

policy would be liable to particularly cut into employer-sponsored health

insurance, said Bivens:

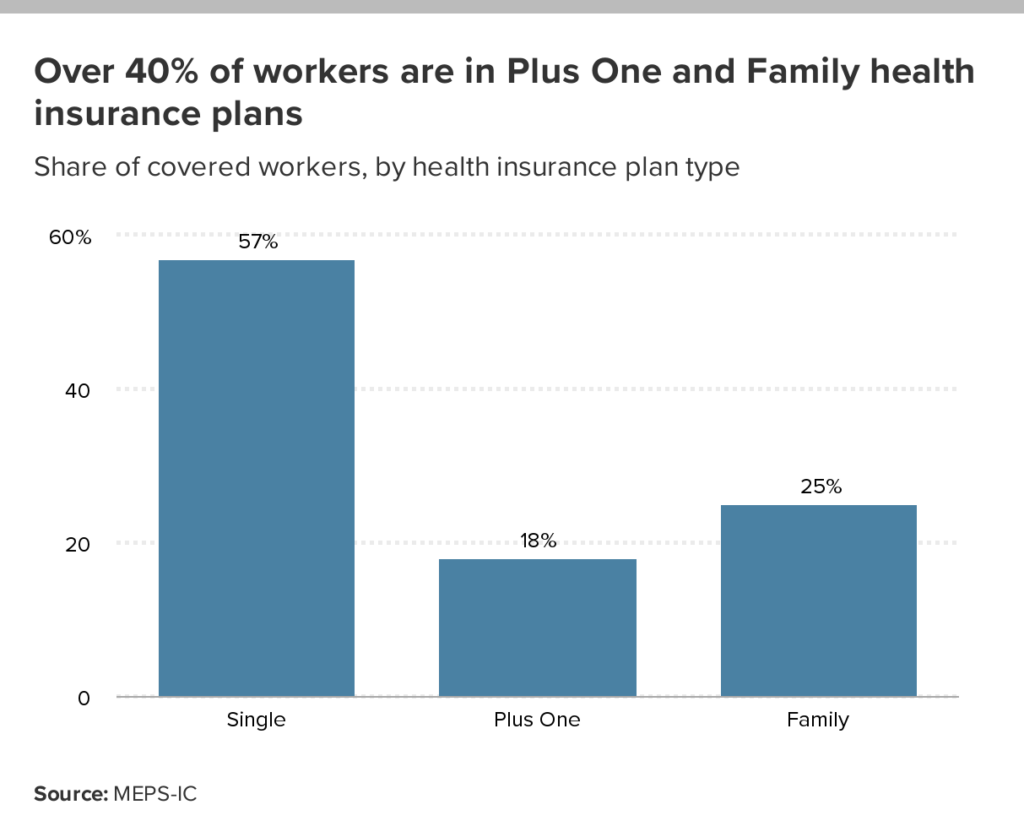

Currently, roughly 13% of employee compensation in the United States takes the form of nonwage benefits provided by employers (not including mandatory contributions for social insurance like Social Security and Medicare or the value of paid leave). About two-thirds of this chunk of nonwage benefits is employer contributions to health insurance.

Employer-provided health insurance is the

dominant form of coverage in the United States, with over 150

million people receiving health insurance through employer plans (including

dependents covered on another person's plan). If employers start being taxed on

these benefits, they will become less and less likely to offer them going

forward.

The

proposal would be "damaging" for millions of families who rely on one

working adult's employer-provided health insurance to cover dependents, such as

children.

"If,

for example, a two-earner household with young kids has one earner working part

time to have more time for childcare, the part-time earner is highly unlikely

to qualify for employer-provided insurance (which is usually made contingent by

employers on working full time), and so this family must rely on the full-time

earner having access to a family health insurance plan," wrote Bivens.

"The Project 2025 plan would hence greatly increase hardship for such

families."

Under

the plan, employers would also be barred from deducting the cost of family

health insurance plans that cover dependents over the age of 23—a clear

attempt, according to Bivens, "to roll back one of the more popular parts

of the Affordable Care Act (ACA), which allowed children to be covered on their

parents' family health insurance plans until age 26."

Bivens

emphasized that the proposal is not novel, but reflects "long-standing

conservative policy efforts to reduce the generosity of health insurance

plans."

The

Republican Study Committee, the largest conservative caucus in the U.S. House

of Representatives, called to tax employer-provided

benefits in its budget proposal earlier this year.

"Trying

to unravel employer-provided benefits and the public safety net for health

insurance is not an idiosyncratic feature of Project 2025, it's a central goal

of the conservative policymaking ecosystem," wrote Bivens.

And

while Trump and his vice presidential candidate, Sen. JD Vance (R-Ohio),

have attempted to

distance themselves from Project 2025, Bivens noted that the Trump campaign has

expressed "enthusiastic approval" of the policy agenda in meetings

with the Heritage Foundation. As Common Dreams reported last

week, Trump flew on a private jet with Heritage Foundation president Kevin

Roberts in 2022.

"The

candidates can claim Project 2025 has no influence on them, but organized

conservative constituencies for the corporate class got everything they wanted

in the first Trump administration," wrote Bivens. "There's no reason

to expect this time to be different."

Whether

the plan to tax employee benefits is enacted by a potential second Trump

administration due to its inclusion in Project 2025 or as the result of "a

long campaign by conservative policymakers to shift costs onto families"

instead of employers, wrote Bivens, the outcome of the plan is clear:

"U.S. workers will lose access to key family-sustaining benefits and face

higher taxes."