“The reason they call it the American Dream is because you have to be asleep to believe it.”

By Gerald E. Scorse, Progressive Charlestown guest columnist

This ideal has long been called the American Dream. It’s a pleasing phrase, but

it runs head-on into an un-pleasing fact. The late comedian George Carlin said

it all with a memorable wake-up call: “The reason they call it the American Dream is

because you have to be asleep to believe it.”

Politicians have been proving Carlin right for decades,

Republicans consistently and Democrats all too often. The GOP and the second

Trump Administration seem bent on doing what they’ve always done, sometimes

even turning the American Dream into the American Nightmare.

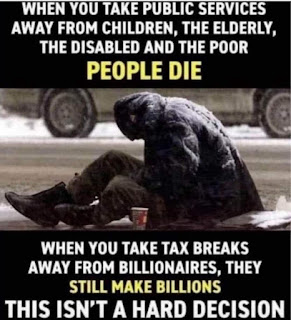

Taxes are a major contributor, especially the billions upon

billions that the rich and corporations don’t pay. Trump and his fellow

Republicans are committed to keeping it that way—and, if their slim

Congressional majorities can stick together, to do even more for those who need

it the least. As one small example, the overall corporate tax rate could drop to 20%; domestic

manufacturers could do even better, ending up with an effective corporate rate

of 15%.

The federal tax code is famous (and infamous) for its huge handouts to those with the highest incomes, the most egregious being the cap on Social Security taxes.

Most workers pay the 6.2% Social Security tax on every

dollar they make. Big earners, though, avoid that tax by the billions. There’s

a dollar cap on earnings subject to the tax, and it rises yearly at the same

rate as average wages. Last year’s cap was $168,600, for 2025 it’s $176,100.

For those in the earnings stratosphere, the cap means that

Social Security taxes can literally begin and end on January 1. In 2024 Elon Musk hit the earnings cap at 12:04 a.m.

on New Year’s Day; for Tim Cook of Apple, it took all of two hours.

Lower taxes on income from wealth than income from work amount to another giant giveaway to the rich. Taxes on long-term capital gains top out at 20%; the corresponding rate on income from work is nearly twice as high, 37%.

The tax code is also chockful of loopholes, many of them so

complex that ordinary Americans can’t even begin to understand them. The

wealthy don’t understand them either, but they don’t have to. They’re able to

pay small fortunes to have their tax accountants and lawyers handle it: “You have an army of well-trained, brilliant people who

sit there all day long, charging $1,000 an hour, thinking up ways to beat” this

tax, that tax, any tax.

One way or the other—whether it’s lawyers working loopholes,

whether it’s the tax laws themselves—the rich somehow avoid paying tens of

billions in taxes. All those lost billions lead inevitably to one result

or the other, both of which gnaw away at The Dream. Less revenue from the top

means either higher taxes for those down below, making it harder for them to

get along; or it means fewer dollars period, threatening the safety net

programs that so many Americans depend on.

Medicare is one of these programs, and its trust fund is set

to run dry sometime in the 2030s. Wouldn’t you know it, part of the blame lies

with some of the richest men in America. While paying Medicare taxes is routine

for workers, a gilded few have been paying not a penny. ProPublica laid it all out in a piece published just

last month, “How a Decades-Old Loophole Lets Billionaires Avoid Medicare

Taxes.”

The Internal Revenue Service (IRS) acts as the nation’s

steward for tax collection and enforcement. It’s long been GOP gospel to do

whatever it can to lower collections and lessen enforcement.

Despite the fact that cutting IRS funding “doesn’t save money, it costs money,” Republicans

have repeatedly slashed away. Between 2010 and 2021 alone, the GOP managed to

reduce the IRS enforcement budget by nearly a quarter. The cutting is endless

and relentless—and it’s not likely to change under Billy Long, Trump’s choice as an early replacement for the reformer Danny

Werfel as IRS Commissioner.

Summing up, you have to be in slumberland (or not paying

attention) to believe in the American Dream. Taxes are a major downer,

lopsidedly favoring those at the top. Those with the power to act need to

finally wake up, to insist that corporations and the wealthy pay their fair

share.

Fat chance, obscenely fat. With the GOP in control, America’s taxes will just keep on mocking the American Dream.

Gerald E. Scorse helped pass the bill requiring basis reporting for capital gains. He writes on taxes. His articles have appeared often in Progressive Charlestown.

© 2022 Gerald E. Scorse

This article first appeared in the New York Daily

News.