Wednesday, December 31, 2025

Trump’s Cruel Immigration Policy Is Devastating Children

Trump brutality against children rivals his first term

Rachel Rutter for Common Dreams

|

| (Photo by Charly Triballeau/ AFP via Getty Images) |

“Ms. Rachel, can ICE take me?”

“What about my dad? Can they take my dad away?”

“I feel so angry about how ICE is grabbing people out of my

neighborhood.”

“I feel traumatized ever since ICE stole my sister.”

“I’m afraid to walk to school. I’m afraid to leave my

house.”

“I want my mom back.”

These are real questions and comments I’ve heard from the kids I work with at Project Libertad in recent days, as Immigration and Customs Enforcement (ICE) terrorizes their communities daily. While newcomers have always faced higher rates of anxiety, depression, Post-Traumatic Stress Disorder (PTSD), and other mental health challenges than their US-born peers, the divide is becoming more apparent each day.

These conversations with

my kids represent a stark increase in fear and anxiety among immigrant

children—and it’s not just an anecdotal shift. The data are clear: The Trump

administration’s increasingly hostile immigration policies are irreversibly

harming children.

Pediatricians Susan Kressly and Michelle Barnes warn of the lifelong impact these policies have on

children’s development and health into adulthood:

Witnessing harm to others and living in constant fear is traumatic to all children in the community. These stressors disrupt brain development and have long-term negative effects on the health and well-being of impacted children. Ultimately, the cumulative effects make these communities less healthy.

RI’s 2025 Climate Action Strategy released

Warns Federal Rollbacks Threaten Climate Commitments

The Executive Climate Change Coordinating Council (EC4), chaired by Rhode Island Department of Environmental Management (DEM) Director Terry Gray, approved the 2025 Climate Action Strategy. The Strategy is intended to guide implementation of the Act on Climate and provides a comprehensive assessment of Rhode Island’s emissions trajectory, programmatic tools, and the feasibility of achieving statutory greenhouse gas reduction mandates under current conditions. Developed in collaboration with the Office of Energy Resources (OER) including significant public input, the strategy outlines a path to reduce greenhouse gas emissions 45% below 1990 levels by 2030.

What Anti-Vaccine Policies Could Mean for Autoimmune Diseases

Will Bobby Jr.'s anti-vaxxer views block development of new vaccine?

Autoimmune diseases disproportionately affect women. This is especially true for lupus (formally known as systemic lupus erythematosus), as about nine in 10 people with the condition are female. Lupus can cause inflammation and pain and commonly affects the skin, joints, and organs including the heart and kidneys.

Scientists have long observed an association between infection with the Epstein-Barr virus, or EBV, and several autoimmune diseases, including lupus. Now, the authors of a study published last month in Science Translational Medicine have dissected that link, shedding light on mechanisms that have remained obscure for too long.

It’s a finding that can lead to a solution. If we can prevent infection with EBV we can potentially prevent lupus. But, as a scientist who studies chronic diseases and an educator who teaches about it, I worry that anti-vaccine policies will hinder the search for a cure.

Most people know EBV as the cause of mononucleosis, or mono, the kissing disease of adolescence. But EBV is a jack-of-all-trades.

Michael Anthony Epstein, Yvonne Barr, and Bert Achong discovered the virus in 1964 as the cause of an aggressive type of cancer seen mostly in African children. Scientists later found that EBV infects almost everybody in the world, though in most cases it does not generate any symptoms, and so the infection goes unnoticed.

CDC awards $1.6 million for hepatitis B vaccine study by controversial Danish researchers

First, decide the conclusion you want and then pay bogus scientists $1.6 million to make up the proof

According to a notice in the Federal Register posted

yesterday, the CDC is paying the University of Southern Denmark to conduct a

single-blind clinical trial of the hepatitis B vaccine in newborns in

Guinea-Bissau, a small country in West Africa with exceptionally high rates of

maternal and infant mortality, where nearly one in five people are infected with the

hepatitis B virus.

The CDC is an agency within HHS. The study aims to assess

the optimal timing and delivery of hepatitis B vaccinations, according to the

notice.

‘Appearance of blatant cronyism’

The new study was awarded without any competition from any

other scientists, giving it “the appearance of blatant cronyism,” said Angela

Rasmussen, PhD, a virologist and professor at the University of Saskatchewan.

Although the federal announcement did not include the names

of the researchers, the Danish university’s Bandim Health Project, which has

conducted vaccine research in the developing African country for decades, has acknowledged being

awarded the CDC grant.

The Bandim project leaders have claimed to find

“non-specific effects” from vaccines—some good and some bad—that

they say should change how vaccine

safety studies are conducted.

Their message has resonated with Kennedy, a

long-time anti-vaccine activist.

In June, Kennedy used

a single study by the Bandim group to justify canceling more

than $1 billion in funding for childhood vaccinations in developing countries.

The observational study found an increased risk of death in children who

received a combined vaccine for diphtheria, tetanus and pertussis (DPT) that

hasn’t been used in the United States in three decades.

Scientists say people shouldn’t put too much faith in that

study, which is an outlier and conflicts with hundreds of studies showing that

vaccines are safe and save lives. Researchers and policy makers normally

consider the totality of scientific evidence on vaccines, rather than a single

study, which may be flawed.

Tuesday, December 30, 2025

Are you on Donald Trump's "enemies list?"

You Could Be on Trump’s Enemies List, But the Mainstream Media Won’t Warn You

The Trump FBI is drawing up an enemies list that could encompass well over half the US public:- Do you “advance… opposition to law and immigration enforcement”?

- Do you have “extreme views in favor of mass migration and open borders”?

- Show an “adherence to radical gender ideology,” meaning you think trans people exist?

- Do you exhibit (what the Trump administration would interpret as) “anti-Americanism,” “anti-capitalism,” or “anti-Christianity”?

- Do you display “hostility towards traditional views on family, religion, and morality”?

Congratulations—you may be headed for Attorney General Pam

Bondi’s “list of groups or entities engaging in acts that may constitute

domestic terrorism.” “Terrorism,” of course, is the magic word that strips you of all sorts of legal

protections, especially in the post-9/11 era.

This is from a Justice Department memo obtained by

independent journalist Ken Klippenstein (12/6/25)—which goes on to instruct the FBI to set up “a

cash reward system” for people who turn in those promoting such thoughtcrime,

and “establish cooperators to provide information and eventually testify

against other members” of groups with these dangerous ideas.

This is the implementation of the Trump administration’s avowed policy of criminalizing dissent—in the words of the NSPM-7 decree, outlawing “organized campaigns of… radicalization… designed to… change or direct policy outcomes” (FAIR.org, 10/3/25; CounterSpin, 10/17/25)—and as such is another giant step towards authoritarianism. Establishment media didn’t see it that way, however.As Klippenstein (12/9/25) pointed out, virtually no corporate media outlets covered this catastrophic memo, and those who did report on it did a generally poor job. The Guardian headline (12/5/25) was “Pam Bondi Tells Law Enforcement Agencies to Investigate Antifa Groups for ‘Tax Crimes,’” and Bloomberg Law (12/5/25) had “Bondi Orders FBI Extremism Intelligence Review with Antifa Focus”—completely misleading framing that suggests that if you’re not “Antifa,” the memo isn’t about you.

Travelling abroad?

How to avoid trouble with ICE upon return whether or not you are a citizen

National Immigration Law Center

We should all be able to travel to visit our loved ones and explore new places. But right now, the Department of Homeland Security (DHS) is going after immigrants in new and harmful ways. Traveling through U.S. airports can be risky, even if you have active or pending legal immigration status and/or have traveled without issues in the past. That’s why it’s more important than ever to know your rights and how to prepare for risks as you travel.

This resource gives travel safety

tips and other resources on how to understand the

risks and prepare yourself and your family.

Disclaimer: This resource provides general information.

It is not legal advice specific to your situation. We recommend that community

members exercise caution and speak to an immigration lawyer about their

individual cases.

What’s Happening

The Transportation Security Administration (TSA), the government agency that handles airport security, is giving passenger information to Immigration and Customs Enforcement (ICE). This means people who don’t have legal immigration status or whose status is uncertain could be arrested or deported when they go through airport security in the United States.

- How

does it happen? A few times each week, TSA sends

ICE lists of people flying through U.S. airports. These lists

include names,

photos, and other details. ICE checks these lists against its own

records. If ICE finds someone they want to target, they can send officers

to arrest that person at the airport.

- Isn’t

my private information protected? Normally,

government agencies have rules

about sharing private information. But TSA and ICE are both part of

the same department – the Department of Homeland Security – so those rules

don’t apply here.

- Is ICE already arresting people at airports? Yes. The New York Times reported on December 12, 2025, that TSA is sharing this information with ICE. Before that, there were already reports of ICE arrests at airports. For example, on November 20, ICE arrested college student Ana Luccía López Belloza at Boston’s Logan Airport while she was waiting to board a flight to visit family for Thanksgiving. She had an old deportation order, though she didn’t know it.

RFK Jr. wants to scrutinize the vaccine schedule – but its safety record is already decades long

"Fixing" what's not broken with a sledge hammer

|

| We now have vaccines for many diseases that once ravaged the population. That's not a problem, but a cause for celebration. |

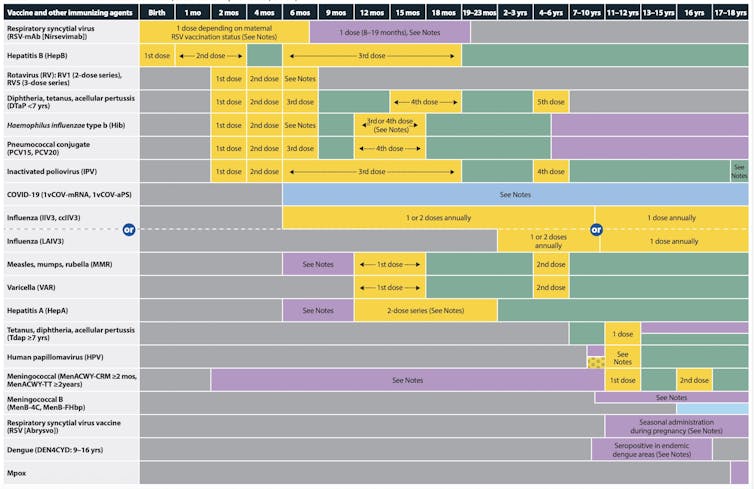

The U.S. childhood immunization schedule, the grid of colored bars pediatricians share with parents, recommends a set of vaccines given from birth through adolescence to prevent a range of serious infections. The basic structure has been in place since 1995, when federal health officials and medical organizations first issued a unified national standard, though new vaccines have been added regularly as science advanced.

Vaccines on the childhood schedule have been tested in controlled trials involving millions of participants, and they are continuously monitored for safety after being rolled out. The schedule represents the accumulated knowledge of decades of research. It has made the diseases it targets so rare that many parents have never seen them.

But the schedule is now under scrutiny.

On Dec. 16, 2025, the Centers for Disease Control and Prevention adopted its first major change to the childhood immunization schedule, under Kennedy’s leadership. The agency accepted an advisory committee’s vote to drop a long-held recommendation that all newborns be vaccinated against hepatitis B, despite no new evidence that questions the vaccine’s long-standing safety record.

Health and Human Services Secretary Robert F. Kennedy Jr., who has cast doubt on vaccine safety for decades, has said he plans to further scrutinize the vaccines children receive.

I’m an infectious disease physician who treats vaccine-preventable diseases and reviews the clinical trial evidence behind immunization recommendations. The vaccine schedule wasn’t designed in a single stroke. It was built gradually over decades, shaped by disease outbreaks, technological breakthroughs and hard-won lessons about reducing childhood illness and death.

With federal officials now casting doubt on its foundations, it’s helpful to know how it came about.

The early years

For the first half of the 20th century, smallpox vaccination was common, required by most states for school entry. But there was no unified national schedule. The combination vaccine against diphtheria, tetanus and pertussis, known as the DTP vaccine, emerged in 1948, and the Salk polio vaccine arrived in 1955, but recommendations for when and how to give them varied by state, by physician and even by neighborhood.

Trump’s Tariffs Are Killing Small Businesses

Trump's national sales tax puts a heavy burden on US small businesses

Seth

Sandronsky for Common Dreams

According to the Pew Research Center, Americans have big trust in small businesses versus big corporations.

Mom-and-pop shops will need that positive vibe and more as they approach the make-or-break year end business season. While small business owners can’t compete on prices with larger companies, there are other factors in play such as personal service.

Nevertheless, prices of goods and services do

matter, so the rising costs that small business owners are paying for imports

due to Donald Trump’s trade tariffs, a tax on American

consumers and businesses, is roiling mom-and-pop shops across the US.

On April 2, 2025, Trump announced that he was via tariffs

“enacting fair trade policies that will restore our workforce, rebuild our

economy, and finally put America First.” According to Small Business Administration

Administrator Kelly Loeffler, mom-and-pop shops would reap a bounty of benefits

from tariffs on imports from global trading partners: “Small businesses will no

longer be crushed by foreign governments and unfair trade deals. Instead, we

will put American industry, workers, and strength

FIRST.”

How are these claims working out on Main Street? We turn to

Fabrice Moschetti, owner of Moschetti Artisan Roasters, in Vallejo, California.

How are these claims working out on Main Street? We turn to

Fabrice Moschetti, owner of Moschetti Artisan Roasters, in Vallejo, California.

Imported coffee he buys from Brazil was tariff-free until the president imposed a baseline “reciprocal tariff” of 10% on imported goods globally, then increased tariffs on Brazilian imports another 40% in July because the government of Brazil was prosecuting its past President Jair Bolsonaro, awaiting a 27-year prison sentence on appeal currently after conviction for planning a military coup against his successor, Brazilian President Luiz Inácio Lula da Silva.

It’s been a struggle to find an adequate supply of coffee,

according to Moschetti, forcing him to truck it in from cities such as Seattle

versus the nearby Port of Oakland. “It’s been difficult to tell the mom-and-pop

owner-operators who we work with that our prices are increasing 40%,” he says.

Monday, December 29, 2025

If everything is "national security," then nothing is.

The legal "defense" for Trump's ballroom is a joke

But according to the administration, construction can’t be

halted for even the briefest moment — or our national security will be

imperiled.

How does putting a pause on the Big Gilded Ballroom

compromise national security? Well, the administration can’t say … because it

would compromise national security.

It’s kind of a fool’s game to treat the administration’s

court filings as legitimate legal arguments. That’s not only because Department

of Justice attorneys are distressingly

comfortable with deceiving judges and defying orders. It’s also

because the administration doesn’t genuinely believe it should be required to

justify or defend its actions, so instead of legal arguments, we just get

assertions of raw, unchecked power.

The most blatant version of this is the administration’s

favorite one to raise — namely, that Trump gets to do what he wants

because he is president. But the vague, fact-free invocation of national

security is in the same category, albeit less obviously so. One is basically

“you can’t tell us what to do,” while the other is more “we don’t have to tell

you what we’re doing or why we are doing it.”

Priorities, again

Meet Trump's pick to be Rhode Island's "interim" US Attorney

Senator Whitehouse describes him as a MAGA stooge with neither the qualifications nor temperament for this position

Read Katherine Gregg's story on him: Charles Calenda to be sworn in as interim US Attorney for RI.

Read Katherine Gregg's story on him: Charles Calenda to be sworn in as interim US Attorney for RI.Calenda's appointment is opposed by both of Rhode Island's Senators, with Sen. Whitehouse describing Calenda's appointment like this:

“Despite good-faith efforts at a bipartisan nomination process with the Trump White House, the MAGA Department of Justice insisted on a MAGA stooge with neither the qualifications nor temperament for this position. There will be no blue slip and we will be rid of him soon enough.”

Scientists reveal a powerful heart boost hidden in everyday foods

Tasty and good for your heart

King's College London

Regular consumption of polyphenol-rich foods like tea, coffee, berries, nuts, and whole grains may significantly support long-term heart health. A decade-long study of more than 3,100 adults found that those who consistently ate polyphenol-packed diets had healthier blood pressure and cholesterol levels, as well as lower predicted cardiovascular risk.

Higher intake of polyphenol-rich foods was linked to better

heart health and slower increases in cardiovascular risk during aging.

Metabolite analysis confirmed the protective effects of key plant compounds

like flavonoids and phenolic acids. Credit: Shutterstock

People who frequently include foods and beverages rich in

polyphenols, such as tea, coffee, berries, cocoa, nuts, whole grains and olive

oil, may experience better heart health over time.

Trump and Bobby Jr. are gunning for trans kids

Ayurella Horn-Muller, Staff Writer

This story was originally reported by Grace Panetta of The 19th. Meet Grace and read more of their reporting on gender, politics and policy.

Even the NRA thinks this is stupid

Trump administration officials announced new proposed regulations targeting gender-affirming care for youth, part of a larger push from the Department of Health and Human Services (HHS) to restrict such care.

One of the new proposed rules would ban hospitals that provide gender affirming care to youth under 18 from receiving Medicaid and Medicare funds. Another proposed rule would bar Medicaid from covering gender-affirming care for youth under 18 and the Children’s Health Insurance Program (CHIP) from covering such care for youth under 19.

HHS Secretary Robert F. Kennedy Jr., along with other officials, formally announced the proposed rules at an event on Thursday morning. In his remarks, Kennedy cast gender affirming care as “sex-rejecting” procedures that impose “lasting harm” on children.“This is not medicine. It is malpractice,” Kennedy said. “We're done with junk science driven by ideological pursuits, not the well-being of children.”

Gender-affirming care for youth, backed by major medical organizations to treat gender dysphoria, varies depending on the patient’s age and circumstances. For those entering adolescence, providers can prescribe puberty blockers, which temporarily halt hormones causing puberty and are also prescribed to cisgender youth who undergo early puberty. Research has shown that puberty blockers significantly reduce depression and risk of suicide in trans and non-binary youth and that gender-affirming care also reduces depression in transgender adults.

Sunday, December 28, 2025

Trump Cabinet Officials Re-Name Themselves

“Good enough for a battleship, it’s good enough for me,” said Homeland Security chief Kristi Trump-Noem.

Mitchell Zimmerman in Common Dreams

Secretary of War Pete Trump-Hegseth and Secretary of State Marco Trump-Rubio were the first to announce that they were changing their names in a display of loyalty to the president, but they were swiftly followed by the remaining cabinet members.A rush of orders for new business cards and government IDs is expected, but key officials are likely to be the first to see their new names recognized on repainted doors and Trump accoutrements.

Priority is

expected to be given to Attorney General Pam Trump-Bondi, Secretary of the

Homeland Security Kristi Trump-Noem, and Secretary of Health and

Human Services Robert F. Trump-Kennedy Jr.

Although Trump-Hegseth and Trump-Rubio were first out of the

box, insiders believe that the changes were inspired by former Secretary

Kennedy, who reportedly mused that if the center honoring his uncle was to be

renamed The Donald J. Trump and the John F. Kennedy Memorial Center for the

Performing Arts, maybe he would change his own name too.

Although Trump-Hegseth and Trump-Rubio were first out of the

box, insiders believe that the changes were inspired by former Secretary

Kennedy, who reportedly mused that if the center honoring his uncle was to be

renamed The Donald J. Trump and the John F. Kennedy Memorial Center for the

Performing Arts, maybe he would change his own name too.

The renaming of the Performing Arts Center followed a renaming that created the Donald J. Trump Institute for Peace and precedes the naming of a proposed group of guided-missile battleships of the United States Navy as the Trump class.

“Kinetically lethal,” said War Secretary Trump-Hegseth.

“Kinetically lethal,” said War Secretary Trump-Hegseth.

Legal observers expect their request will be rejected by Chief Justice John G.

Trump-Roberts and Associate Justices Clarence Trump-Thomas, Samuel A.

Trump-Alito, Neil M. Trump-Gorsuch, Brett M. Trump-Kavanaugh, and Amy Coney

Trump-Barrett.

Mitchell Zimmerman Zimmerman is an attorney, longtime social activist, and author of the anti-racism thriller "Mississippi Reckoning" (2019).

The Gavle Goat is dead. Long live the Charlestown New Year's Eve bonfire!

After several safe Christmas seasons, world's favorite goat finds a new way to die

By Will Collette

I first started writing about Sweden's Gavle goat in 2011, the year Tom Ferrio and I launched Progressive Charlestown.A proud holiday tradition in the Swedish town of Gavle since 1966, local resident build a giant goat (Gävlebocken) made of straw that stands in the town square through the Advent season.

Except when it doesn't.

While a majority of town residents love the goat, a sizeable minority don't. They make it their business every year to burn the goat down. It does make a pretty spectacular bonfire. There's a lively betting pool on whether the goat will survive and, if so, how long. And as the saying goes, a certain amount of alcohol is involved.

Vandals caught in the act usually do three months of jail time. Metro.UK reports "of the 58 Gävle goats in history, 42 have been destroyed."

Each year I wrote about the Gävlebocken, usually in the context of publicizing Charlestown's own New Year's Eve bonfire. Some year's, the goat made it; other years, it didn't.

Due largely to dramatically heightened security, the Gävlebocken made it through the past several years uncharred.

But this year, its luck ran out.

Yesterday, December 27, the Gävlebocken was busted up by high winds from Atlantic Storm Johannes.

Hopefully, the weather will be kind on Wednesday night for Charlestown's annual New Year's Eve bonfire at Ninigret Park. Currently, the National Weather Service is forecasting a cold (20 degrees) and cloudy for Charlestown.Charlestown's bonfire was started as volunteer effort by Frank Glista who hustled up the lumber (usually from Arnold Lumber) and hand-crafted it himself. Frank carried on this work for years until recently handing it off to former Engineers union leader and current Charlestown Residents United chair Tim Quillen.

The Charlestown bonfire has had its own share of troubles. In 2013, an undisclosed complainant to DEM asked that the bonfire be banned because it created an illegal "municipal waste disposal site." DEM issued a "Notice of Intent to Enforce" which was promptly appealed by then Charlestown Treasurer Pat Anderson.

DEM rejected Pat's appeal and then former Charlestown state Representative Donna Walsh got to work, ultimately getting DEM to rescind its intended enforcement action.

There was a lot going on in Charlestown at that time. Bradford residents were hammering at DEM for its failure to enforce the law on the infamous Copar Quarry on the Charlestown-Westerly line. Town Councilor Deputy Dan Slattery was going on a tear about Ninigret Park, "phantom properties," state acquisition of properties to protect water resources after just completed his campaign to destroy former town administrator Bill DiLibero's career. Planning Commissar Ruth Platner was cranking up her effort to micromanage every business, residence and land parcel in town.

Banning the bonfire was someone's bright idea, someone who has never stepped forward to take the "credit." But if you study the history, you can make a pretty good guess.

Pharmacists offer tips that could reduce your out-of-pocket drug costs

My prescription costs what?!

Even when Americans have health insurance, they can have a hard time affording the drugs they’ve been prescribed.

About 1 in 5 U.S. adults skip filling a prescription due to its cost at least once a year, according to KFF, a health research organization. And 1 in 3 take steps to cut their prescription drug costs, such as splitting pills when it’s not medically necessary or switching to an over-the-counter drug instead of the one that their medical provider prescribed.

As pharmacy professors who research prescription drug access, we think it’s important for Americans to know that it is possible to get prescriptions filled more affordably, as long as you know how before you go to the pharmacy.

US Launches Christmas Strikes on Nigeria—the 9th Country Bombed by Trump

Trump has now bombed more countries than any president in history.

“Tonight, at my direction as Commander in Chief, the United States launched

a powerful and deadly strike against ISIS Terrorist Scum in Northwest Nigeria,

who have been targeting and viciously killing, primarily, innocent Christians,

at levels not seen for many years, and even Centuries!” Trump said Thursday in a post on his Truth Social network.

“I have previously warned these Terrorists that if they did

not stop the slaughtering of Christians, there would be hell to pay, and

tonight, there was,” the president continued. “The Department of War executed

numerous perfect strikes, as only the United States is capable of doing.”

A US Department of Defense official speaking on condition of

anonymity told the Associated Press that the United States

worked with Nigeria to conduct the bombing, and that the government of Nigerian

President Bola Tinubu—who is a Muslim—approved the attacks.

It was not immediately known how many people were killed or

wounded in the strikes, or whether there are any civilian casualties.

Saturday, December 27, 2025

Why the GOP Healthcare Plans Won’t Fill the Prescription

So is this the best they can do?

The basic problem is that healthcare costs are hugely skewed. Ten percent of the population accounts for more

than 60% of total spending, and just 1% accounts for 20% of spending. Most

people have relatively low healthcare costs. The trick with healthcare is

paying for small number of people who do have high costs.

Individual Choice, Cherry-Picking the Pool, and Screwing

Cancer Survivors

There is one story they could envision, which would make it

much easier for insurers to skew their pool. The Affordable Care Act (ACA)

restricted what sort of plans could be offered in the exchanges in order to

limit the ability for insurers to avoid high-cost individuals.

It would be possible to relax these restrictions to allow insurers to cherry pick their enrollees. For example, they could offer high-deductible plans, say $15,000 in payments, before any coverage kicked in.

No person with a serious health condition would buy this sort of plan since they know they would be paying at least $15,000 a year in medical expenses, and then a substantial fraction of everything above this amount, in addition to the premium itself.

On the other hand, a low-cost plan with $15,000 deductible might look pretty good to someone in good health, whose medical expenses usually don’t run beyond the cost of annual checkup.

Turn Your Christmas Tree into Fish Habitat

Here's a smart way to dispose of your xmas tree

Spruce up wildlife habitat this holiday season! For the eighth year, the Rhode Island Department of Environmental Management (DEM) and the Rhode Island Chapter of Trout Unlimited (TU) team up for “Trees for Trout,” recycling donated conifer trees to restore habitat for wild brook trout and other aquatic life.

Is RFK Jr. backing Big Food’s drive to overturn tough new state laws?

Bobby Jr. echoes industry talking points on food safety laws

Stacy Malkan, U.S. Right to Know

At least 90 proposals in dozens of states seek to restrict, ban

or label ultra-processed food or synthetic ingredients. The push is based

on strong

scientific evidence that the poor health of many Americans may arise

in part from eating so much ultra-processed food.

Two new COVID vaccine studies show shots keep kids out of the emergency room and reduce risks to pregnant women and their babies

While Bobby Jr. peddles fake science, real science reinforces value of vaccine

Two articles on two new studies

Updated 2024-25 COVID vaccine cut emergency visits among

kids, study suggests

Researchers looked at data from electronic health records to

assess how well the updated vaccines, which target the Omicron JN.1 and

JN.1-derived sublineages, protected against COVID-related ED and UC visits from

August 2024 to September 2025. The test-negative, case-control study measured

the added protection provided by the 2024-25 dose in children and adolescents,

many of whom already had some immunity from prior infection, previous

vaccination, or both.

76% effectiveness against severe disease in young kids

Among children aged 9 months to 4 years, vaccine

effectiveness (VE) against COVID-associated ED/UC visits was 76% during the

first 7 to 179 days after vaccination. Protection remained stable through 299

days.

These VE estimates are similar to or higher than those

observed in adults during the same season, and they exceed that reported in

young children during the 2023-24 season. According to the authors, the higher

2024-25 estimates might be related to different infection patterns compared

with previous seasons or fewer changes in circulating variants in

2024-25.

During the 2024-25 season, hospitalization rates among US

infants aged 6 to 11 months were higher than those of all adult age-groups

except those aged 65 years and older. These findings underscore the potential

benefits of COVID-19 vaccination in eligible infants, note the authors.

In children and adolescents aged 5 to 17 years, the 2024-25

vaccines reduced the risk of an ED/UC visit by 56% during the first 7 to 179

days after vaccination. Protection declined slightly to 45% when the window was

extended from 7 to 299 days.

Friday, December 26, 2025

Who’s the Last Person in the World to Deserve the Nobel Peace Prize?

The person who’s been waging illegal wars

Actually, it’s a reminder of what a strong malignant

narcissist can accomplish when untethered from reality.

Gianni Infantino, president of FIFA, the world

football league, awarded Trump the first (and likely last) annual FIFA Peace

Prize — along with a hagiographic video of Trump and “peace.”

What FIFA has to do with peace is anyone’s guess, but

Infantino is evidently trying to curry favor with Trump. (Infantino, by the

way, oversaw the 2020 FIFA World Cup in Qatar, defending and minimizing Qatar’s

miserable human rights record. He also played a key role in selecting Saudi

Arabia to host the 2034 FIFA World Cup, notwithstanding the Saudi murder

of Washington Post columnist Jamal Khashoggi.)

Both Trump’s absurd renaming of the U.S. Institute of Peace

and the equally absurd FIFA award are parts of Trump’s campaign to get the

Nobel Peace Prize — something he has coveted since Barack Obama was awarded it

in 2009 (anything Obama got credited with, Trump wants to discredit or match).

.jpg)

.webp)